Share this

INSIDE LOOK: A MONTHLY ANALYSIS OF LOADSMART’S DATA & MARKET INDICES

by aaronroseman

June was an irregular month as far as the freight market goes: typical seasonality would suggest we’d have seen a steady ramp up in rates/volumes into July 4th. Instead, rates actually softened throughout June and demand surged much less than it would in a typical year. From a macroeconomic perspective, we see signs of a sluggish economy, but no recession yet.

Read more to get our freight market recap on the past 1-2 months, our predictions for the coming 1-2 months, a drayage market update and much more!

Full Truckload Spot Market Overview

- Volumes: As usual, Volumes dropped over Memorial Day and then rebounded in the first half of June. Surprisingly, however, volumes then actually came down on the back half of June as we approached July 4th

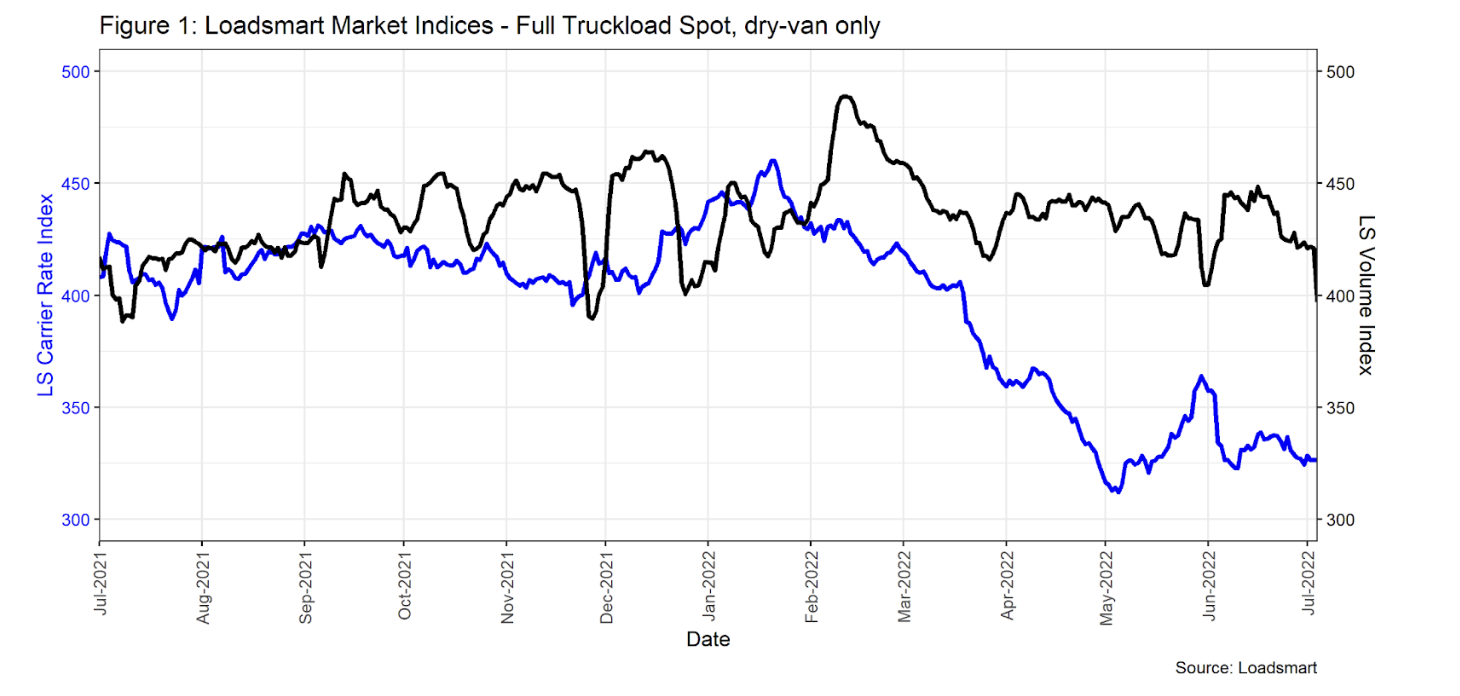

- Rates: As seen in Figure 1, in May Loadsmart’s Rate Index had a brief recovery from the extreme market softening that took place from Jan-May’22 – in May LS carrier rates recovered 13%.

