Share this

Inside Look: August’s Analysis of Loadsmart’s Data & Market Indices

by jpallmerine

August’s freight market showed much of the same as the past few months with actually some additional softening overall according to our indices. Due to persistent demand headwinds and an excess of capacity, we expect any seasonal retail surge effect in September to be largely muted.

As usual, in this Monthly Market Update, we will (a) provide a brief update/analysis of the full truckload market and (b) present some compelling trucking-related economic analysis to provide a macroeconomic view on the state of the market.

We hope you enjoy! #movemorewithless

Full Truckload Market Overview

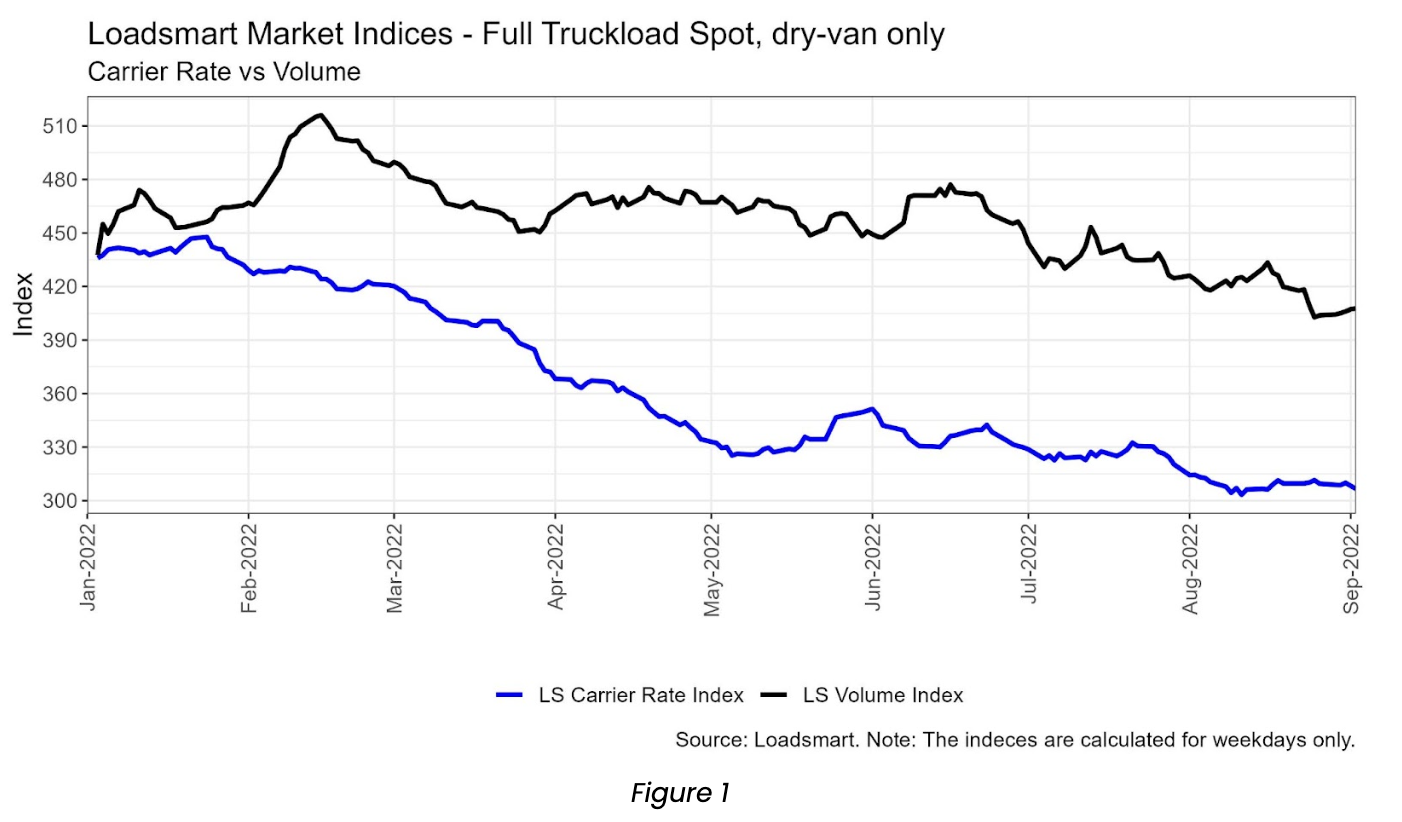

- Volumes: our volume index is down by 5% MoM in August – this decrease wasn’t concentrated across any specific industries and the minor decline looks to be roughly in line with the broader market. This volume decrease signals further demand softening as we would typically see a bounce back in volumes after a softer July.

