Share this

September’s Inside Look: An Analysis of Loadsmart’s Data & Market Indices

by jpallmerine

Say what you will about the softened freight market, September was certainly an exciting month. We experienced a muted market impact from Labor Day, we narrowly avoided nation-wide rail strikes, and a Category 4 hurricane, Hurricane Ian, made landfall on the southeastern coast of the US. Although there is still more to be seen from the impact of the hurricane as well as peak retail season, in September the excess capacity in the market easily absorbed most of the disruption that came its way.

As usual, in this Monthly Market Update, we will (a) provide a brief update/analysis of the full truckload market and (b) present some compelling trucking-related economic analysis to provide a macroeconomic view on the state of the market.

We hope you enjoy! #movemorewithless

Please reach out to Stella Carneiro (stella.carneiro@loadsmart.com) or Jon Payne (jonathan.payne@loadsmart.com) with any questions, suggestions, thoughts, etc. Thank you!

Full Truckload Market Overview

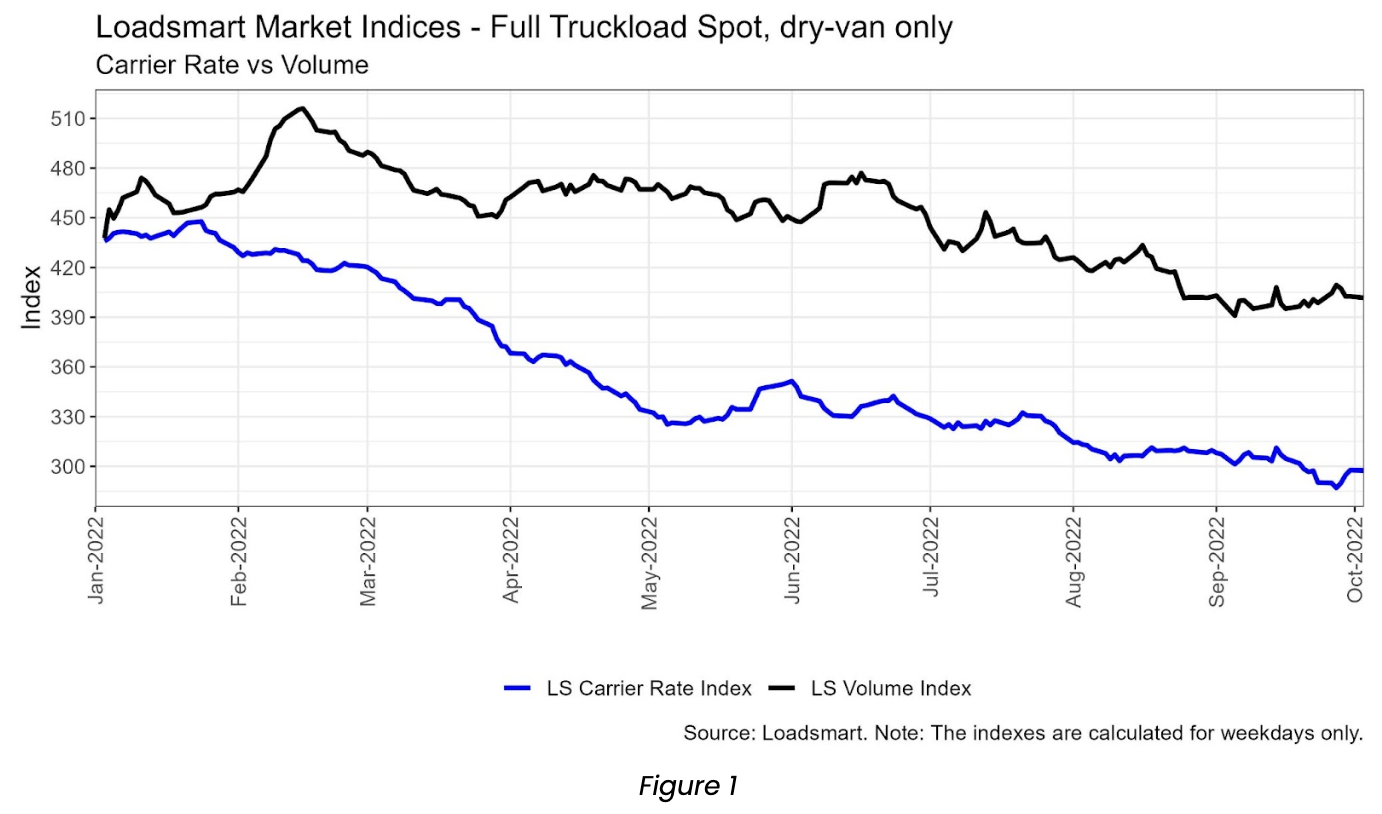

- Volumes: our volume index remained stable throughout the month of September (~0% change MoM). We see this stabilization as a positive sign in light of the volume declines of the past few months, suggesting that volumes could be starting to rebound as we enter the beginning of retail season in October.

