Share this

Inside Look: July’s Analysis of Loadsmart’s Data & Market Indices

by aaronroseman

July’s freight market movements went mostly as expected. Spot rates declined MoM given soft freight demand and excess capacity and contract rates began their decline – a decline that we expect to continue to see over the coming 4-6 months as they catch up to low spot rates.

As usual, in this Monthly Market Update, we will (a) provide an update / analysis of the full truckload market and (b) present some compelling trucking-related economic data and analysis to provide a macroeconomic view on the state of the market.

We hope you enjoy! #movemorewithless

Full Truckload Market Overview

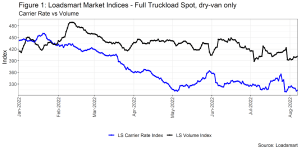

Figure 1

- Volumes: our average volume index is down by 7% MoM. After hitting a new YTD bottom on July 4th, the index recovered traction again till mid-July, when the downward trend resumed.

- Rates: in the first half of July, our price index plunged, reaching a level near the yearly low. In the second half, the index had a brief recovery led by Southern California’s (Los Angeles and Ontario) heated demand. Sonar’s OTRI for the region displayed a similar bounce since demand, and hence, prices soared amidst an increase in port activity. In the last week of the month, SoCal prices normalized and the index returned to its beginning of the month levels.

Suggestions for shippers:

- With national rejections (measured by Sonar’s OTRI) sitting at ~6.3% (the lowest point in over 2 years), shippers are in the driver’s seat. If you need/want to move freight on the spot market, it should be easy to find capacity and you can push rates as much as 10-15% below even in current market conditions. Carriers need freight.

- As mentioned in our last monthly, remember to keep driving contract rates down as they still have a 20%+ gap from spot rates.

- According to DAT’s National DRV spot & contract indices, contract rates have begun their descent: from June > July, National DRV contract rates were down 4 cents, and so far, in August, they’re down 14 cents.

- Contract rates are dropping much faster than spot rates, which only have dropped 4 cents from July > August

- If you want to recognize cost savings as the market softens but do not want to constantly re-bid your network, consider leveraging Loadsmart’s Reliable Contract Solution – click here to read more

- According to DAT’s National DRV spot & contract indices, contract rates have begun their descent: from June > July, National DRV contract rates were down 4 cents, and so far, in August, they’re down 14 cents.

What is Loadsmart expecting for August and what are we watching closely?

- We expect contract rates to continue their somewhat rapid decline (5%+ in August) as well as minor spot rate reductions (1-3%). August is historically soft, and we do not see anything that would indicate a tightening over the coming weeks

- We know there is an excess of capacity in the market today, so Loadsmart is focused on demand indicators in August: import volumes, consumer demand, and overall freight demand. These have all been bearish recently and will be key for understanding what kind of peak season impact we could expect for September and October.

Freight & Economics

Diesel prices

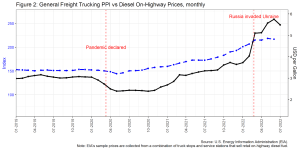

- After six months of consecutive increases, diesel prices began to drop in July, declining 5% MoM, as shown in Figure 2.

- The upward trend in diesel prices started in Dec/2021 when the oil production could not meet the post-pandemic resurging demand as offices and industries began reopening.

- In March, a supply issue was added to the mix when the U.S. imposed sanctions on Russian oil and diesel prices peaked in June costing $5.75/gallon – shown in Figure 2.

- Figure 2 plots the (Producers Price Index) PPI for freight trucking, which measures the average monthly change in the amount received for trucking services.

- The PPI is highly tied to diesel price, but comparing the two series historical volatility since 2007, we notice that the first is 50% less volatile than the latter, which shows how the carrier market’s can struggle in fuel prices hike cycles, such as the current one. Given their market competitiveness, carriers are unable to pass-through a great share of the fuel price hikes to their customers.

Figure 2

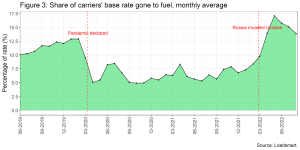

- The same conclusion is drawn more explicitly from our internal data. In Figure 3, we display the average share of fuel surcharge levied on a carrier’ base rate. Since mid-2019 there were two external shocks that jolted this series, dividing it into three periods.

- In the pre-pandemic period, the average share of the rate taken by fuel surcharge was around 11% of the base rate. During the two years of covid restrictions, the rate fell to only 6%, and; after the Russian-Ukraine war began, it rebounded reaching a historical high of 17%.

Figure 3

- But if freight demand remains stable at current levels, we expect the share of fuel surcharge on rates to continue to drop as diesel prices are currently in a downward trend.

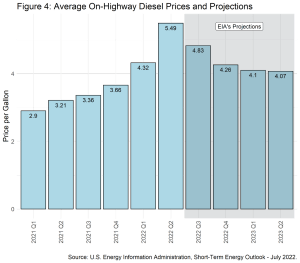

- Recent forecasts from EIA suggest that, indeed, the oil supercycle is over and diesel prices should stabilize at lower levels in the fourth quarter of 2022 – Figure 4.