- Rates: in August our price index remained stable overall (i.e. it finished around where it began), but in the second week, it reached its lowest point in 2022. Additionally, the index was down 5% overall MoM largely due to the 7% drop from the end of July to early August. The additional rate softening in August wasn’t particularly surprising (we actually predicted this in our last month’s market update): volumes softened slightly and capacity remains loose.

Suggestions for shippers:

- Contract rates are continuing their decline as expected (down about 3% MoM according to LS data). The soft market is here to stay for at least another ~6-9 months so be sure to push contract rates down as much as possible amidst the incoming RFP Season.

- If you want to recognize cost savings as the market softens but do not want to constantly re-bid your network (and with 100% PTA), consider leveraging Loadsmart’s Reliable Contract Solution – click here to read more.

- There are mixed reviews on what to expect over the next 2 months as we head into the typical Peak Retail Season.

- Some believe that the significant decline in imports indicates further truckload demand headwinds, while others argue this won’t directly impact truckload demands as much as other key variables like durable goods manufacturing output and homes under construction.

- Regardless of your stance, it’s likely that the market will remain soft over this period so ensure you set your expectations correctly.

- What is Loadsmart expecting for September and what are we watching closely: spot rates have likely hit their floor for 2022, and we expect September to be flat in terms of rates and volumes. Contract rates should begin to speed up their decline downward with another ~5-7% decrease MoM.