- But as soon as we passed Memorial Day, the recovery was proven to be only temporary. The rate index dropped (-9%) closer to its beginning-of-May values and it has been oscillating at the 325-340 range since the end of May.

- On Friday, July 1st, carrier rates were 27% lower YoY and Loadsmart felt a somewhat muted impact from July 4th overall (minimal rolled loads, manageable load stacking, no big demand surges, etc)

Suggestions for shippers:

- Similar to produce season, the food and bev surge starts in the south and then migrates north as the weather heats up even further. Don’t be surprised if some markets in the mid-northern parts of the country experience tightened capacity over the next month as we finish up the summer surge

- Remember that contract rates follow spot rates and are very likely going to decline over the coming 6-12 months

- If you want to recognize cost savings as the market softens but don’t want to constantly re-bid your network, consider leveraging Loadsmart’s Reliable Contract Solution – click here to read more

Loadsmart’s “Hot Take” for the Full Truckload Market for July

- We predict a truckload demand softening in July (10-15% decline in our index) given typical seasonality, the macro backdrop of weaker consumer demand, the recent industrial output declines, and an impending recession

- Supply (capacity) should remain strong throughout July as Logistics Managers’ Transportation capacity index still saw minor growth in June and Sonar’s Outbound Tender Reject Index hit its lowest point of the year. We predict rates to steadily decline throughout July by 5-10%

