Share this

2022 Railroad Labor Negotiations: A Review Of Major Events And Potential Long-Term Impacts

by jpallmerine

The domestic supply-chain apprehensively watched the unfolding of the latest railroad labor dispute as another walkout threat loomed over the past 3 weeks. That is until this past Friday, Dec 2 when Biden signed into law a bill that removed the chance of a legal rail strike.

Although this legal strike has been averted for now, these discussions will not go away entirely. Still, there appears to be significant unrest amidst some railroad parties. This article provides a summary of the conflict between unions & railroaders and a brief recap of contract negotiations. Additionally, we show how trucking demand is being affected by this supply chain uncertainty.

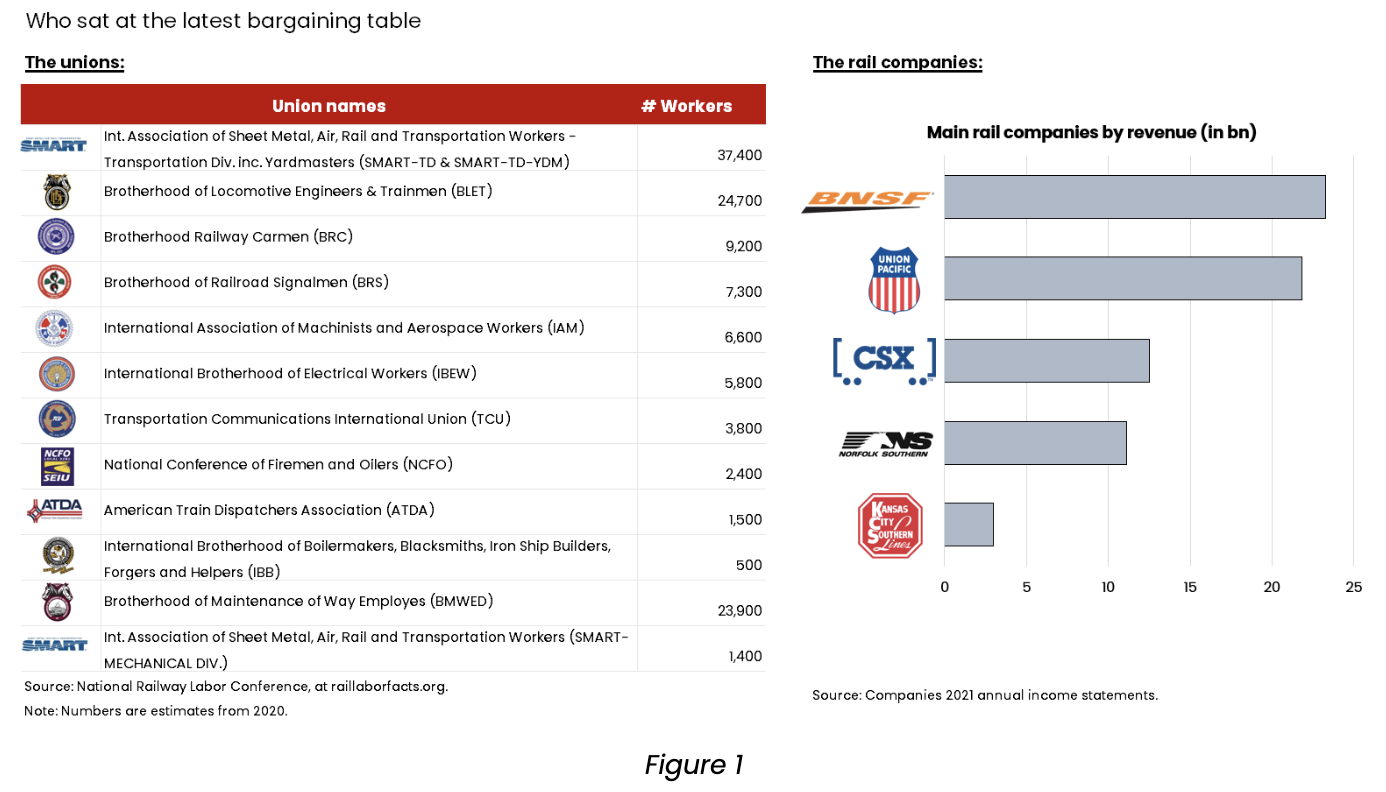

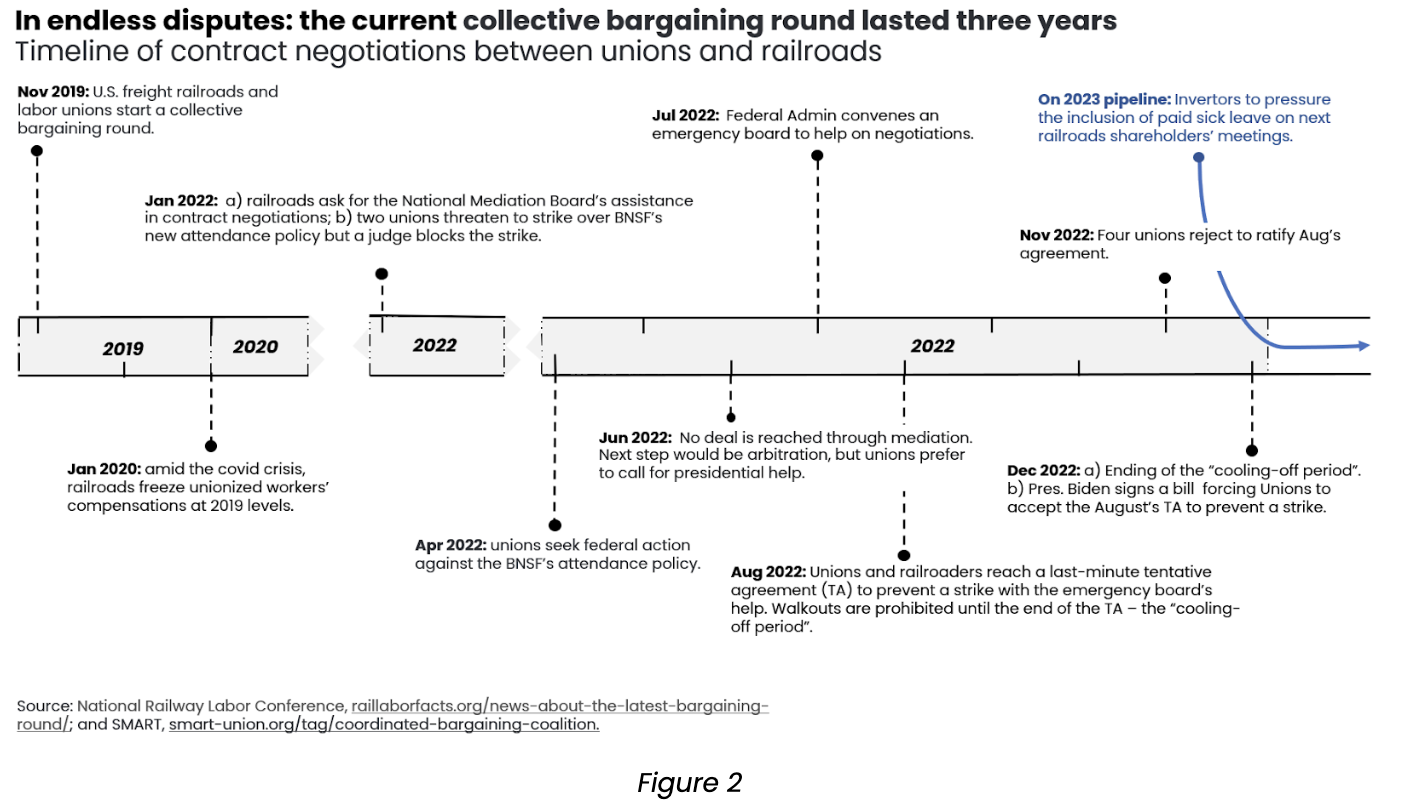

The latest rail strike threat was another edgy episode of the ongoing collective bargaining round in rail that began in Nov 2019. Long-lasting bargaining rounds in this industry are not unusual in US history. The former negotiation, for example, started in 2014 and ended only in 2018; but the two parties reached an agreement without the need for federal intervention. The recent bargaining round, conversely, dragged on much more chaotically and ultimately required direct presidential involvement to curb the imminent threats of strikes. Figure 1 lists the unions and the rail companies involved in the latest negotiation.

The railroad industry’s long-standing financial strategy is to cut operating costs by running longer trains with fewer stops, hence reducing the workforce needed (and requiring more effort per employee). At its onset, the pandemic hastened companies’ layoff plans, so by mid-2020 – when economic activity rebounded – railroads found themselves too short-staffed to deal with the sudden surge in demand. Train crews were put unstoppingly on call for weeks without days off.

Yet, rail companies argue that workers’ on-call availability is crucial for rail freight to stay competitive and the safety of reduced train crews is guaranteed by cutting-edge monitoring technology. In August 2022, on a hastily wrought deal forged by the federal emergency board, they agreed to increase workers’ payment raises by 24% retroactive to 2020, but were unwilling to relax their working schedule and guarantee paid sick leave.

Consequently, four of the twelve unions later refused to ratify the deal, stating that their concerns about workers’ well-being were not addressed. Those in discontent started a new bargaining that was set to end on Dec 9. But as this deadline approached without a foreseeable resolution, the federal administration had to quickly intervene to prevent a walkout. On Dec 2, President Biden signed a bill forcing workers to accept the August agreement, curbing the possibility of a strike.

