Share this

Is decline in consumption already impacting the freight market?

by aaronroseman

The recent drops in US consumption expenditures make trucking companies fear this could exaggerate the soft freight market by further compressing freight demand and prices. The goal of this article is to put freight’s dependence on procyclical consumption into a broader historical perspective using both internal and external data. Our key takeaways are:

(i) in the previous US recession, overall freight tonnage declined as personal consumption declined. In the current recession environment, we are seeing falls in consumption but we have yet to see a similar fall in freight tonnage;

(ii) durable goods spending started to drop since the end of the stimulus checks policy – Loadsmart’s demand for freight tied to this category has visibly drop too;

(iii) continued declines in durables consumption become more likely amidst an economic downturn, which will likely result in a drop in volumes for the freight industry.

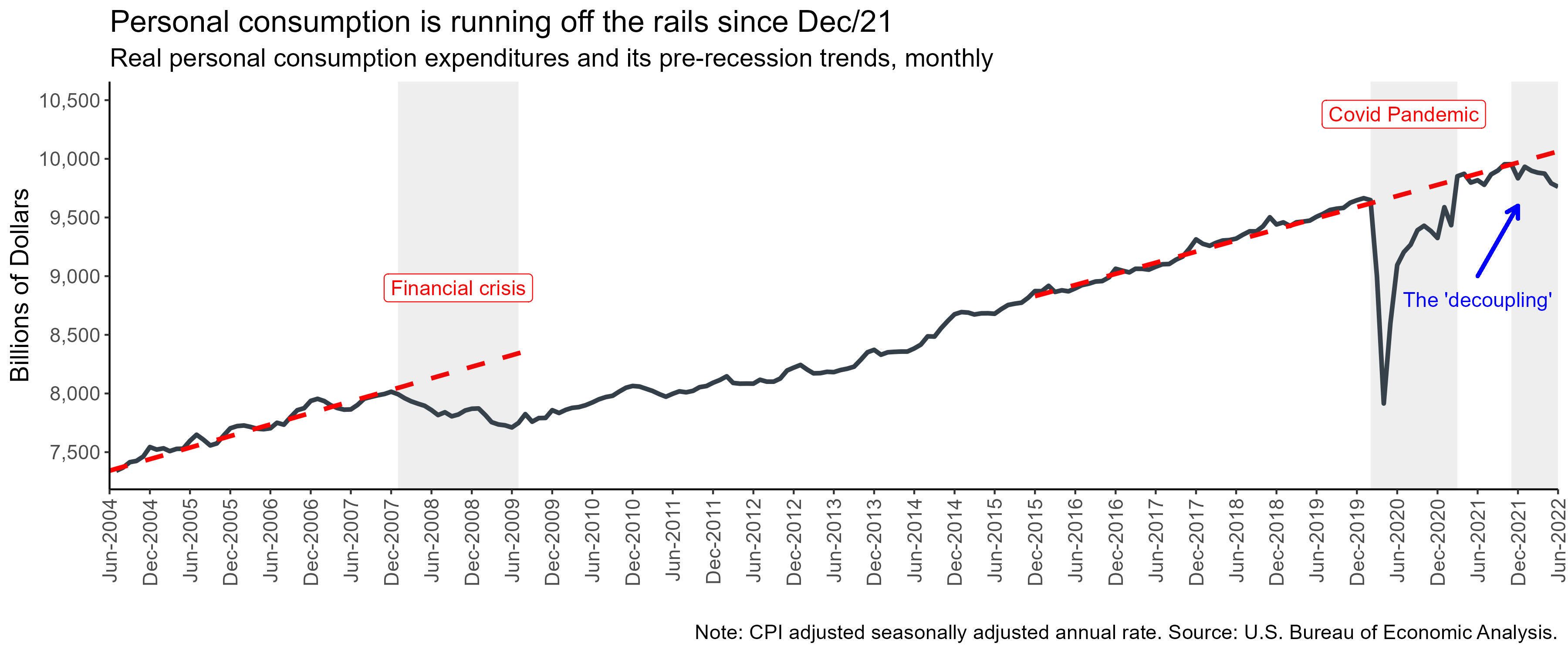

In Dec/21, real personal consumption expenditure started decoupling from its pre-pandemic growth trend – as seen in Figure 1. But this decoupling is still far from being as severe as the one brought by the 2007 financial crisis. Last June, overall consumption maintained its same level YoY, while amid the financial crisis in 2007 it was declining 2% YoY on average every month.

Typically, governments have more tools to fight inflation-driven recessions (e.g. interest rate hikes) than credit-driven ones, but given the geopolitical issues at play (the sanctions against Russian oil, the resurgence of US-China trade war tariffs, etc) the negative economic scenario will likely remain.

Figure 1

Personal consumption expenditure can be broken down into three components: non-durable goods, durable goods, and services. Although the first two are relevant to the freight world, the second one is the main driver of volatility in the current market.