- Rates: our price index declined 3% MoM, reaching a new yearly low in late September. During the first three weeks of the month, our index remained stable and at a level similar to August (~300 points), but in the fourth week it dropped to under 290 points. The pace of the rate decline has certainly become milder over the past 3 quarters (our price index dropped 15% QoQ in the 1Q, 11% in 2Q, and 9% in the 3Q). Despite the low expectations for peak season disruption, Loadsmart expects minimal to no rate declines in 4Q

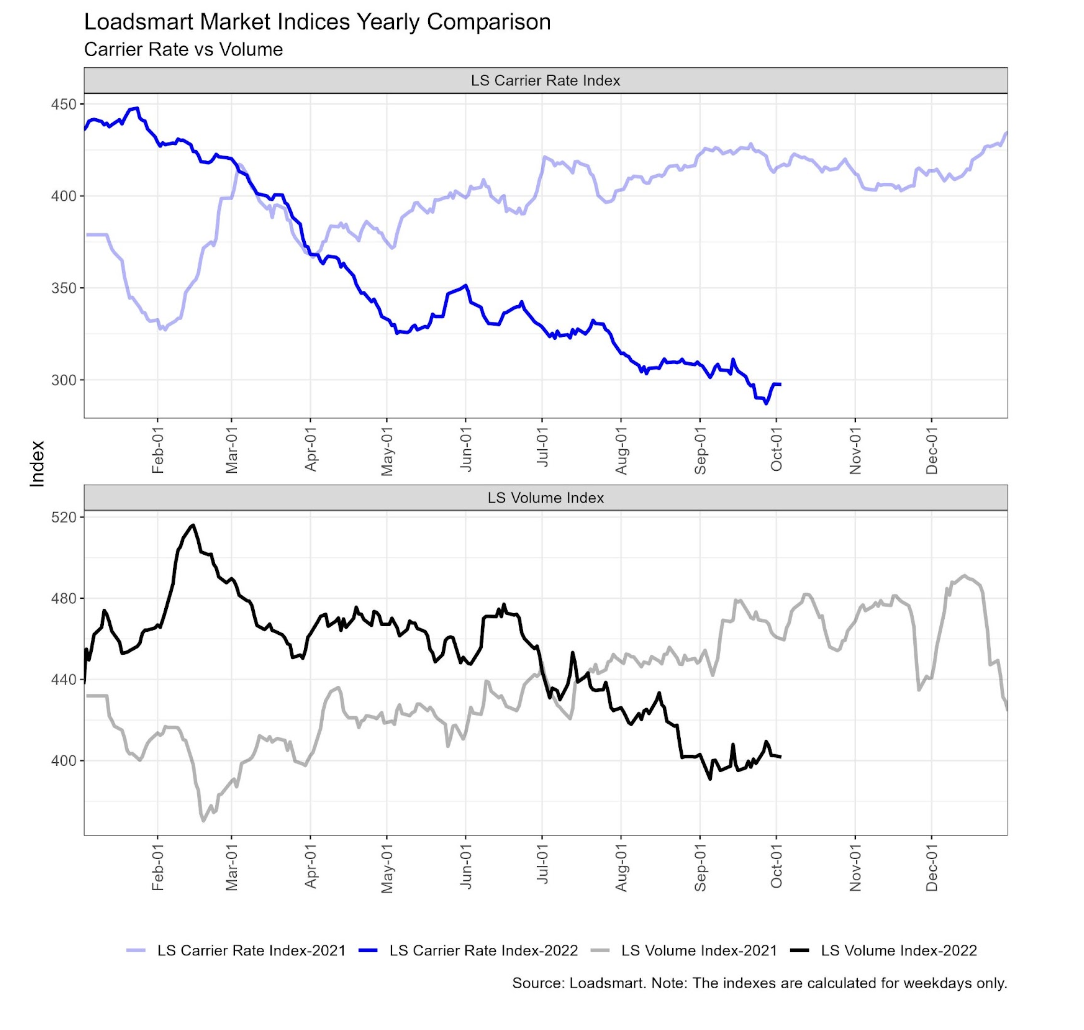

Below we’ve also provided YoY comparisons for our rate and volume indices, respectively.