Freight & Economics

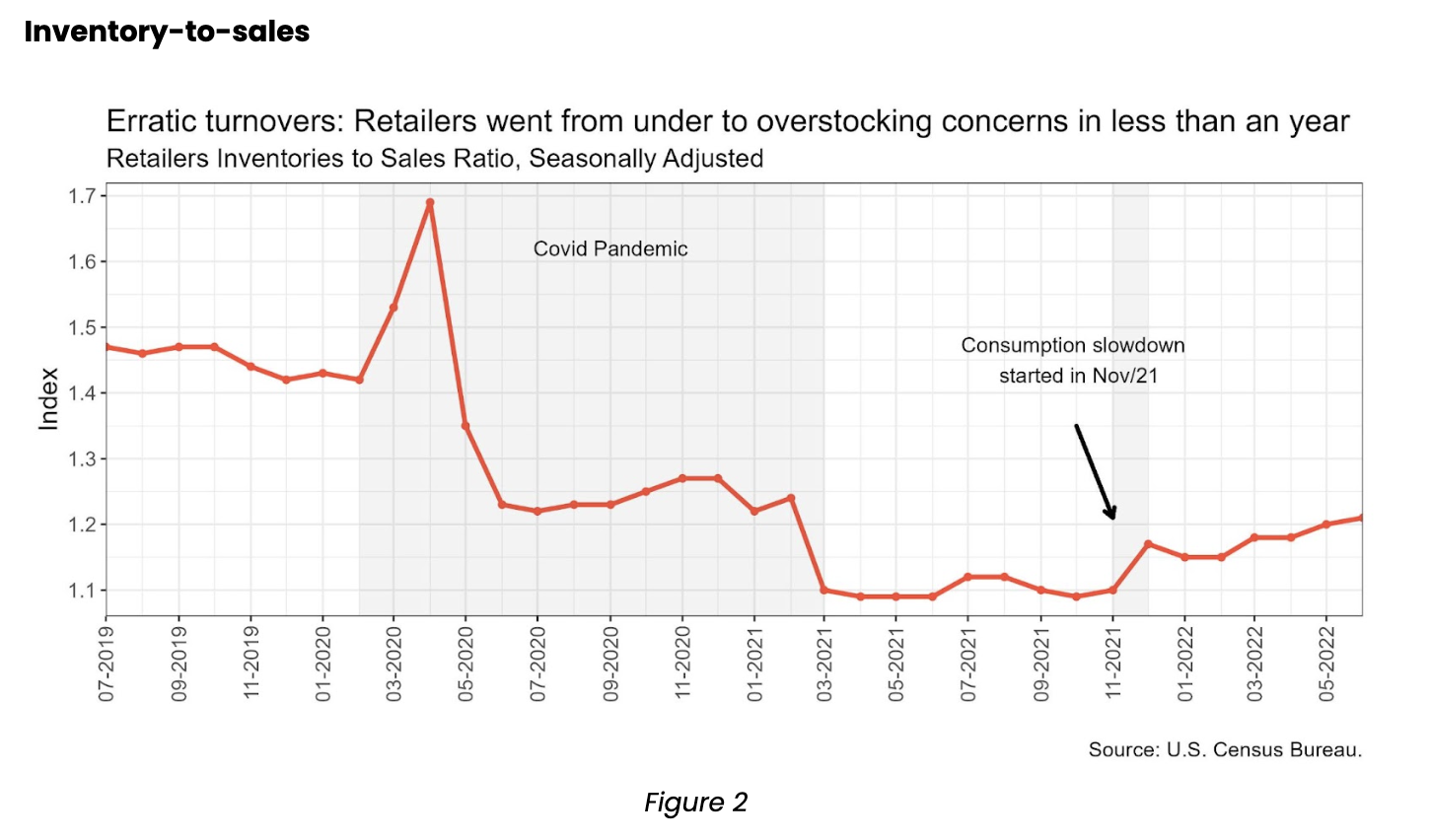

- Retailers’ inventory-to-sales ratio was 1.21 in June; i.e. the inventory surplus was enough to cover for additional 1.21 months of sales. The ratio reached its highest level since Feb/21, when it was at 1.24 – as shown in Figure 2.

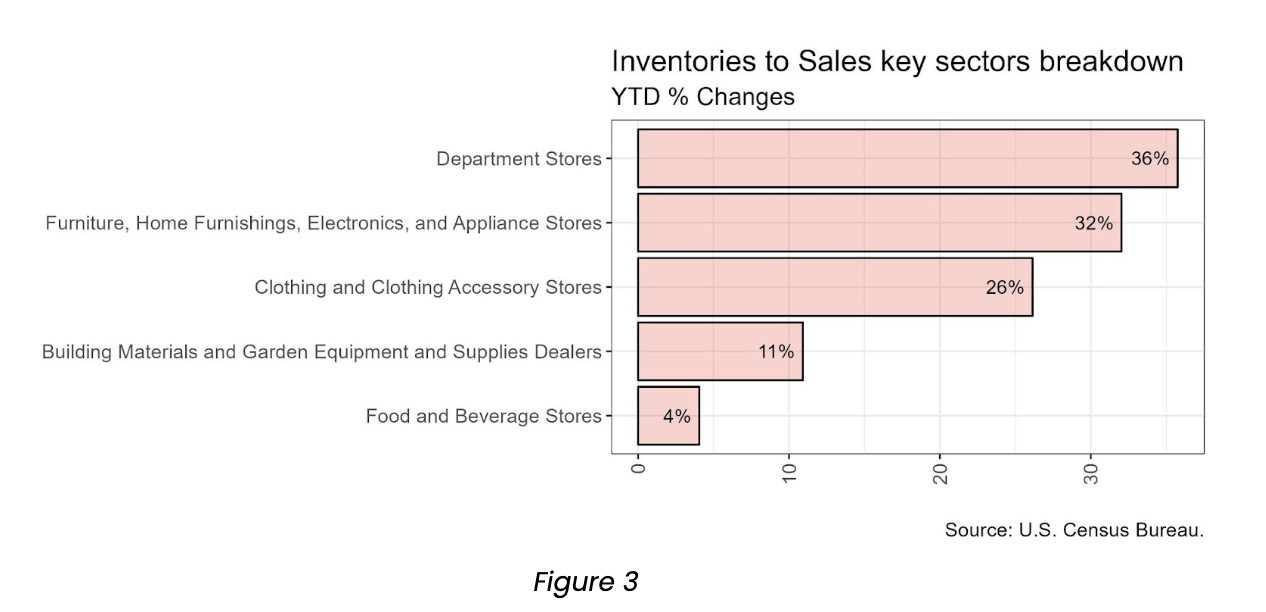

- The increase in inventory-to-sales ratio was mostly brought by consumption slowdown, especially by the weakening in demand for discretionary items. Breaking down the ratio by sectors, we note that department stores and home goods had the highest YTD increases in the ratio (36% and 32%, respectively, Figure 3).