Notable Freight & Economic Relationships

Industrial production from key sectors

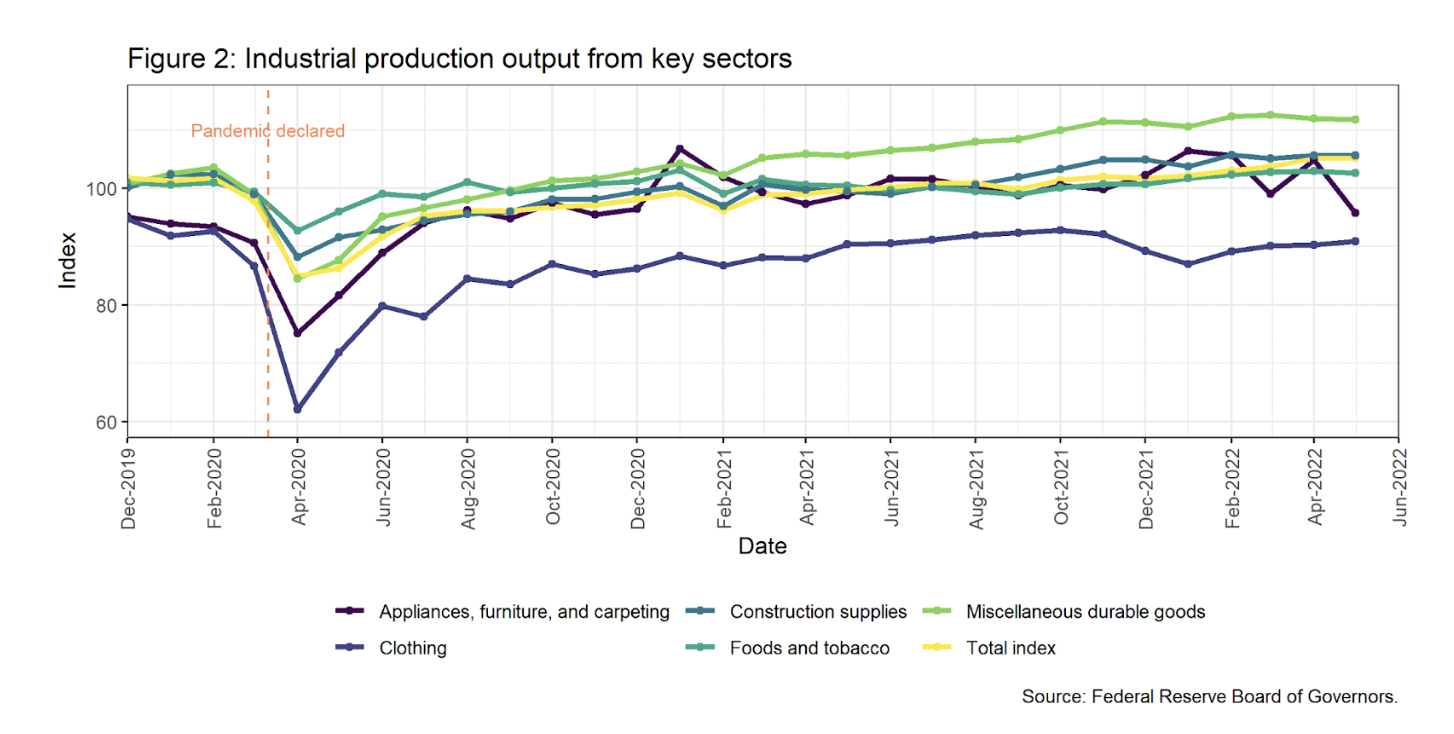

- Loadsmart is exposed to large amounts of shipping activity on key goods such as food and tobacco, furniture, clothing and construction supplies. In Figure 2 below, we report the recent levels of industrial production in these sectors.

- Industrial production flattening will likely have an impact on softening truckload demand since these industries are our primary end-users.

- Output gains for most sectors have been close to zero for the past three months, except for furniture that had large oscillations, declining 8% MoM from April to May.

- Finally, we might see signs of slowdown – specially for durable goods that had a remarkable output growth in 2021 – but no indication of recession so far.

Heavy truck market

- Another variable highly correlated to industrial production, but more capable to show the impact of output fluctuations on haulers is heavy truck demand.

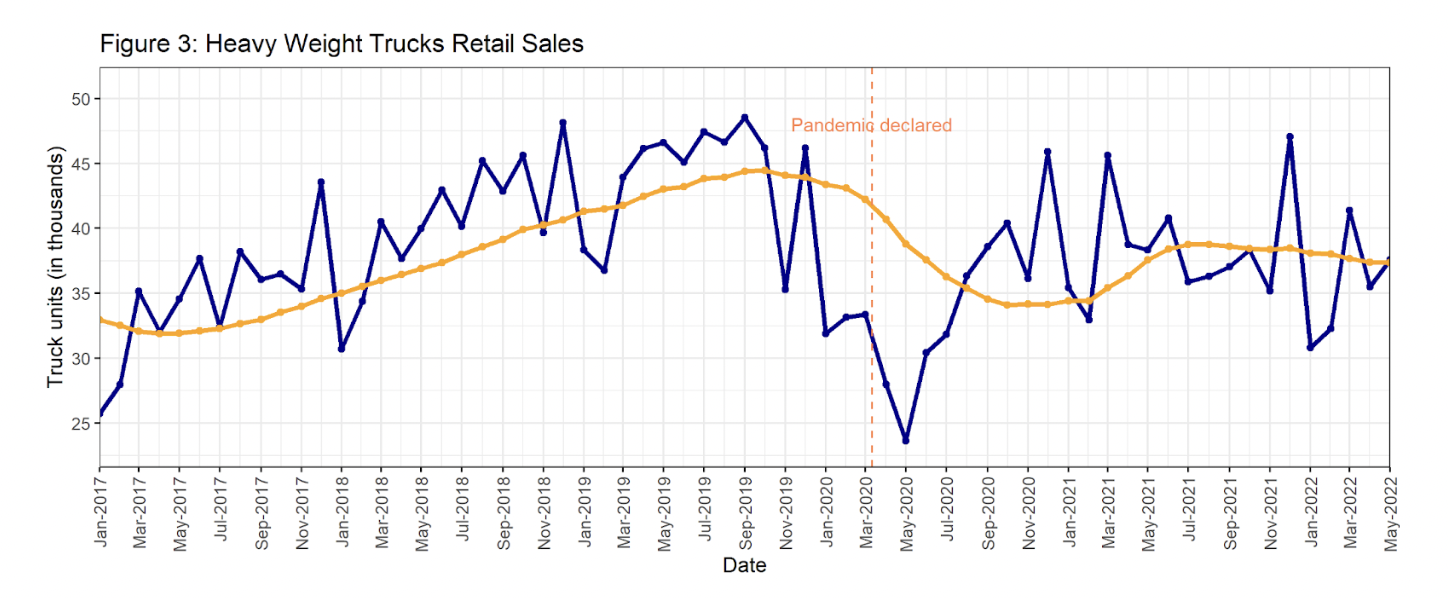

- As shown in Figure 3 below, heavy weight trucks retail sales increased by 5% MoM, with 37.5 thousand truck units sold in May, according to FED estimates.

