Share this

The Effects of the Shanghai Lockdown on US Freight Market: No Clear Concerns So Far

by jpallmerine

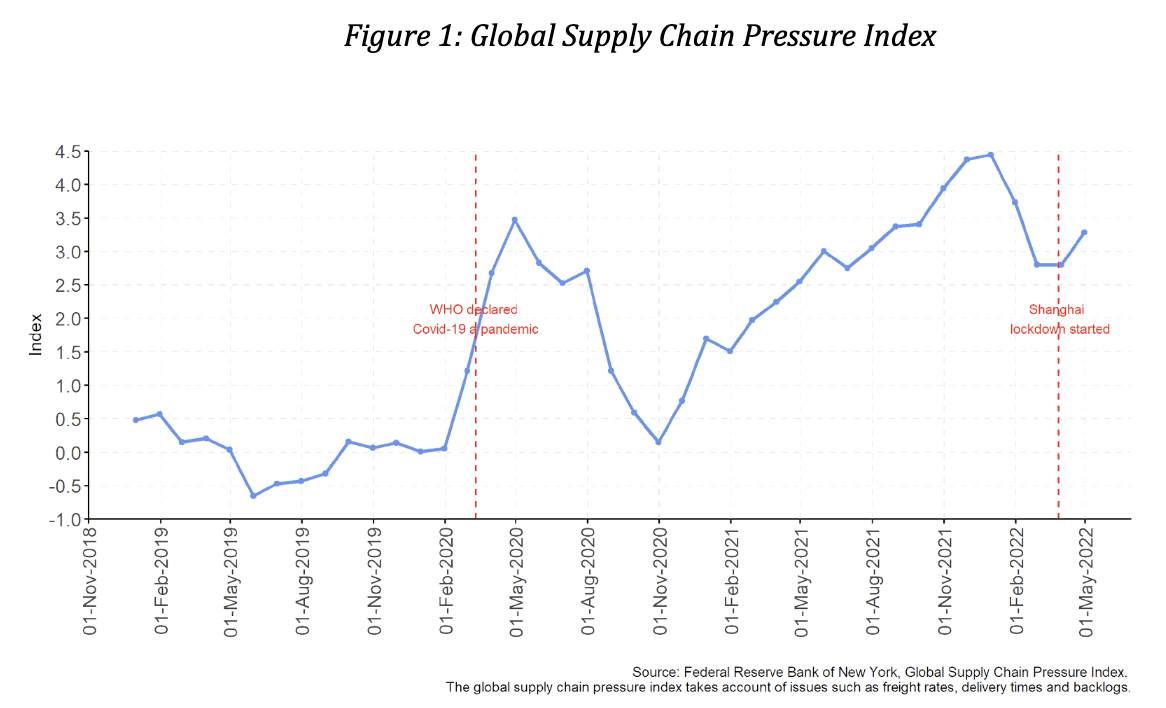

From April 1st to June 1st, the city of Shanghai was subjected to a strict lockdown policy that generated notable disruptions to the global supply chain. Shanghai is home to China’s busiest container seaport, responsible for 27% of all maritime exports from China to the US, and although the port has continued operating, it has been running at severely reduced capacity since the new lockdowns began (1). According to the New York FED, the event contributed to logistic backlogs that caused the Global Supply Chain Pressure Index (GSCPI, shown in Figure 1) to rebound after four months of continuous declines.

Given the global supply chain impacts from these lockdowns, many U.S. companies find themselves asking, are the lockdowns having notable impacts on domestic port/freight activity? To help answer this question from one of many perspectives, below we look at (i) import data (ii) Loadsmart truckload activity around major port areas (2).

———————————–

(1) According to Datamyne-Descartes data for the full year of 2021.

(2) Besides Shanghai, other minor Chinese ports have also been affected by lockdowns.