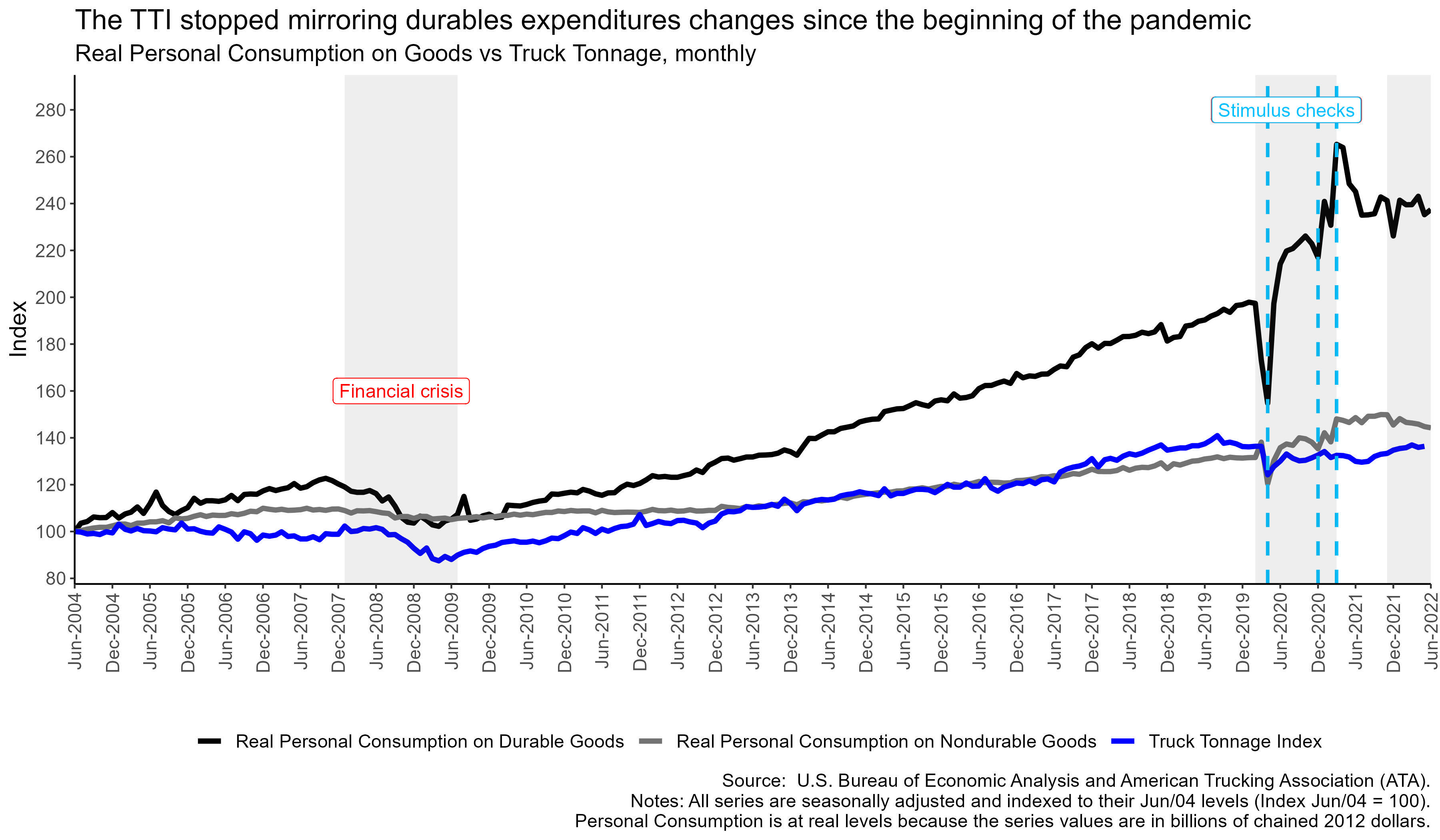

By connecting consumption spending and the freight market in Figure 2, we see that, during the financial crisis-led recession, the expenditure on goods dropped 10% compared to pre-crisis levels while the tonnage of freight transported by trucks, measured by ATA’s Truck Tonnage Index (TTI), declined 15% in the same period (Jan/08 vs Jun/09).

Figure 2

In the last few years, it was only in the first month of the pandemic (Apr/20) that the TTI had a significant decline (10% MoM) – from which it never fully recovered. The spikes in durable goods consumption triggered by stimulus checks releases had little impact on the TTI. And so did the further decline in durable goods consumption that followed the end of this policy on Mar/21.

In the last few years, it was only in the first month of the pandemic (Apr/20) that the TTI had a significant decline (10% MoM) – from which it never fully recovered. The spikes in durable goods consumption triggered by stimulus checks releases had little impact on the TTI. And so did the further decline in durable goods consumption that followed the end of this policy on Mar/21.

One hypothesis as to why the TTI stopped moving in line with durable goods expenditures is that it became outdated due to its inability to capture spot freight’s share of the market. As shown by Sonar’s OTVI (truckload volume index), tendered truckload volumes increased by 40-50% from 2018/2019 to 2021, while the TTI only shows a minor recovery in tonnage following the pandemic (at lower levels than in 2018-2019). From Q2 2020 to January 2022, the amount of freight moved in the spot trucking market has soared, but the TTI did not seem to mirror this change.

