Our logistics experts.

Your market insights.

Market insights should look like your routing guide: everything you need in one place when you need it. That’s why we bring all our logistics experts and thought leaders together on this blog so we can help you understand what’s going on and prepare for what’s coming.

Loadsmart’s Look Ahead: An Analysis of Key Freight & Economic Indicators to Watch in January 2026

Loadsmart’s Look Ahead: An Analysis of Key Freight & Economic Indicators to Watch in January 2026

Jan 22, 2026

1

min read

Loadsmart’s Look Ahead: An Analysis of Key Freight & Economic Indicators to Watch in December 2025

Loadsmart’s Look Ahead: An Analysis of Key Freight & Economic Indicators to Watch in December 2025

Dec 3, 2025

1

min read

Loadsmart’s Look Ahead: An Analysis of Key Freight & Economic Indicators to Watch in November 2025

Loadsmart’s Look Ahead: An Analysis of Key Freight & Economic Indicators to Watch in November 2025

Nov 3, 2025

1

min read

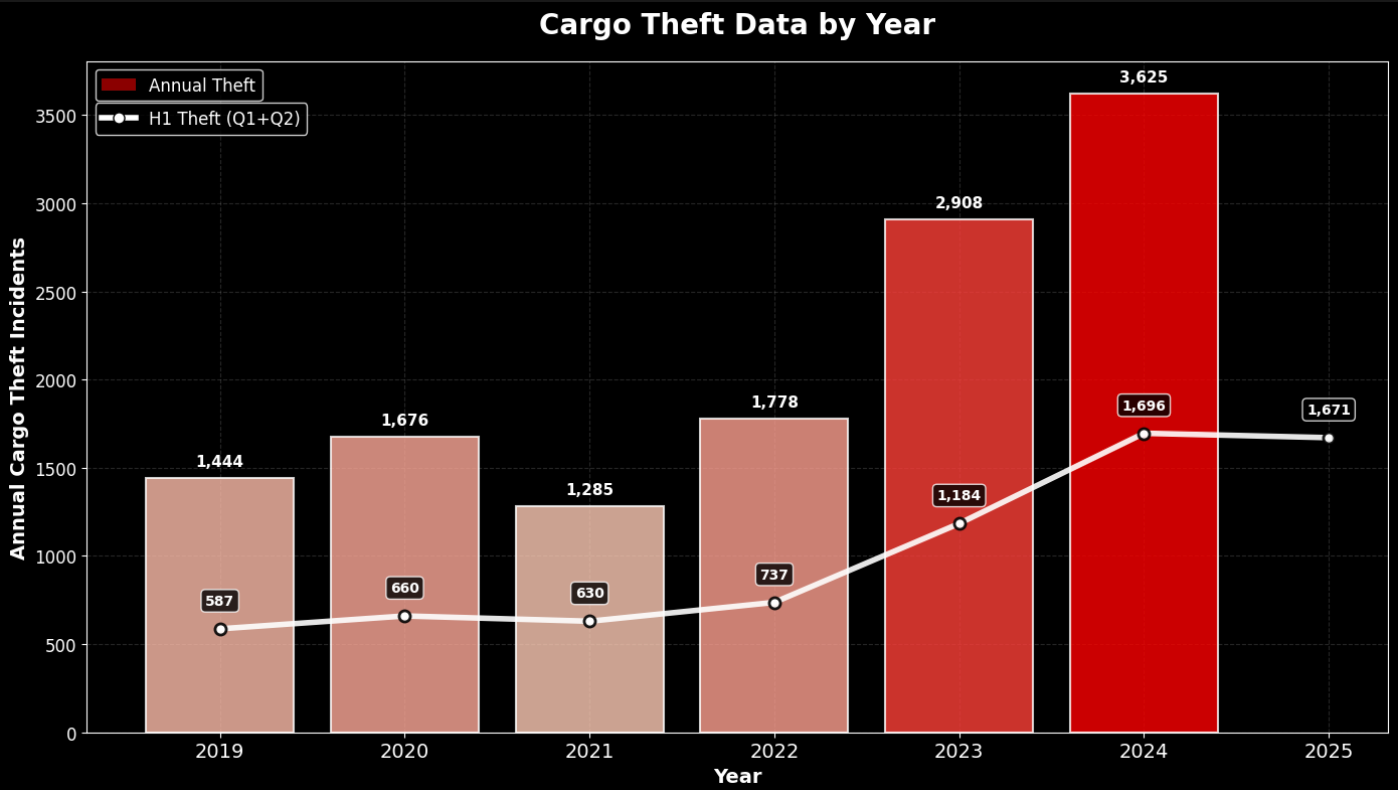

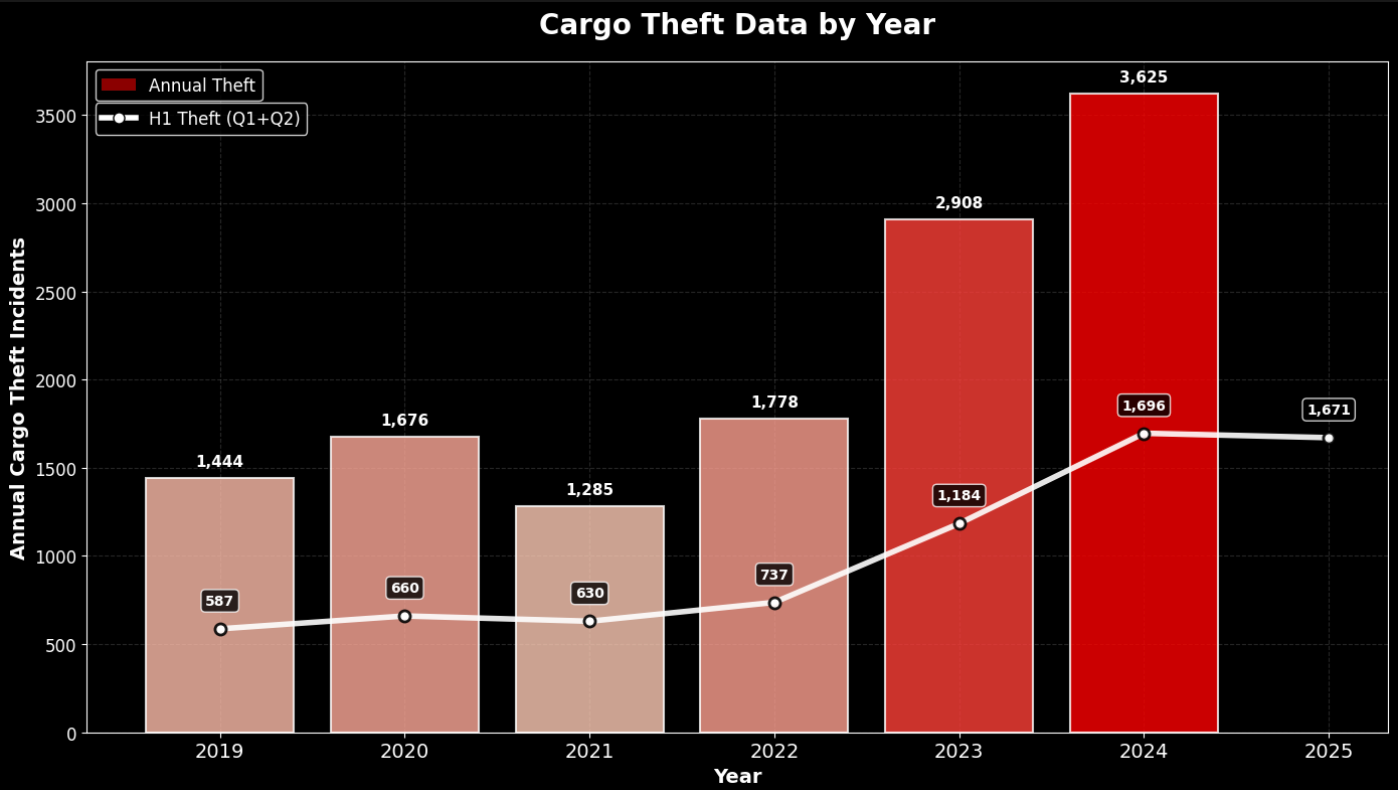

Cargo Theft is Evolving, and Getting Smarter

Cargo Theft is Evolving, and Getting Smarter

Oct 30, 2025

4

min read

Loadsmart’s Look Ahead: An Analysis of Key Freight & Economic Indicators to Watch in October 2025

Loadsmart’s Look Ahead: An Analysis of Key Freight & Economic Indicators to Watch in October 2025

Oct 20, 2025

1

min read