- Additional supply chain disruptions (port congestion, labor shortages, and disputes in the transportation sector) have also contributed to this rise as it is safer to overstock when lead times became less predictable.

- This increase has a direct impact on the freight market – with more inventory in stock, retailers have less of a need for additional freight.

Trucking employment

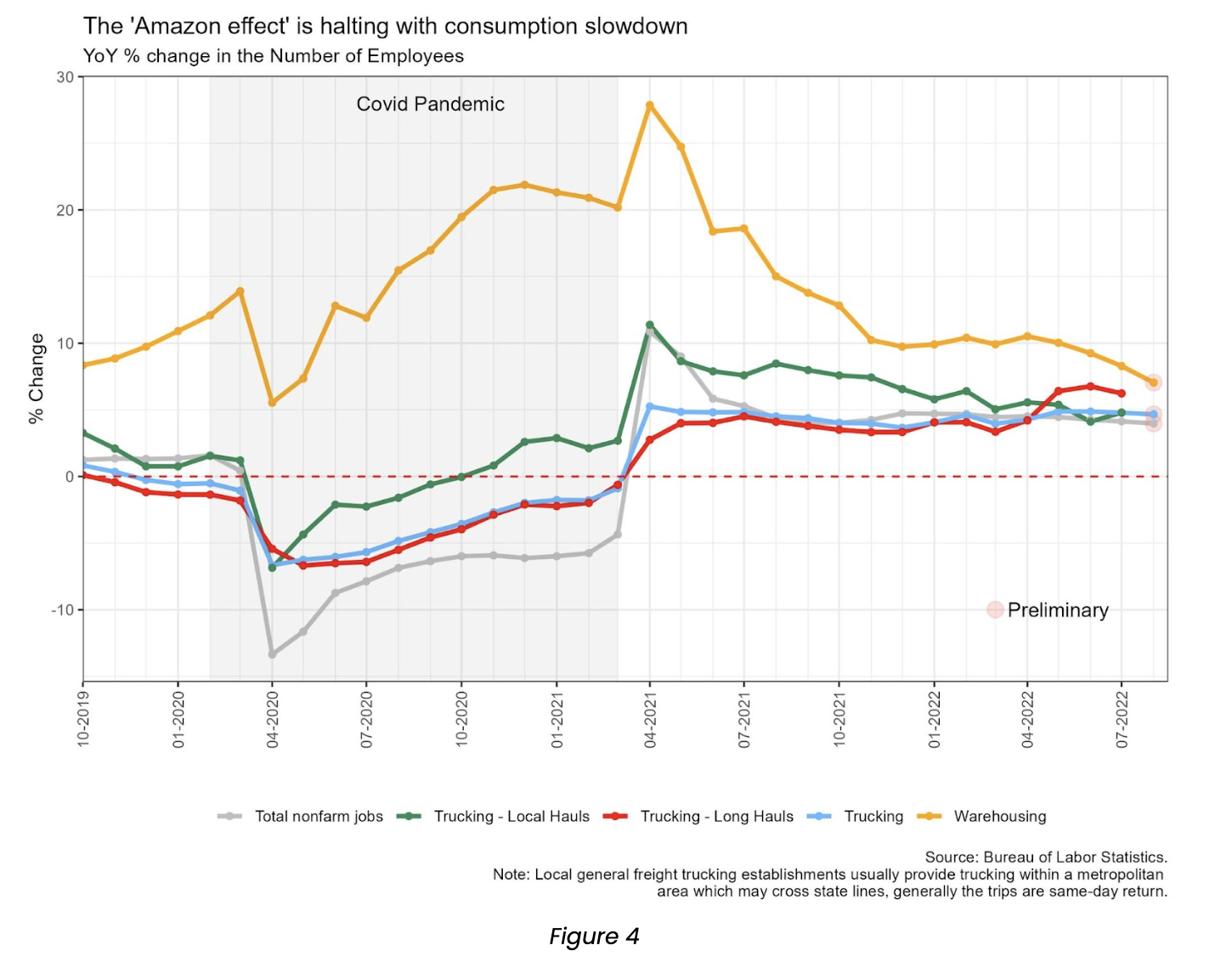

- The freshly released August jobs report shows that the labor market for trucking remains solid with an employment growth rate of 4.6% in August, 0.7 p.p above the overall nonfarm rate – shown in Figure 4.