———————————–

Maritime Imports

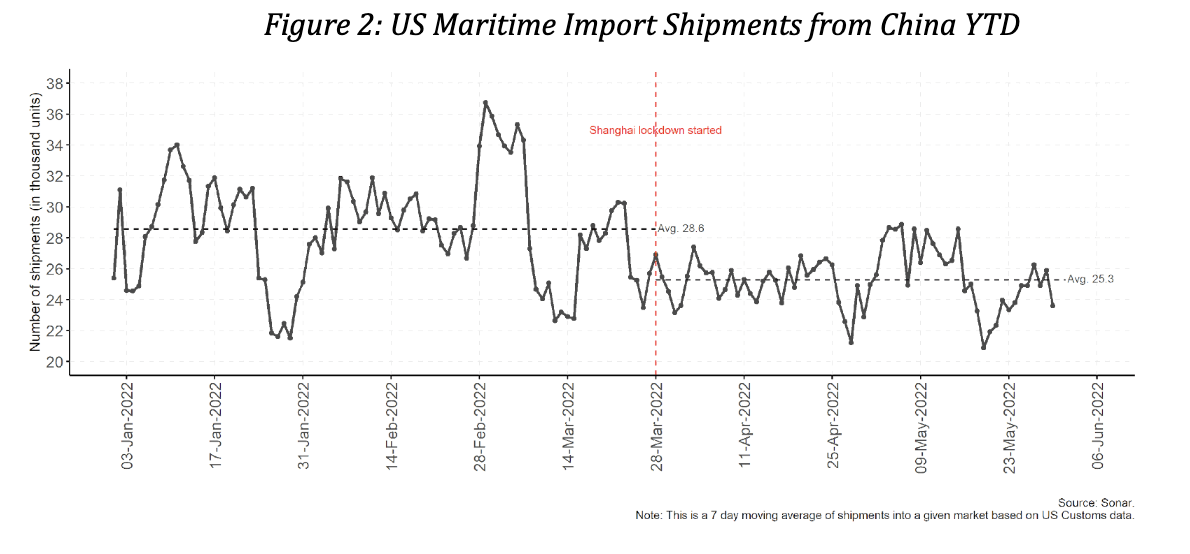

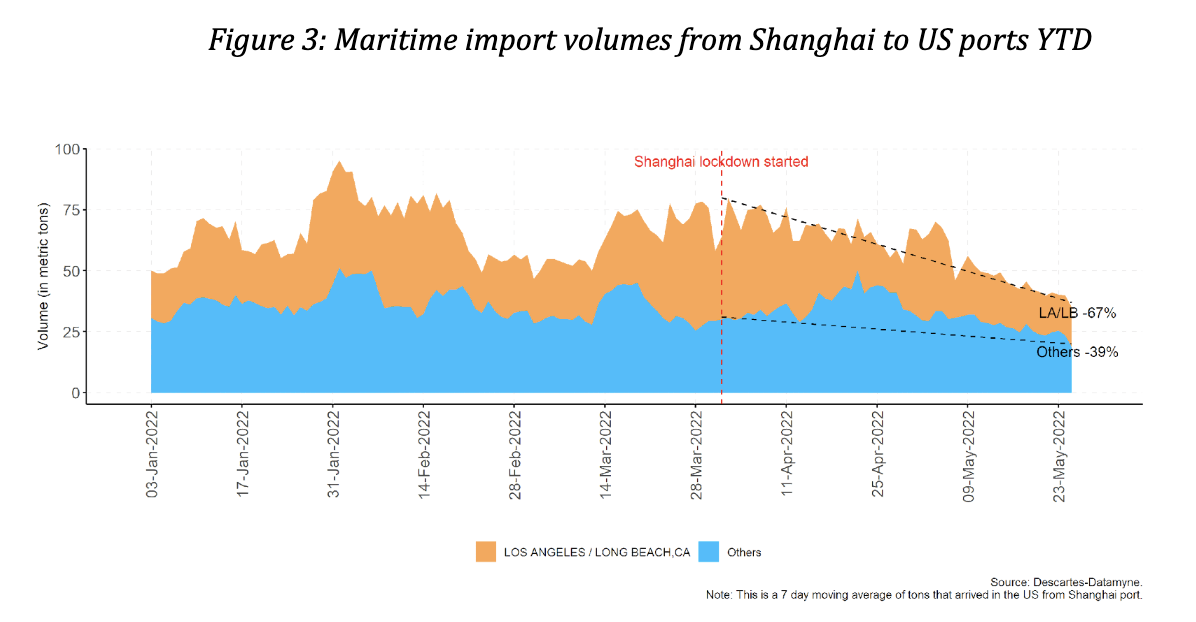

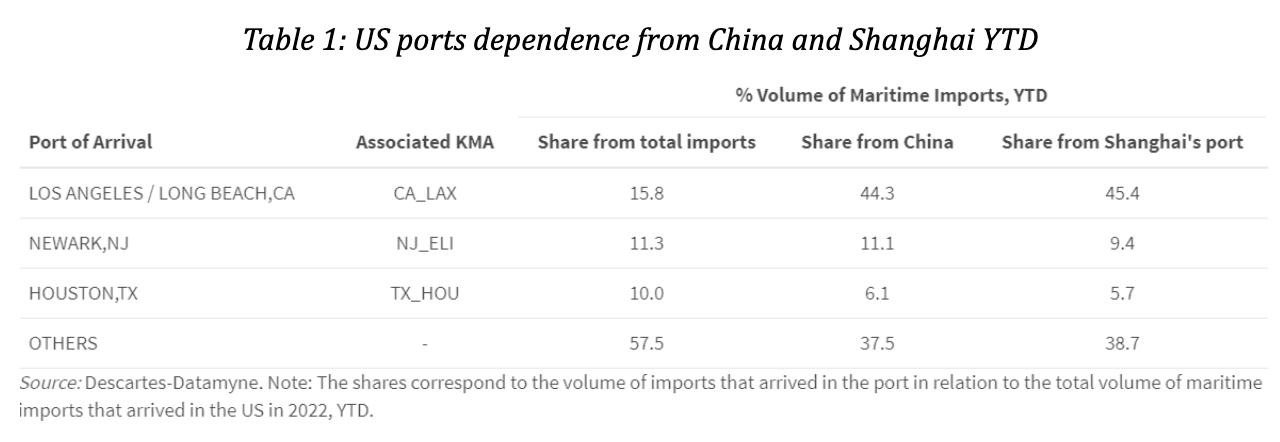

For the U.S. market, the average number of shipments with imports arriving from China declined around 12% since the lockdown began – Figure 2. But this drop was not expected to affect all port activity equally. As we can see in Table 1, the ports of Los Angeles-Long Beach (LA/LB) receive 45% of all imports from Shanghai to the U.S. – and 44% of all imports from China. The next closest port, in terms of share of Shanghai imports, is Newark with only 11%. Also, the LA/LB ports also experienced the greatest decline in the volume of imports arriving from Shanghai in the recent weeks as seen in Figure 3.