- But given this series’ high vulnerability to seasonal fluctuations, we can better evaluate it using the 12-month rolling average. The rolling average shows a mild downward trend in sales starting in July 2021.

- With the stagnancy in industrial production growth, truck sales are expected to keep following the 12-month rolling mean downward trend.

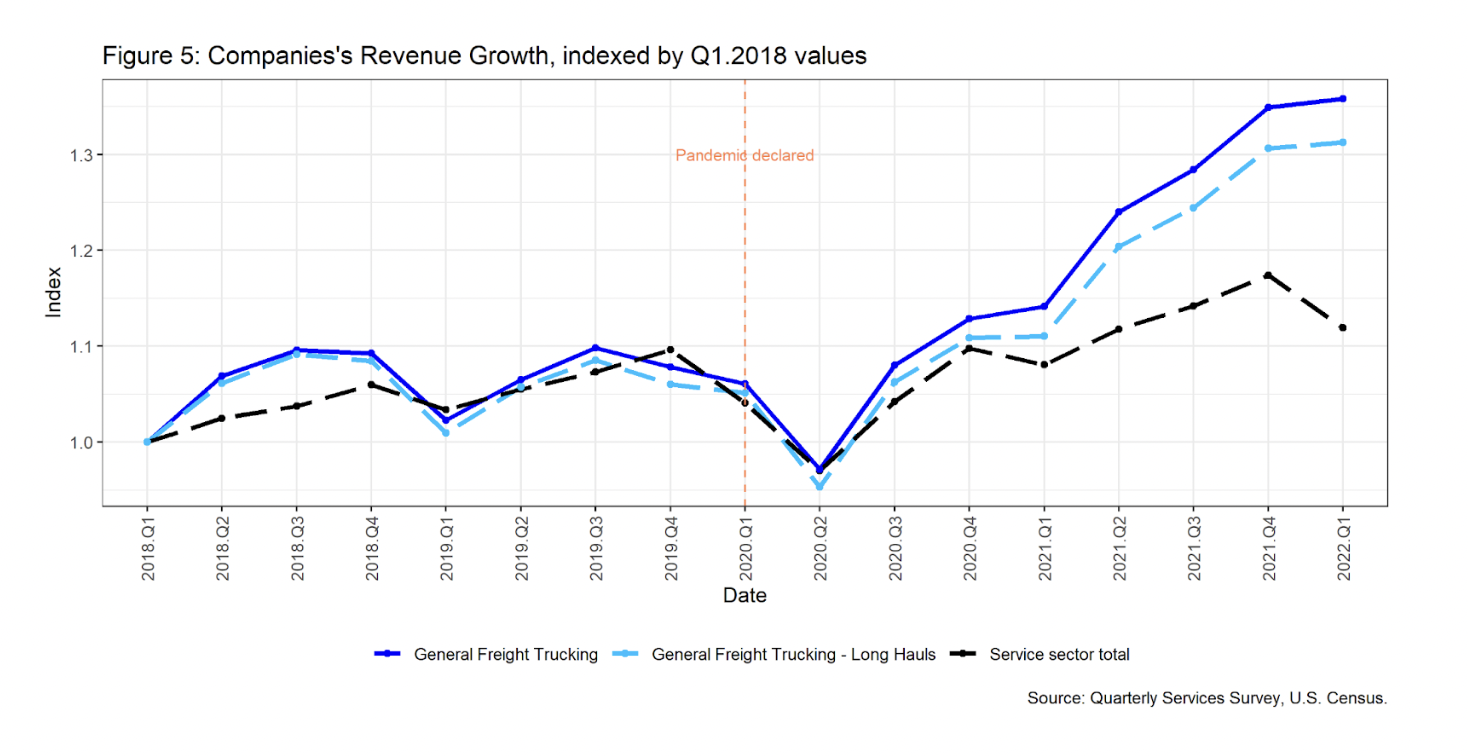

Freight companies’ financial health

Freight companies’ financial health

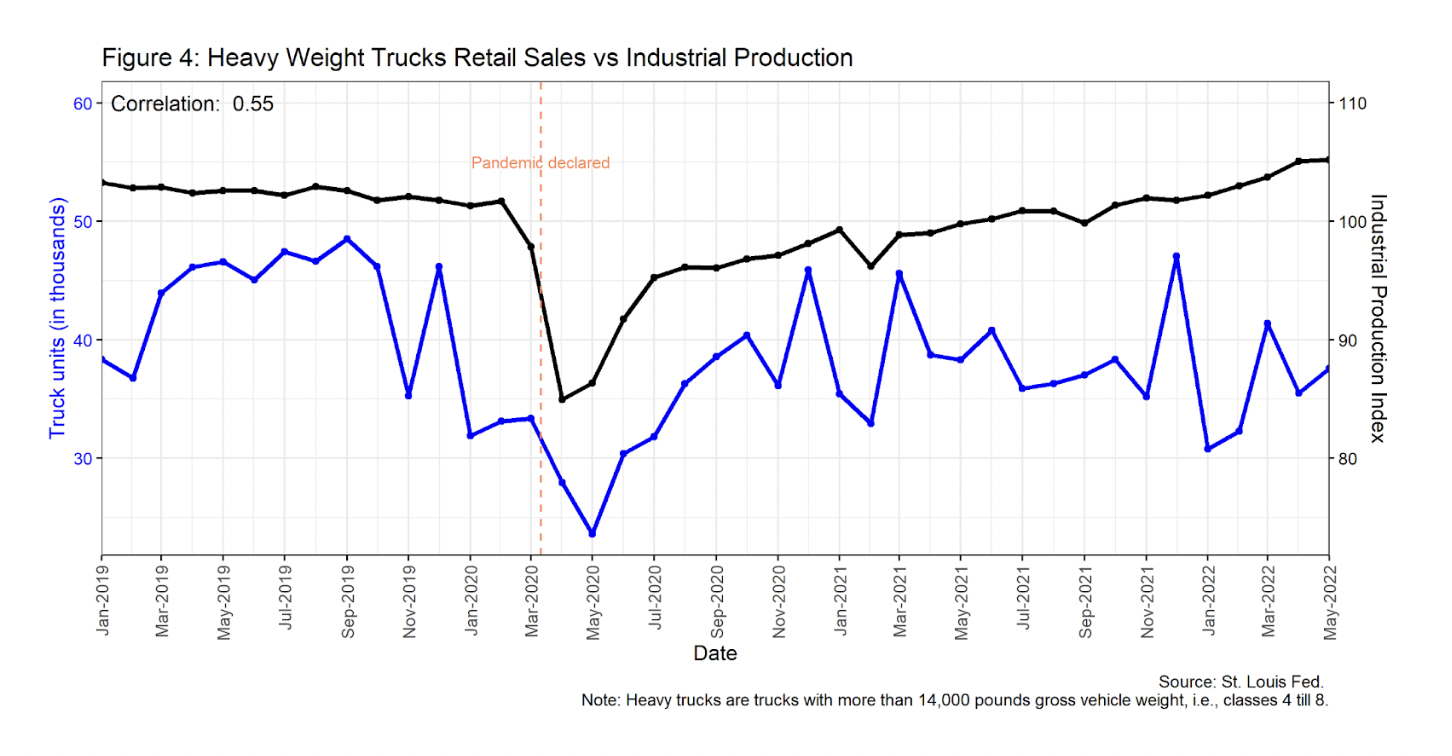

- Data from The US Census Quarterly Services Survey, displayed in Figure 4, show that freight companies kept their revenue roughly constant in the first quarter of 2022. The estimated total revenue of freight trucking companies rose only 1% in QoQ, both for total and long haul business.

- This result is far below from last year’s average QoQ growth of 5%, but it shows this sector’s financial strength amid the recent economic slowdown when compared to the general service sector. The services sector’ revenue declined 5% QoQ.