What is Loadsmart expecting / watching closely in October:

- The beginning of RFP Season is upon us! Loadsmart’s current freight market outlook projects that we’ll remain in a deflationary market through Q3’23 and we’re currently approaching the floor for the spot market rate environment. Therefore we expect a competitive rate environment amidst this bid cycle as carriers/brokers will fight to grab as much primary freight as possible.

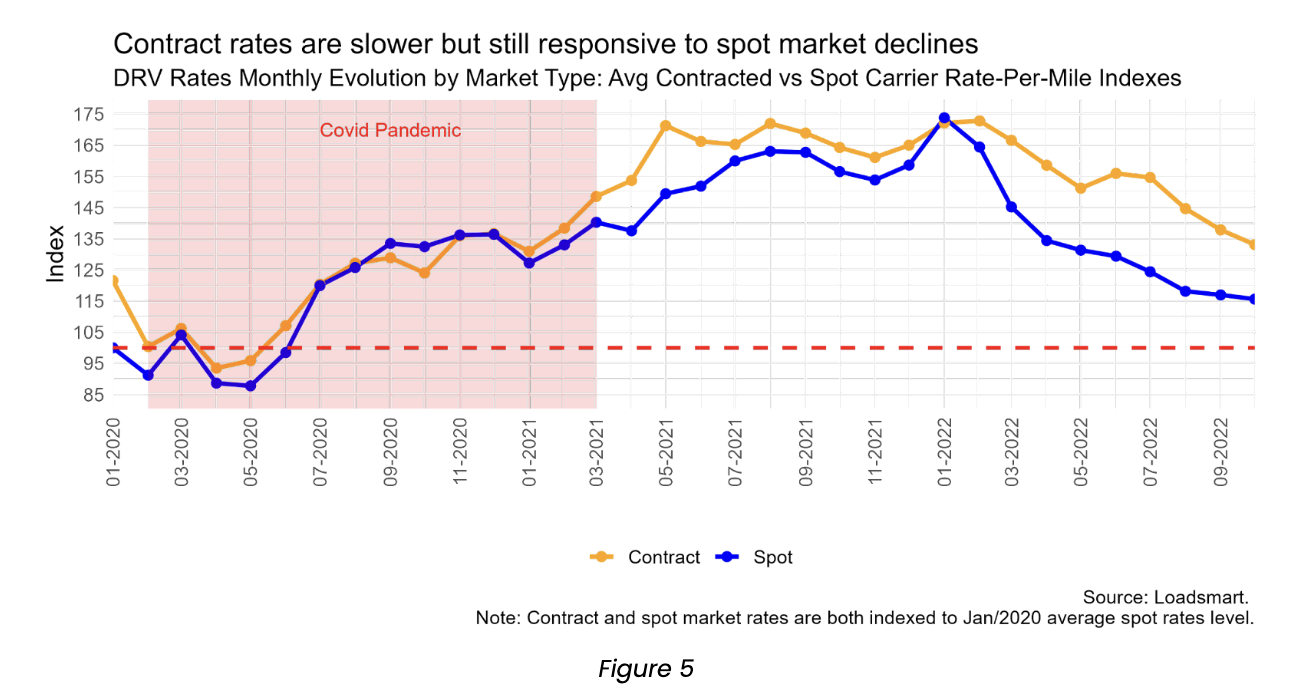

- As discussed below, contract rates have been coming down steadily since July 2022, and we expect this to continue at least through Q1’23

- As other industry experts have noted (see here), diesel prices are really the only remaining wild card that we think could materially impact the timing / depth of the floor in spot rates. Assuming no drastic declines in diesel to occur, we expect rates to hold steady in Q4 for the first time all year.

- In October we’ll also be watching closely for the release of national consumption spending data – with the 5th interest rate hike since March, we’re expecting to see the beginnings of deflationary consumption levels.