Indeed, it does seem that import flows into LA/LB have softened more than other major ports, which is likely due to the lockdown-related disruption. Our next step was to understand how the decline in LA/LB imports may have affected the domestic truckload market in this region.

Loadsmart Truckload Data

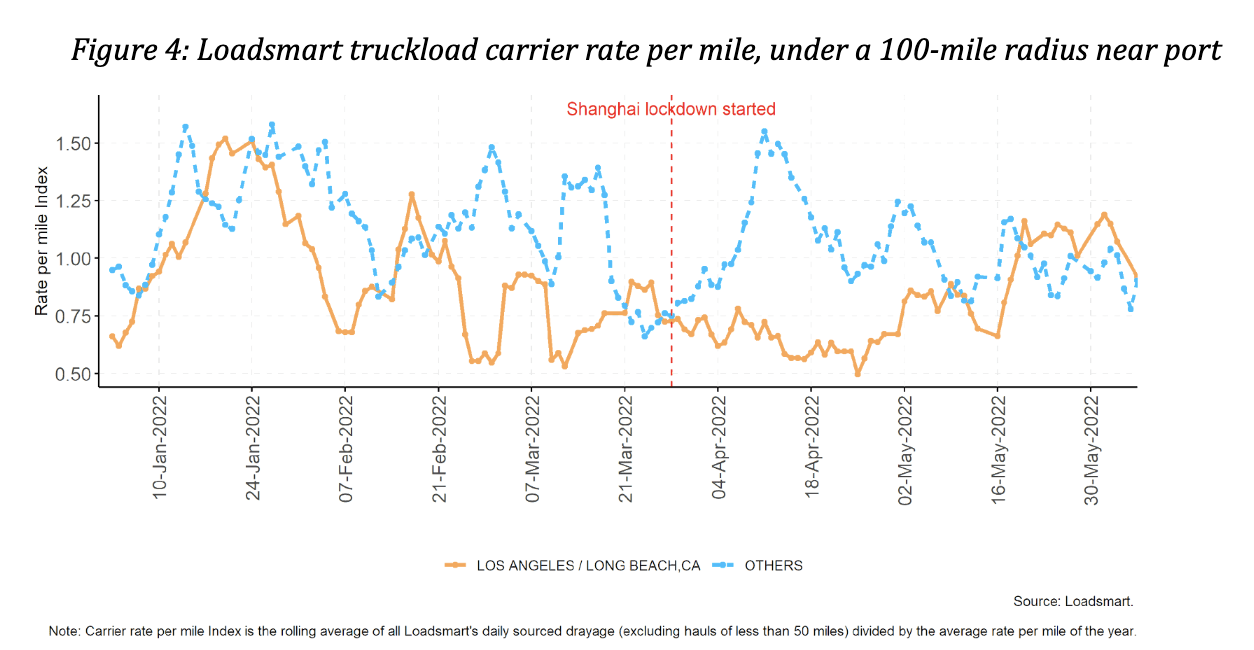

To understand if this fall in imports connected to Shanghai affected the domestic truckload market in SoCal, we assessed a basic hypothesis: if the Shanghai import declines into LA/LB were significant, then it should have triggered a downward pressure on carrier rates during this period. To investigate this, we measured the average carrier rate per mile paid on outbound volumes from locations within a 100-mile-radius from these ports.