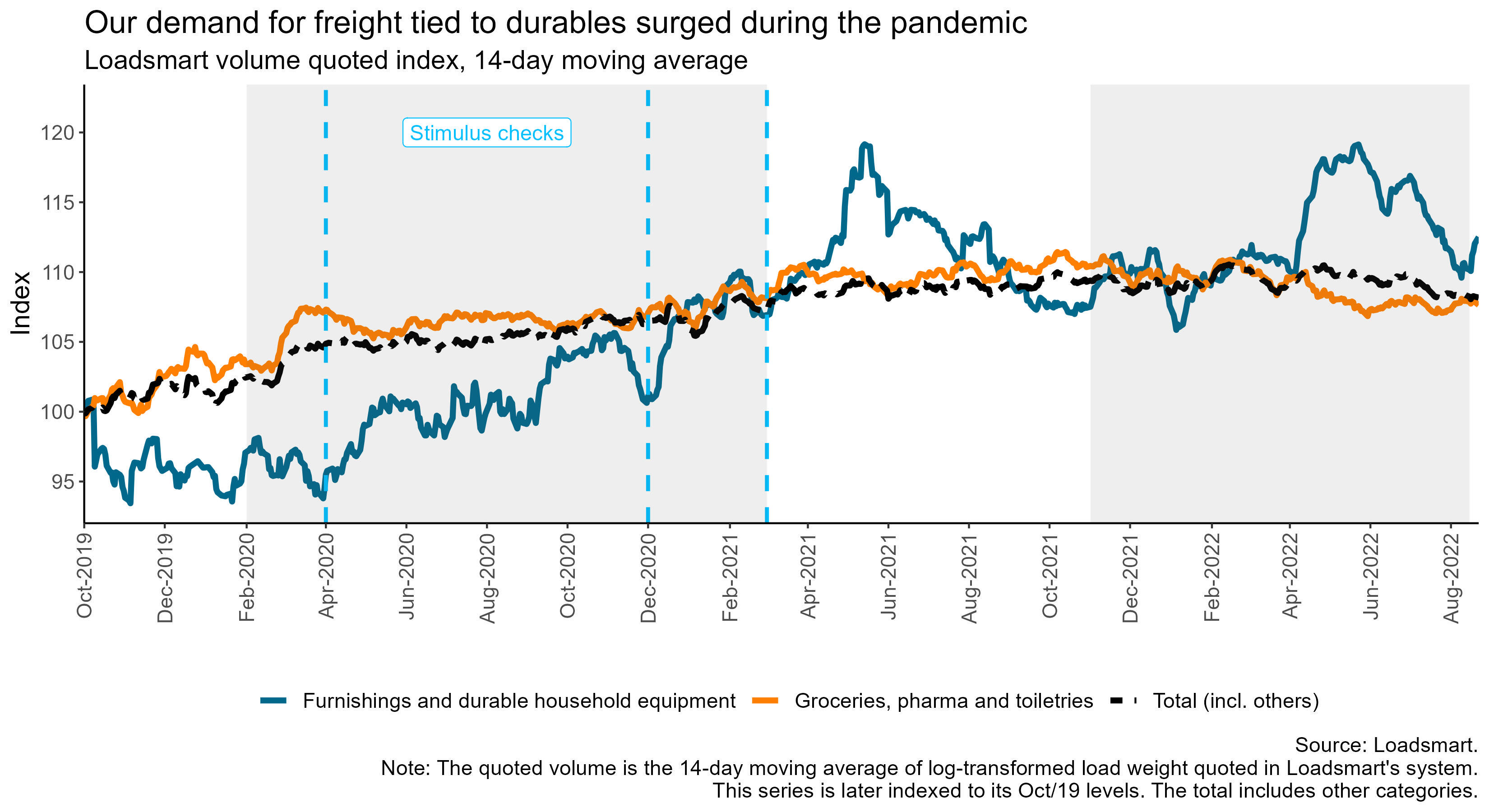

By plotting Loadsmart’s quoted spot volume, we see that, indeed, demand for freight tied to durable goods – proxied by our “Furnishings and durable household equipment” commodity category – surged in tune with the release of the stimulus checks, increasing by 11% during the pandemic (Feb/20 to Mar/21) – as displayed in Figure 3. In the same period, the demand for freight tied to non-durables, represented by “Groceries, pharma and toiletries”, increased only by 5%.

But the reason why our overall quoted volume has not been largely impacted by the drop in durables consumption so far is that the largest chunk of our demand actually comes from moving non-durable goods, the least cyclical component of overall consumption expenditures.

Figure 3

In the current recessive scenario, we expect durable consumption to continue to decline at a faster pace than non durables and services, which should cause notable downward pressures on overall freight tonnage (a pressure that we are currently feeling at Loadsmart). As we all know, further weakening in freight demand will leave trucking businesses to operate with even more capacity which would likely result in further rate declines.

In the current recessive scenario, we expect durable consumption to continue to decline at a faster pace than non durables and services, which should cause notable downward pressures on overall freight tonnage (a pressure that we are currently feeling at Loadsmart). As we all know, further weakening in freight demand will leave trucking businesses to operate with even more capacity which would likely result in further rate declines.