Freight & Economics

Hurricane Ian

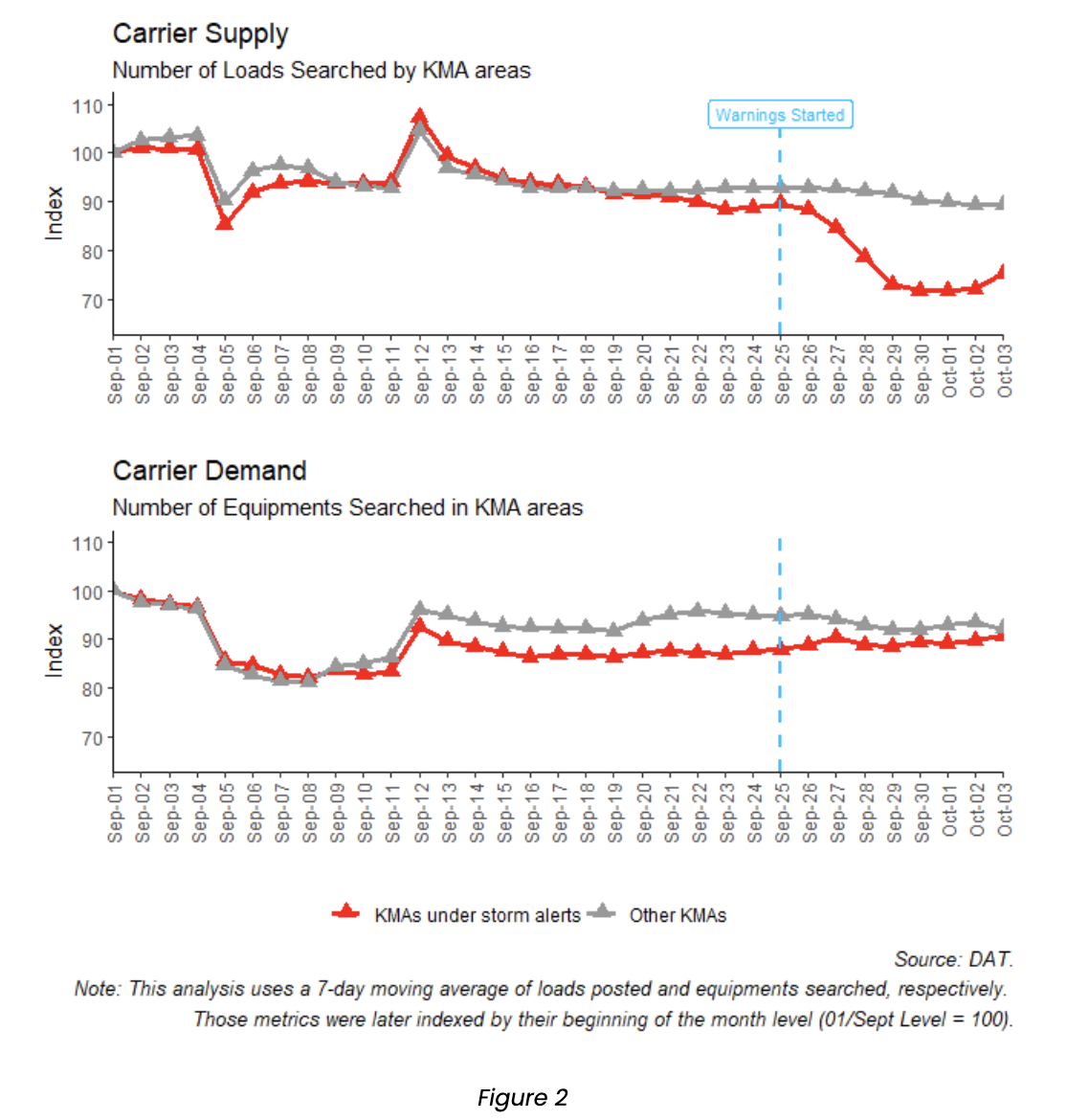

- The strongest storm to hit the US in 2022 brought damaging effects to the trucking industry as well. Our analysis shows that regions under storm warnings and watches had a carrier supply decline of 20% WoW (25 Sept to 02 Oct) since the alerts first started on 25 Sept – as seen in Figure 2. .

- Freight demand stayed roughly constant during the same period, which indicates that shippers had difficulties trying to find drivers willing to inbound into these areas.