The hypothesis would suggest that rates from the regions surrounding LA/LB ports should have declined far more than their peers’ rates. Instead, we observed that OB LA/LB full truckload rates were stable, oscillating within a $1 dollar-range since mid-April and actually even increased overall as seen in Figure 4.

In conclusion, although we see that the decline in LA/LB imports likely stemmed from the Shanghai lockdowns, we have not seen a direct softening in truckload data that can be connected to it just yet. Even though the city lifted its two-month long lockdown a few days ago, Loadsmart will continue to monitor port activity connected to it as the effect on the global chain is expected to last for a few more months.

ABOUT LOADSMART

Transforming the future of freight, Loadsmart leverages technology and logistics data to build efficiency around how freight is priced, booked and shipped. Pairing comprehensive logistics technology with deep-seated freight industry expertise, Loadsmart fuels business growth, simplifies operations and increases efficiency for carriers and shippers alike. For more information, please visit: https://loadsmart.com. Move more with less.

Share this

- Loadsmart Blog (159)

- Blog (121)

- Shipper (106)

- Market Trends (101)

- Enterprise Shipper (69)

- Carrier (66)

- News (62)

- Data Insights (51)

- Thought Leadership (45)

- Warehouse (41)

- SMB Shipper (38)

- Our Partners (34)

- ShipperGuide TMS (31)

- Opendock (30)

- Product Updates (29)

- Mode Optimization (25)

- Loadsmart (23)

- Mid-Market Shipper (18)

- Case Study (17)

- Brokerage Services (15)

- Managed Transportation (11)

- Video (9)

- Award (7)

- FreightIntel AI (5)

- Instant Execution (4)

- Asset (3)

- Food and Beverage (3)

- Freight Management (3)

- Logistics Solutions (3)

- YMS (3)

- eBook (3)

- 4PL (2)

- International (2)

- NavTrac (2)

- Podcast (2)

- UK (2)

- Yard Management System (2)

- Cold Storage (1)

- Faces of Loadsmart (1)

- Paper Packaging (1)

- Retail (1)

- Security (1)

- Transportation Management System (1)

- January 2026 (1)

- December 2025 (1)

- November 2025 (1)

- October 2025 (2)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (7)

- April 2025 (6)

- March 2025 (3)

- February 2025 (10)

- January 2025 (4)

- December 2024 (4)

- November 2024 (5)

- October 2024 (11)

- September 2024 (11)

- August 2024 (5)

- July 2024 (5)

- June 2024 (9)

- May 2024 (7)

- April 2024 (6)

- March 2024 (2)

- February 2024 (2)

- January 2024 (5)

- December 2023 (6)

- November 2023 (2)

- October 2023 (12)

- September 2023 (5)

- August 2023 (3)

- July 2023 (4)

- June 2023 (10)

- May 2023 (5)

- April 2023 (5)

- March 2023 (7)

- February 2023 (5)

- January 2023 (7)

- December 2022 (4)

- November 2022 (13)

- October 2022 (4)

- September 2022 (7)

- August 2022 (11)

- July 2022 (6)

- June 2022 (5)

- May 2022 (2)

- April 2022 (4)

- March 2022 (6)

- February 2022 (7)

- January 2022 (9)

- December 2021 (3)

- November 2021 (5)

- October 2021 (7)

- September 2021 (2)

- August 2021 (2)

- July 2021 (4)

- June 2021 (6)

- May 2021 (6)

- April 2021 (5)

- March 2021 (8)

- February 2021 (3)

- January 2021 (3)

- December 2020 (7)

- November 2020 (9)

- October 2020 (7)

- September 2020 (6)

- August 2020 (10)

- July 2020 (8)

- June 2020 (3)

- May 2020 (1)

- April 2020 (2)

- March 2020 (2)

- February 2020 (1)

- January 2020 (1)

- November 2019 (2)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- June 2019 (2)

- May 2019 (3)

- March 2019 (1)

- February 2019 (3)

- December 2018 (1)

- November 2018 (2)

- October 2018 (1)

- September 2018 (2)

- August 2018 (1)

- July 2018 (1)

- June 2018 (3)

- May 2018 (4)

- April 2018 (1)

- February 2018 (1)

- January 2018 (4)

- November 2017 (1)

- October 2017 (2)

- June 2017 (1)

- May 2017 (2)

- April 2017 (1)

- February 2017 (1)

- January 2017 (2)

- October 2016 (1)

- August 2016 (1)

- July 2016 (2)

- June 2016 (1)

- March 2016 (1)

- January 2016 (1)

- December 2015 (3)

- November 2015 (2)

- October 2015 (6)

- July 2015 (1)

- June 2015 (1)

- April 2015 (2)

- March 2015 (13)

- February 2015 (17)

- January 2015 (15)

- December 2014 (35)

- November 2014 (26)

- October 2014 (60)

- September 2014 (2)