Loadsmart’s Look Ahead: An Analysis of Key Freight & Economic Indicators to Watch in September 2025

Loadsmart’s Look Ahead: An Analysis of Key Freight & Economic Indicators to Watch in September 2025

Sep 17, 2025

1

min read

Loadsmart’s Look Ahead: An Analysis of Key Freight & Economic Indicators to Watch in August 2025

Loadsmart’s Look Ahead: An Analysis of Key Freight & Economic Indicators to Watch in August 2025

Aug 18, 2025

2

min read

Loadsmart’s Look Ahead: An Analysis of Key Freight & Economic Indicators to Watch in July 2025

Loadsmart’s Look Ahead: An Analysis of Key Freight & Economic Indicators to Watch in July 2025

Jul 16, 2025

2

min read

Loadsmart’s Look Ahead: An Analysis of Key Freight & Economic Indicators to Watch in June 2025

Loadsmart’s Look Ahead: An Analysis of Key Freight & Economic Indicators to Watch in June 2025

Jun 9, 2025

2

min read

What is a Statement on Origin—and why does it matter for UK warehouses?

What is a Statement on Origin—and why does it matter for UK warehouses?

May 27, 2025

5

min read

Case Study: Ralph Moyle Uses Opendock to Coordinate Up To 500 Weekly Appointments for Food and Beverage Clients

Case Study: Ralph Moyle Uses Opendock to Coordinate Up To 500 Weekly Appointments for Food and Beverage Clients

May 16, 2025

1

min read

Faces of Loadsmart: Meet Geoff Kelley, COO

Faces of Loadsmart: Meet Geoff Kelley, COO

May 14, 2025

4

min read