Here are the details of our analysis:

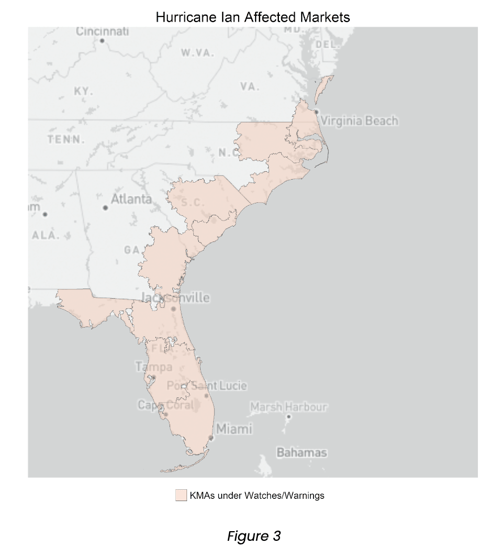

- We split the US Key Market Areas (KMAs) into two categories: the “KMAs under storm alerts”, who were under NHC alerts related to Hurricane Ian; and the “Other KMAs” , without any alerts – as shown in Figure 3.

- Further, we calculate two metrics for these categories using the DAT platform: (i) the 7-day rolling average number of loads searched, a proxy for carrier supply; (ii) the 7-day rolling average number of equipment searched, a proxy for carrier demand.

- Given that the territory covered by “Other KMAs” is about 25 times larger than the one covered by “KMAs under storm alerts”, we divide each daily metric by its beginning of the month observation (01 Sept). The results are presented in Figure 2.

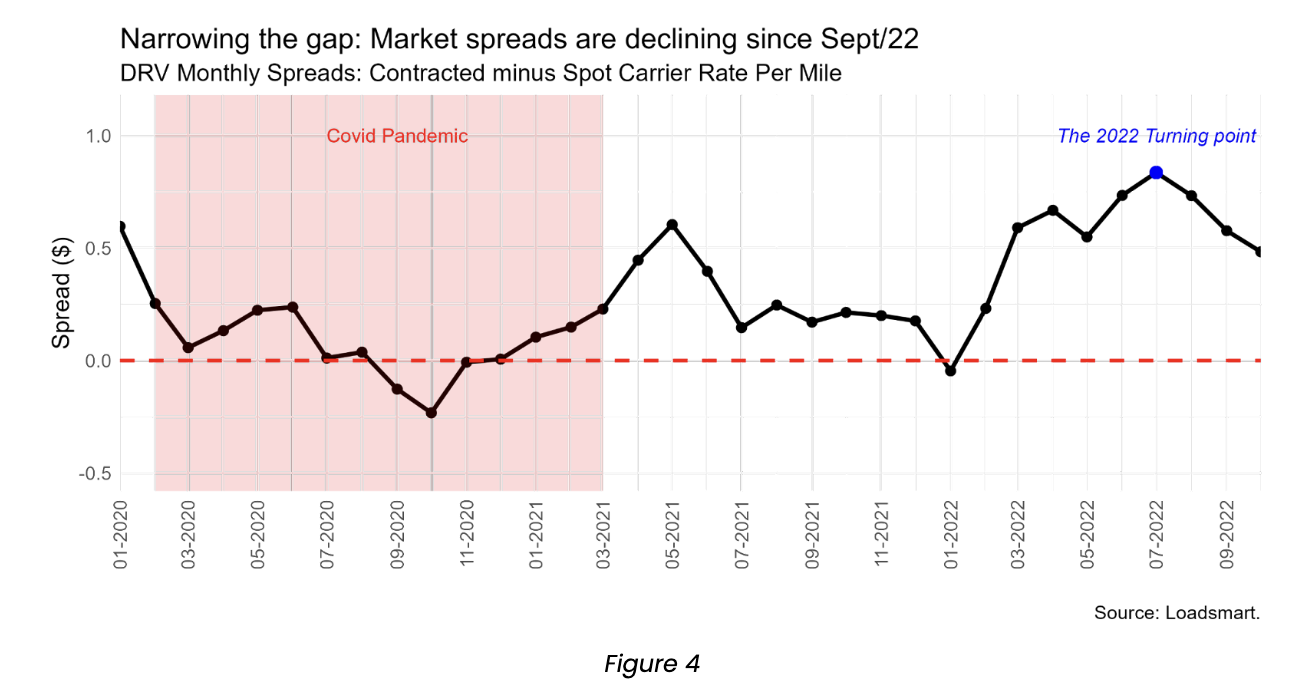

Contract vs Spot spreads

- The third quarter began with a trend reversal in the spreads between contract and spot markets – and ended with the consolidation of a new downward trend (i.e. contract rates began to decline at a rate fast enough that they began to close the distance from the much lower spot rates).