- For the warehousing sector, payrolls continued to increase above the overall rate too but at a slower pace. The sector’s YoY rate was 7.0%, down 3.5 p.p. from Apr/22 peak – Figure 4.

- The slowdown in hirings reflects e-commerce retailers’ decisions to delay new warehouse openings and forgo plans of building more plants.

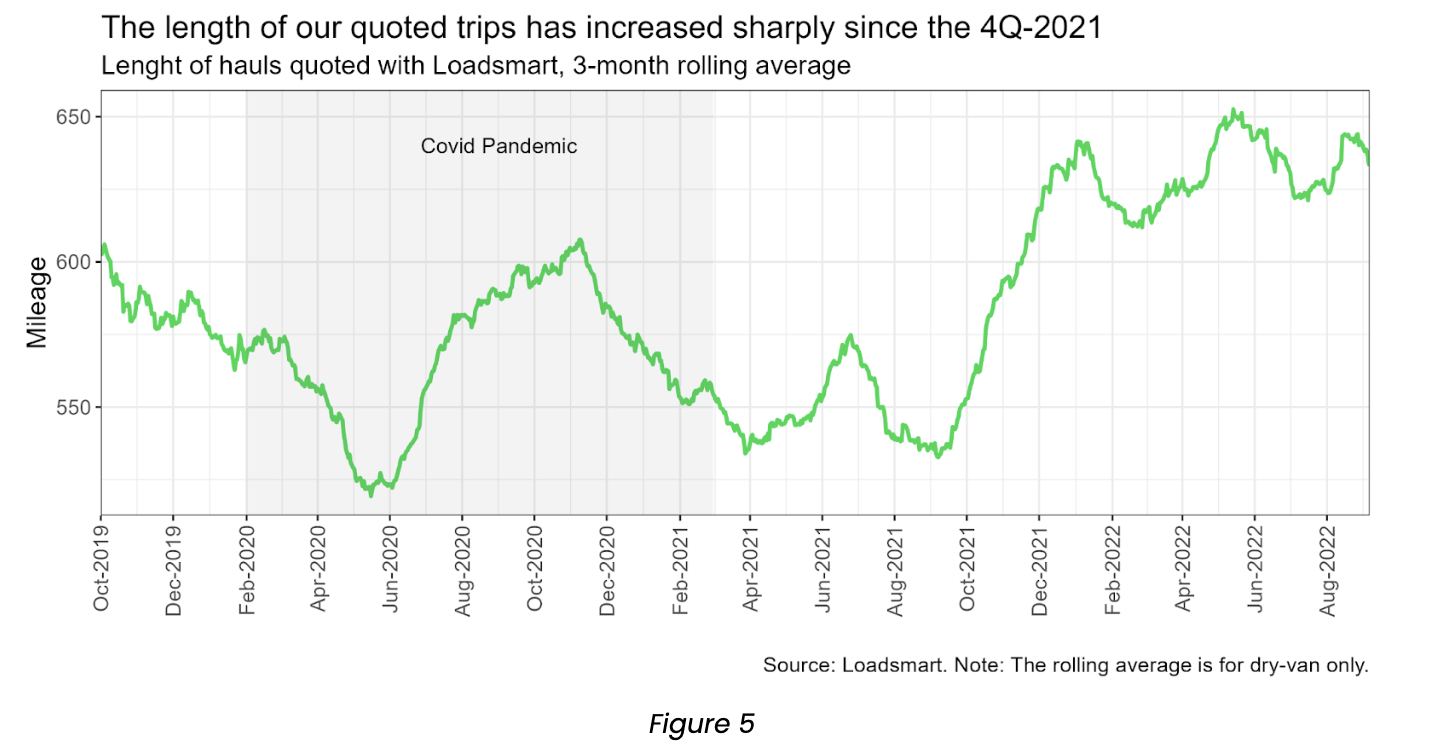

- During the pandemic, online retailers enhanced their strategy to reduce delivery times and shipping costs by expanding their network of distribution facilities and consequently shrinking the length of hauls.

- The strategy’s implementation had direct effects on transportation’s labor market: the number of jobs for warehouse staff and local-haul drivers grew far more than the overall nonfarm payroll. This phenomenon was known as the “Amazon effect”, as it was led by the e-commerce giant.

- Yet, these labor market trends from the “Amazon effect” were discontinued when the economy re-opened. In Figure 4, we see that:

- There has been consecutive declines in the hirings for warehousing since then.