Share this

- Loadsmart Blog (159)

- Blog (121)

- Shipper (106)

- Market Trends (101)

- Enterprise Shipper (69)

- Carrier (66)

- News (62)

- Data Insights (51)

- Thought Leadership (45)

- Warehouse (41)

- SMB Shipper (38)

- Our Partners (34)

- ShipperGuide TMS (31)

- Opendock (30)

- Product Updates (29)

- Mode Optimization (25)

- Loadsmart (23)

- Mid-Market Shipper (18)

- Case Study (17)

- Brokerage Services (15)

- Managed Transportation (11)

- Video (9)

- Award (7)

- FreightIntel AI (5)

- Instant Execution (4)

- Asset (3)

- Food and Beverage (3)

- Freight Management (3)

- Logistics Solutions (3)

- YMS (3)

- eBook (3)

- 4PL (2)

- International (2)

- NavTrac (2)

- Podcast (2)

- UK (2)

- Yard Management System (2)

- Cold Storage (1)

- Faces of Loadsmart (1)

- Paper Packaging (1)

- Retail (1)

- Security (1)

- Transportation Management System (1)

- January 2026 (1)

- December 2025 (1)

- November 2025 (1)

- October 2025 (2)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (7)

- April 2025 (6)

- March 2025 (3)

- February 2025 (10)

- January 2025 (4)

- December 2024 (4)

- November 2024 (5)

- October 2024 (11)

- September 2024 (11)

- August 2024 (5)

- July 2024 (5)

- June 2024 (9)

- May 2024 (7)

- April 2024 (6)

- March 2024 (2)

- February 2024 (2)

- January 2024 (5)

- December 2023 (6)

- November 2023 (2)

- October 2023 (12)

- September 2023 (5)

- August 2023 (3)

- July 2023 (4)

- June 2023 (10)

- May 2023 (5)

- April 2023 (5)

- March 2023 (7)

- February 2023 (5)

- January 2023 (7)

- December 2022 (4)

- November 2022 (13)

- October 2022 (4)

- September 2022 (7)

- August 2022 (11)

- July 2022 (6)

- June 2022 (5)

- May 2022 (2)

- April 2022 (4)

- March 2022 (6)

- February 2022 (7)

- January 2022 (9)

- December 2021 (3)

- November 2021 (5)

- October 2021 (7)

- September 2021 (2)

- August 2021 (2)

- July 2021 (4)

- June 2021 (6)

- May 2021 (6)

- April 2021 (5)

- March 2021 (8)

- February 2021 (3)

- January 2021 (3)

- December 2020 (7)

- November 2020 (9)

- October 2020 (7)

- September 2020 (6)

- August 2020 (10)

- July 2020 (8)

- June 2020 (3)

- May 2020 (1)

- April 2020 (2)

- March 2020 (2)

- February 2020 (1)

- January 2020 (1)

- November 2019 (2)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- June 2019 (2)

- May 2019 (3)

- March 2019 (1)

- February 2019 (3)

- December 2018 (1)

- November 2018 (2)

- October 2018 (1)

- September 2018 (2)

- August 2018 (1)

- July 2018 (1)

- June 2018 (3)

- May 2018 (4)

- April 2018 (1)

- February 2018 (1)

- January 2018 (4)

- November 2017 (1)

- October 2017 (2)

- June 2017 (1)

- May 2017 (2)

- April 2017 (1)

- February 2017 (1)

- January 2017 (2)

- October 2016 (1)

- August 2016 (1)

- July 2016 (2)

- June 2016 (1)

- March 2016 (1)

- January 2016 (1)

- December 2015 (3)

- November 2015 (2)

- October 2015 (6)

- July 2015 (1)

- June 2015 (1)

- April 2015 (2)

- March 2015 (13)

- February 2015 (17)

- January 2015 (15)

- December 2014 (35)

- November 2014 (26)

- October 2014 (60)

- September 2014 (2)