- In the last four consecutive months average spread in rates between the two markets fell around 50% (July to October) – Figure 4.

- As we all know and as seen in Figure 5, spot rates dropped successively throughout the year. Contract followed the lead for most months but had a flatter decline compared to spot until July, when the average spread between the two hit $0.85 cents.

- But since July, contract rates have started to catch up on this difference and the spread is currently at $0.50 cents (Figure 4). We expect an intersection of these rates in Q1 / Q2 2023 which will help push the freight market closer to an inflationary environment.

Share this

- Loadsmart Blog (159)

- Blog (121)

- Shipper (106)

- Market Trends (100)

- Enterprise Shipper (69)

- Carrier (66)

- News (62)

- Data Insights (51)

- Thought Leadership (45)

- Warehouse (41)

- SMB Shipper (38)

- Our Partners (34)

- ShipperGuide TMS (31)

- Opendock (30)

- Product Updates (29)

- Mode Optimization (25)

- Loadsmart (23)

- Mid-Market Shipper (18)

- Case Study (17)

- Brokerage Services (15)

- Managed Transportation (11)

- Video (9)

- Award (7)

- FreightIntel AI (5)

- Instant Execution (4)

- Asset (3)

- Food and Beverage (3)

- Freight Management (3)

- Logistics Solutions (3)

- YMS (3)

- eBook (3)

- 4PL (2)

- International (2)

- NavTrac (2)

- Podcast (2)

- UK (2)

- Yard Management System (2)

- Cold Storage (1)

- Faces of Loadsmart (1)

- Paper Packaging (1)

- Retail (1)

- Security (1)

- Transportation Management System (1)

- December 2025 (1)

- November 2025 (1)

- October 2025 (2)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (7)

- April 2025 (6)

- March 2025 (3)

- February 2025 (10)

- January 2025 (4)

- December 2024 (4)

- November 2024 (5)

- October 2024 (11)

- September 2024 (11)

- August 2024 (5)

- July 2024 (5)

- June 2024 (9)

- May 2024 (7)

- April 2024 (6)

- March 2024 (2)

- February 2024 (2)

- January 2024 (5)

- December 2023 (6)

- November 2023 (2)

- October 2023 (12)

- September 2023 (5)

- August 2023 (3)

- July 2023 (4)

- June 2023 (10)

- May 2023 (5)

- April 2023 (5)

- March 2023 (7)

- February 2023 (5)

- January 2023 (7)

- December 2022 (4)

- November 2022 (13)

- October 2022 (4)

- September 2022 (7)

- August 2022 (11)

- July 2022 (6)

- June 2022 (5)

- May 2022 (2)

- April 2022 (4)

- March 2022 (6)

- February 2022 (7)

- January 2022 (9)

- December 2021 (3)

- November 2021 (5)

- October 2021 (7)

- September 2021 (2)

- August 2021 (2)

- July 2021 (4)

- June 2021 (6)

- May 2021 (6)

- April 2021 (5)

- March 2021 (8)

- February 2021 (3)

- January 2021 (3)

- December 2020 (7)

- November 2020 (9)

- October 2020 (7)

- September 2020 (6)

- August 2020 (10)

- July 2020 (8)

- June 2020 (3)

- May 2020 (1)

- April 2020 (2)

- March 2020 (2)

- February 2020 (1)

- January 2020 (1)

- November 2019 (2)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- June 2019 (2)

- May 2019 (3)

- March 2019 (1)

- February 2019 (3)

- December 2018 (1)

- November 2018 (2)

- October 2018 (1)

- September 2018 (2)

- August 2018 (1)

- July 2018 (1)

- June 2018 (3)

- May 2018 (4)

- April 2018 (1)

- February 2018 (1)

- January 2018 (4)

- November 2017 (1)

- October 2017 (2)

- June 2017 (1)

- May 2017 (2)

- April 2017 (1)

- February 2017 (1)

- January 2017 (2)

- October 2016 (1)

- August 2016 (1)

- July 2016 (2)

- June 2016 (1)

- March 2016 (1)

- January 2016 (1)

- December 2015 (3)

- November 2015 (2)

- October 2015 (6)

- July 2015 (1)

- June 2015 (1)

- April 2015 (2)

- March 2015 (13)

- February 2015 (17)

- January 2015 (15)

- December 2014 (35)

- November 2014 (26)

- October 2014 (60)

- September 2014 (2)