- The job growth in long-haul trucking has overcome short-haul since May/22.

- By looking at Loadsmart data, we note that the average length of trips quoted has increased sharply at the end of last year and remains at similar levels till now – Figure 5. The average hauls length was certainly shorter during the pandemic, but there was no clear trend during the period.

Please reach out to Stella Carneiro (stella.carneiro@loadsmart.com) or Jon Payne (jonathan.payne@loadsmart.com) with any questions, suggestions, thoughts, etc. Thank you!

Share this

- Loadsmart Blog (159)

- Blog (121)

- Shipper (106)

- Market Trends (101)

- Enterprise Shipper (69)

- Carrier (66)

- News (62)

- Data Insights (51)

- Thought Leadership (45)

- Warehouse (41)

- SMB Shipper (38)

- Our Partners (34)

- ShipperGuide TMS (31)

- Opendock (30)

- Product Updates (29)

- Mode Optimization (25)

- Loadsmart (23)

- Mid-Market Shipper (18)

- Case Study (17)

- Brokerage Services (15)

- Managed Transportation (11)

- Video (9)

- Award (7)

- FreightIntel AI (5)

- Instant Execution (4)

- Asset (3)

- Food and Beverage (3)

- Freight Management (3)

- Logistics Solutions (3)

- YMS (3)

- eBook (3)

- 4PL (2)

- International (2)

- NavTrac (2)

- Podcast (2)

- UK (2)

- Yard Management System (2)

- Cold Storage (1)

- Faces of Loadsmart (1)

- Paper Packaging (1)

- Retail (1)

- Security (1)

- Transportation Management System (1)

- January 2026 (1)

- December 2025 (1)

- November 2025 (1)

- October 2025 (2)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (7)

- April 2025 (6)

- March 2025 (3)

- February 2025 (10)

- January 2025 (4)

- December 2024 (4)

- November 2024 (5)

- October 2024 (11)

- September 2024 (11)

- August 2024 (5)

- July 2024 (5)

- June 2024 (9)

- May 2024 (7)

- April 2024 (6)

- March 2024 (2)

- February 2024 (2)

- January 2024 (5)

- December 2023 (6)

- November 2023 (2)

- October 2023 (12)

- September 2023 (5)

- August 2023 (3)

- July 2023 (4)

- June 2023 (10)

- May 2023 (5)

- April 2023 (5)

- March 2023 (7)

- February 2023 (5)

- January 2023 (7)

- December 2022 (4)

- November 2022 (13)

- October 2022 (4)

- September 2022 (7)

- August 2022 (11)

- July 2022 (6)

- June 2022 (5)

- May 2022 (2)

- April 2022 (4)

- March 2022 (6)

- February 2022 (7)

- January 2022 (9)

- December 2021 (3)

- November 2021 (5)

- October 2021 (7)

- September 2021 (2)

- August 2021 (2)

- July 2021 (4)

- June 2021 (6)

- May 2021 (6)

- April 2021 (5)

- March 2021 (8)

- February 2021 (3)

- January 2021 (3)

- December 2020 (7)

- November 2020 (9)

- October 2020 (7)

- September 2020 (6)

- August 2020 (10)

- July 2020 (8)

- June 2020 (3)

- May 2020 (1)

- April 2020 (2)

- March 2020 (2)

- February 2020 (1)

- January 2020 (1)

- November 2019 (2)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- June 2019 (2)

- May 2019 (3)

- March 2019 (1)

- February 2019 (3)

- December 2018 (1)

- November 2018 (2)

- October 2018 (1)

- September 2018 (2)

- August 2018 (1)

- July 2018 (1)

- June 2018 (3)

- May 2018 (4)

- April 2018 (1)

- February 2018 (1)

- January 2018 (4)

- November 2017 (1)

- October 2017 (2)

- June 2017 (1)

- May 2017 (2)

- April 2017 (1)

- February 2017 (1)

- January 2017 (2)

- October 2016 (1)

- August 2016 (1)

- July 2016 (2)

- June 2016 (1)

- March 2016 (1)

- January 2016 (1)

- December 2015 (3)

- November 2015 (2)

- October 2015 (6)

- July 2015 (1)

- June 2015 (1)

- April 2015 (2)

- March 2015 (13)

- February 2015 (17)

- January 2015 (15)

- December 2014 (35)

- November 2014 (26)

- October 2014 (60)

- September 2014 (2)