Share this

Measuring Volatility for the Full Truckload Spot Market

by aaronroseman

Spot rates in the full truckload market are essentially commoditized, causing spot rates to be an important source of systematic risk for all participants in the industry (carriers, shippers, brokerages, etc.). The ability to accurately estimate this systematic risk (i.e. volatility) for the truckload market is challenging due to inherent complexities embedded in the price of fuel, labor conditions, technological changes, macro-economic environment and the seasonality of industrial production and retail sales.

Unsurprisingly, modeling and predicting volatility has a great importance in the market: if shippers can predict and benchmark freight volatility, they can optimize lane selection and avoid overspending, resulting in a more sustainable supply chain network.

The objective of this analysis is to present Loadsmart’s dynamic approach to predict freight spot market volatility using GARCH modeling, an advanced technique used in financial econometrics. We also intend to show how this prediction of volatility will enable Loadsmart to help shippers (a) benchmark the risk embedded in their freight spend and (b) to determine the acceptable levels of price variation within their network in the short- and long-term.

Estimating volatility:

Generate a daily rate index:

To predict spot rate volatility, we first had to generate a daily spot rate index that we could analyze directly. Truckload spot market rates can be represented by an index generated from the top 10 most relevant key market areas in the US in terms of freight volume.

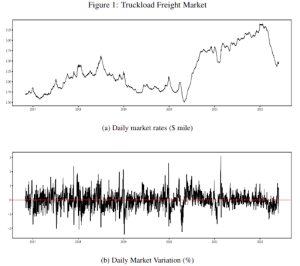

Generating this index ━ Figure 1a ━ required a two-stage procedure: (1) a data cleaning process, which included defining the most important lanes that originate from each major area and (2) an average of all lane rates on a daily basis from November, 2016 to May, 2022. All in all, this index comprises 875 unique lanes. To properly assess volatility, we also generated a chart that views daily market variation ━ Figure 1b.

We observed that the daily pricing index has significant “serial correlation” (a concept popularly found in financial market analysis), meaning that a shipper or carrier may alter their behavior in a non-random way depending on how the rates evolve. We also found truckload rates to exhibit non-constant volatility over time, which helps explain the behavior for the daily market variations and distinct periods of high and low volatility.

Applying the GARCH Methodology:

Without going into too much detail, the GARCH (Generalized Auto Regressive Conditional Heteroskedasticity) methodology provides a useful framework for assessing truckload price volatility due to the statistical dynamics of daily market variations (Figure 1b above). The main results/conclusions drawn from applying this methodology on the full truckload spot market included:

- The market generally presents weak sensitivity to new information, probably due to the large number of competing carriers;

- Estimated long-run (annualized) volatility of 5.42% (i.e. prices vary yearly by 5-6% on average);

- Volatility persistence of about 2 weeks (i.e. today’s market volatility will influence future volatility for up to 2 weeks);

- Volatility tends to revert to its average level over time.

Empirical implications and conclusion:

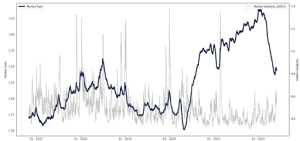

- In Figure 2 below we plot the GARCH volatility output along with the spot rate index. Volatility (unsurprisingly) tends to spike around unusual nation-wide events, such as the Polar Vortexes in the winters of 2019 and 2021, and often at the end of the year as well.

Figure 2: Daily Market volatility

- Leveraging a volatility output such as this can enable shippers to select the best market to move a load (especially since we can create this same measurement on the lane level). As many of us know, over periods of high volatility, shippers should avoid the spot market and opt for contract agreements in order to avoid finance risk exposure

- Ignoring specific situations, the implications of these results overall indicate that the truckload market is actually a stable environment and good for long-term investments. In other words, growth should be focused on the contract market which supports how many shippers already attempt to distribute more of their freight spend on contracted freight.