Figure 4

Transborder Flows

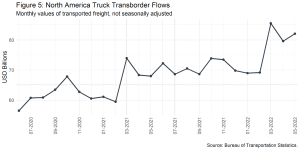

- North American transborder freight was up 28.3% in May YoY, according to the Bureau of Transportation Statistics. Trucks were responsible for 59% of these transborder flows, moving US$82 bn in the same month (a 15.7% rise YoY) – see Figure 5. The top traded commodities were: (i) computers and parts ($15 bn); (ii) electrical machinery ($12 bn); (iii) vehicles and parts ($11 bn).

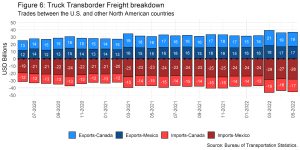

- By breaking down trucking flow values we notice that most of this increase in transborder freight volume was brought by the rise in imports from Mexico to the U.S – truck freight rose 20.7% in May YoY – as shown in Figure 6.

- Mexican imports had been gradually gaining market share in the U.S. over the last few years as a result of the U.S. and China trade war.

Figure 5

Figure 6

Please reach out to Jon Payne (jonathan.payne@loadsmart.com) with any questions, suggestions, thoughts, etc. Thank you!

Share this

- Loadsmart Blog (160)

- Blog (119)

- Shipper (105)

- Market Trends (93)

- Enterprise Shipper (69)

- Carrier (66)

- News (63)

- Data Insights (51)

- Thought Leadership (45)

- Warehouse (42)

- SMB Shipper (38)

- Our Partners (34)

- ShipperGuide TMS (33)

- Opendock (32)

- Product Updates (29)

- Mode Optimization (25)

- Loadsmart (23)

- Case Study (19)

- Mid-Market Shipper (18)

- Brokerage Services (15)

- Managed Transportation (11)

- Video (9)

- Award (7)

- FreightIntel AI (5)

- Instant Execution (4)

- Asset (3)

- Food and Beverage (3)

- Freight Management (3)

- Logistics Solutions (3)

- YMS (3)

- eBook (3)

- 4PL (2)

- International (2)

- NavTrac (2)

- Podcast (2)

- UK (2)

- Yard Management System (2)

- Cold Storage (1)

- Faces of Loadsmart (1)

- Paper Packaging (1)

- Retail (1)

- Transportation Management System (1)

- June 2025 (1)

- May 2025 (7)

- April 2025 (6)

- March 2025 (3)

- February 2025 (11)

- January 2025 (5)

- December 2024 (4)

- November 2024 (4)

- October 2024 (11)

- September 2024 (11)

- August 2024 (5)

- July 2024 (5)

- June 2024 (9)

- May 2024 (7)

- April 2024 (6)

- March 2024 (2)

- February 2024 (2)

- January 2024 (5)

- December 2023 (6)

- November 2023 (2)

- October 2023 (12)

- September 2023 (5)

- August 2023 (3)

- July 2023 (4)

- June 2023 (10)

- May 2023 (5)

- April 2023 (5)

- March 2023 (7)

- February 2023 (5)

- January 2023 (7)

- December 2022 (4)

- November 2022 (13)

- October 2022 (4)

- September 2022 (7)

- August 2022 (11)

- July 2022 (6)

- June 2022 (5)

- May 2022 (2)

- April 2022 (4)

- March 2022 (6)

- February 2022 (7)

- January 2022 (9)

- December 2021 (3)

- November 2021 (5)

- October 2021 (7)

- September 2021 (2)

- August 2021 (2)

- July 2021 (4)

- June 2021 (6)

- May 2021 (6)

- April 2021 (5)

- March 2021 (8)

- February 2021 (3)

- January 2021 (3)

- December 2020 (7)

- November 2020 (9)

- October 2020 (7)

- September 2020 (6)

- August 2020 (10)

- July 2020 (8)

- June 2020 (3)

- May 2020 (1)

- April 2020 (2)

- March 2020 (2)

- February 2020 (1)

- January 2020 (1)

- November 2019 (2)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- June 2019 (2)

- May 2019 (3)

- March 2019 (1)

- February 2019 (3)

- December 2018 (1)

- November 2018 (2)

- October 2018 (1)

- September 2018 (2)

- August 2018 (1)

- July 2018 (1)

- June 2018 (3)

- May 2018 (4)

- April 2018 (1)

- February 2018 (1)

- January 2018 (4)

- November 2017 (1)

- October 2017 (2)

- June 2017 (1)

- May 2017 (2)

- April 2017 (1)

- February 2017 (1)

- January 2017 (2)

- October 2016 (1)

- August 2016 (1)

- July 2016 (2)

- June 2016 (1)

- March 2016 (1)

- January 2016 (1)

- December 2015 (3)

- November 2015 (2)

- October 2015 (6)

- July 2015 (1)

- June 2015 (1)

- April 2015 (2)

- March 2015 (13)

- February 2015 (17)

- January 2015 (15)

- December 2014 (35)

- November 2014 (26)

- October 2014 (60)

- September 2014 (2)