- That said, given what we’ve discussed above, we expect to see this revenue growth for Freight Trucking companies to slow down further in Q2’22 or even decline

ABOUT LOADSMART

Transforming the future of freight, Loadsmart leverages technology and logistics data to build efficiency around how freight is priced, booked and shipped. Pairing comprehensive logistics technology with deep-seated freight industry expertise, Loadsmart fuels business growth, simplifies operations and increases efficiency for carriers and shippers alike. For more information, please visit: https://loadsmart.com. Move more with less.

Share this

- Loadsmart Blog (159)

- Blog (121)

- Shipper (106)

- Market Trends (101)

- Enterprise Shipper (69)

- Carrier (66)

- News (62)

- Data Insights (51)

- Thought Leadership (45)

- Warehouse (41)

- SMB Shipper (38)

- Our Partners (34)

- ShipperGuide TMS (31)

- Opendock (30)

- Product Updates (29)

- Mode Optimization (25)

- Loadsmart (23)

- Mid-Market Shipper (18)

- Case Study (17)

- Brokerage Services (15)

- Managed Transportation (11)

- Video (9)

- Award (7)

- FreightIntel AI (5)

- Instant Execution (4)

- Asset (3)

- Food and Beverage (3)

- Freight Management (3)

- Logistics Solutions (3)

- YMS (3)

- eBook (3)

- 4PL (2)

- International (2)

- NavTrac (2)

- Podcast (2)

- UK (2)

- Yard Management System (2)

- Cold Storage (1)

- Faces of Loadsmart (1)

- Paper Packaging (1)

- Retail (1)

- Security (1)

- Transportation Management System (1)

- January 2026 (1)

- December 2025 (1)

- November 2025 (1)

- October 2025 (2)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (7)

- April 2025 (6)

- March 2025 (3)

- February 2025 (10)

- January 2025 (4)

- December 2024 (4)

- November 2024 (5)

- October 2024 (11)

- September 2024 (11)

- August 2024 (5)

- July 2024 (5)

- June 2024 (9)

- May 2024 (7)

- April 2024 (6)

- March 2024 (2)

- February 2024 (2)

- January 2024 (5)

- December 2023 (6)

- November 2023 (2)

- October 2023 (12)

- September 2023 (5)

- August 2023 (3)

- July 2023 (4)

- June 2023 (10)

- May 2023 (5)

- April 2023 (5)

- March 2023 (7)

- February 2023 (5)

- January 2023 (7)

- December 2022 (4)

- November 2022 (13)

- October 2022 (4)

- September 2022 (7)

- August 2022 (11)

- July 2022 (6)

- June 2022 (5)

- May 2022 (2)

- April 2022 (4)

- March 2022 (6)

- February 2022 (7)

- January 2022 (9)

- December 2021 (3)

- November 2021 (5)

- October 2021 (7)

- September 2021 (2)

- August 2021 (2)

- July 2021 (4)

- June 2021 (6)

- May 2021 (6)

- April 2021 (5)

- March 2021 (8)

- February 2021 (3)

- January 2021 (3)

- December 2020 (7)

- November 2020 (9)

- October 2020 (7)

- September 2020 (6)

- August 2020 (10)

- July 2020 (8)

- June 2020 (3)

- May 2020 (1)

- April 2020 (2)

- March 2020 (2)

- February 2020 (1)

- January 2020 (1)

- November 2019 (2)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- June 2019 (2)

- May 2019 (3)

- March 2019 (1)

- February 2019 (3)

- December 2018 (1)

- November 2018 (2)

- October 2018 (1)

- September 2018 (2)

- August 2018 (1)

- July 2018 (1)

- June 2018 (3)

- May 2018 (4)

- April 2018 (1)

- February 2018 (1)

- January 2018 (4)

- November 2017 (1)

- October 2017 (2)

- June 2017 (1)

- May 2017 (2)

- April 2017 (1)

- February 2017 (1)

- January 2017 (2)

- October 2016 (1)

- August 2016 (1)

- July 2016 (2)

- June 2016 (1)

- March 2016 (1)

- January 2016 (1)

- December 2015 (3)

- November 2015 (2)

- October 2015 (6)

- July 2015 (1)

- June 2015 (1)

- April 2015 (2)

- March 2015 (13)

- February 2015 (17)

- January 2015 (15)

- December 2014 (35)

- November 2014 (26)

- October 2014 (60)

- September 2014 (2)