Finally, we’d like to summarize how shippers can benefit from leveraging this risk model:

- Understand how to measure of risk in the freight market, which is critical for smart business planning;

- Use market volatility as a benchmark to identify market opportunities at the lane level, specifically in periods of market shifts (know when to move a load on either the spot or contract market);

- This could act as a proxy for discount rate for valuation of contracts;

- Determine the acceptable/reasonable levels of price variation in the short- and long-term for your network or by lane. This can assist with price negotiation, reviewing your costs, assessing floating rate contract structures, and much more

If you have questions, thoughts you’d like to share, or would like more information on how Loadsmart can help measure volatility for your freight network, please reach out to jonathan.payne@loadsmart.com and max.resende@loadsmart.com

Share this

- Loadsmart Blog (159)

- Blog (121)

- Shipper (106)

- Market Trends (101)

- Enterprise Shipper (69)

- Carrier (66)

- News (62)

- Data Insights (51)

- Thought Leadership (45)

- Warehouse (41)

- SMB Shipper (38)

- Our Partners (34)

- ShipperGuide TMS (31)

- Opendock (30)

- Product Updates (29)

- Mode Optimization (25)

- Loadsmart (23)

- Mid-Market Shipper (18)

- Case Study (17)

- Brokerage Services (15)

- Managed Transportation (11)

- Video (9)

- Award (7)

- FreightIntel AI (5)

- Instant Execution (4)

- Asset (3)

- Food and Beverage (3)

- Freight Management (3)

- Logistics Solutions (3)

- YMS (3)

- eBook (3)

- 4PL (2)

- International (2)

- NavTrac (2)

- Podcast (2)

- UK (2)

- Yard Management System (2)

- Cold Storage (1)

- Faces of Loadsmart (1)

- Paper Packaging (1)

- Retail (1)

- Security (1)

- Transportation Management System (1)

- January 2026 (1)

- December 2025 (1)

- November 2025 (1)

- October 2025 (2)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (7)

- April 2025 (6)

- March 2025 (3)

- February 2025 (10)

- January 2025 (4)

- December 2024 (4)

- November 2024 (5)

- October 2024 (11)

- September 2024 (11)

- August 2024 (5)

- July 2024 (5)

- June 2024 (9)

- May 2024 (7)

- April 2024 (6)

- March 2024 (2)

- February 2024 (2)

- January 2024 (5)

- December 2023 (6)

- November 2023 (2)

- October 2023 (12)

- September 2023 (5)

- August 2023 (3)

- July 2023 (4)

- June 2023 (10)

- May 2023 (5)

- April 2023 (5)

- March 2023 (7)

- February 2023 (5)

- January 2023 (7)

- December 2022 (4)

- November 2022 (13)

- October 2022 (4)

- September 2022 (7)

- August 2022 (11)

- July 2022 (6)

- June 2022 (5)

- May 2022 (2)

- April 2022 (4)

- March 2022 (6)

- February 2022 (7)

- January 2022 (9)

- December 2021 (3)

- November 2021 (5)

- October 2021 (7)

- September 2021 (2)

- August 2021 (2)

- July 2021 (4)

- June 2021 (6)

- May 2021 (6)

- April 2021 (5)

- March 2021 (8)

- February 2021 (3)

- January 2021 (3)

- December 2020 (7)

- November 2020 (9)

- October 2020 (7)

- September 2020 (6)

- August 2020 (10)

- July 2020 (8)

- June 2020 (3)

- May 2020 (1)

- April 2020 (2)

- March 2020 (2)

- February 2020 (1)

- January 2020 (1)

- November 2019 (2)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- June 2019 (2)

- May 2019 (3)

- March 2019 (1)

- February 2019 (3)

- December 2018 (1)

- November 2018 (2)

- October 2018 (1)

- September 2018 (2)

- August 2018 (1)

- July 2018 (1)

- June 2018 (3)

- May 2018 (4)

- April 2018 (1)

- February 2018 (1)

- January 2018 (4)

- November 2017 (1)

- October 2017 (2)

- June 2017 (1)

- May 2017 (2)

- April 2017 (1)

- February 2017 (1)

- January 2017 (2)

- October 2016 (1)

- August 2016 (1)

- July 2016 (2)

- June 2016 (1)

- March 2016 (1)

- January 2016 (1)

- December 2015 (3)

- November 2015 (2)

- October 2015 (6)

- July 2015 (1)

- June 2015 (1)

- April 2015 (2)

- March 2015 (13)

- February 2015 (17)

- January 2015 (15)

- December 2014 (35)

- November 2014 (26)

- October 2014 (60)

- September 2014 (2)