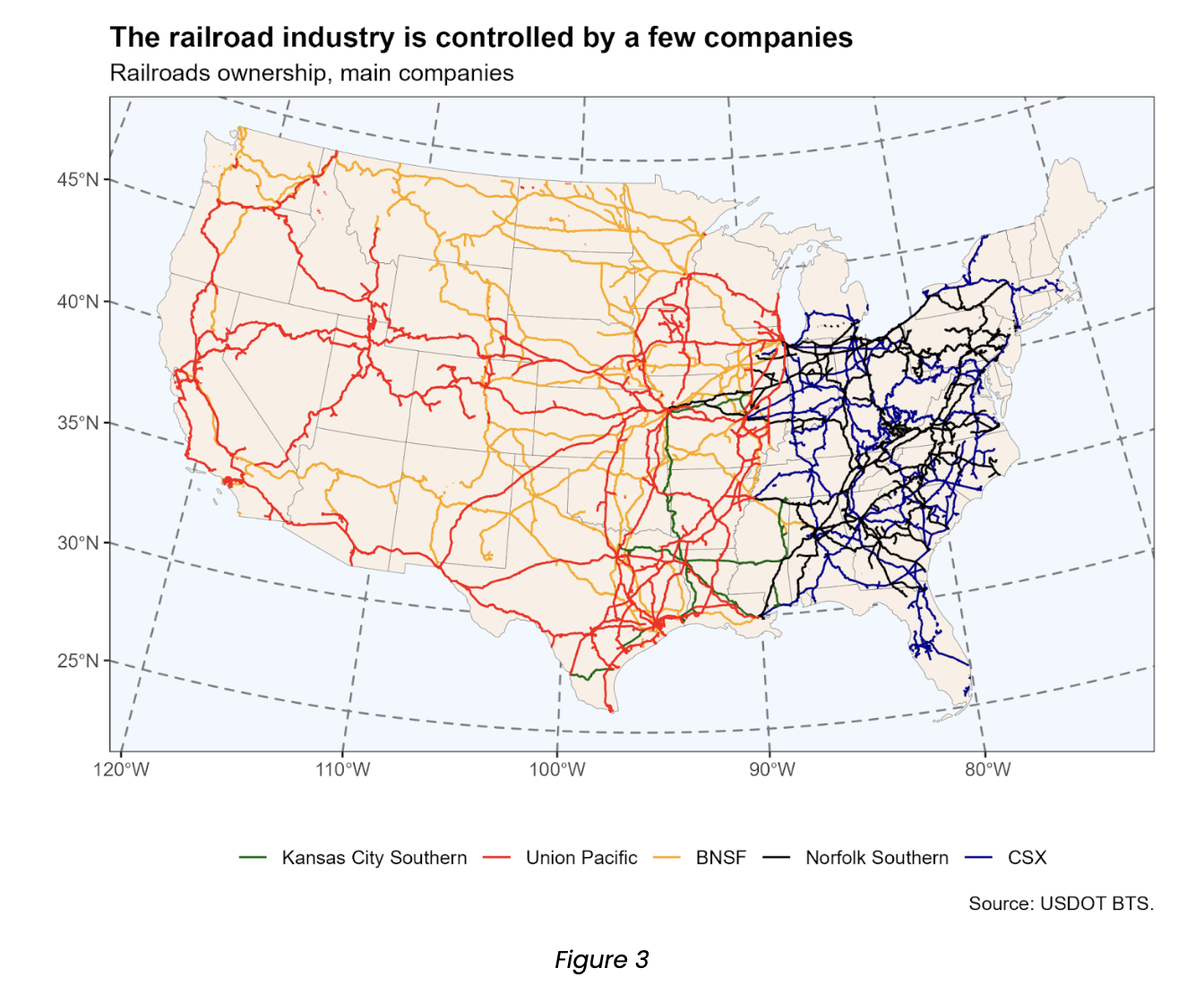

Shippers that rely on rail have felt the worsening in the mode’s service quality since the 2020 economic recovery. In April 2022, the Surface Transportation Board (STB) hosted an emergency hearing about rail freight delays. The productive sector – manufacturers, farmers, and energy producers – has been calling out STB to allow for more market competition in the industry for a while now. Currently, the railroad industry is controlled by four main companies: CSX and Norfolk Southern dominate the Eastern region, while Union Pacific and BNSF lead the Central to Pacific areas – as shown in Figure 3.

A rail strike would put significant pressure on the truckload freight market. The trucking industry has not enough spare capacity to replace rail freight in the case of a disruption. The American Trucking Associations (ATA) estimates that “idling all 7,000 long-distance daily freight trains in the U.S. would require more than 460,000 additional long-haul trucks every day.” See ATA’s letter to congress here.

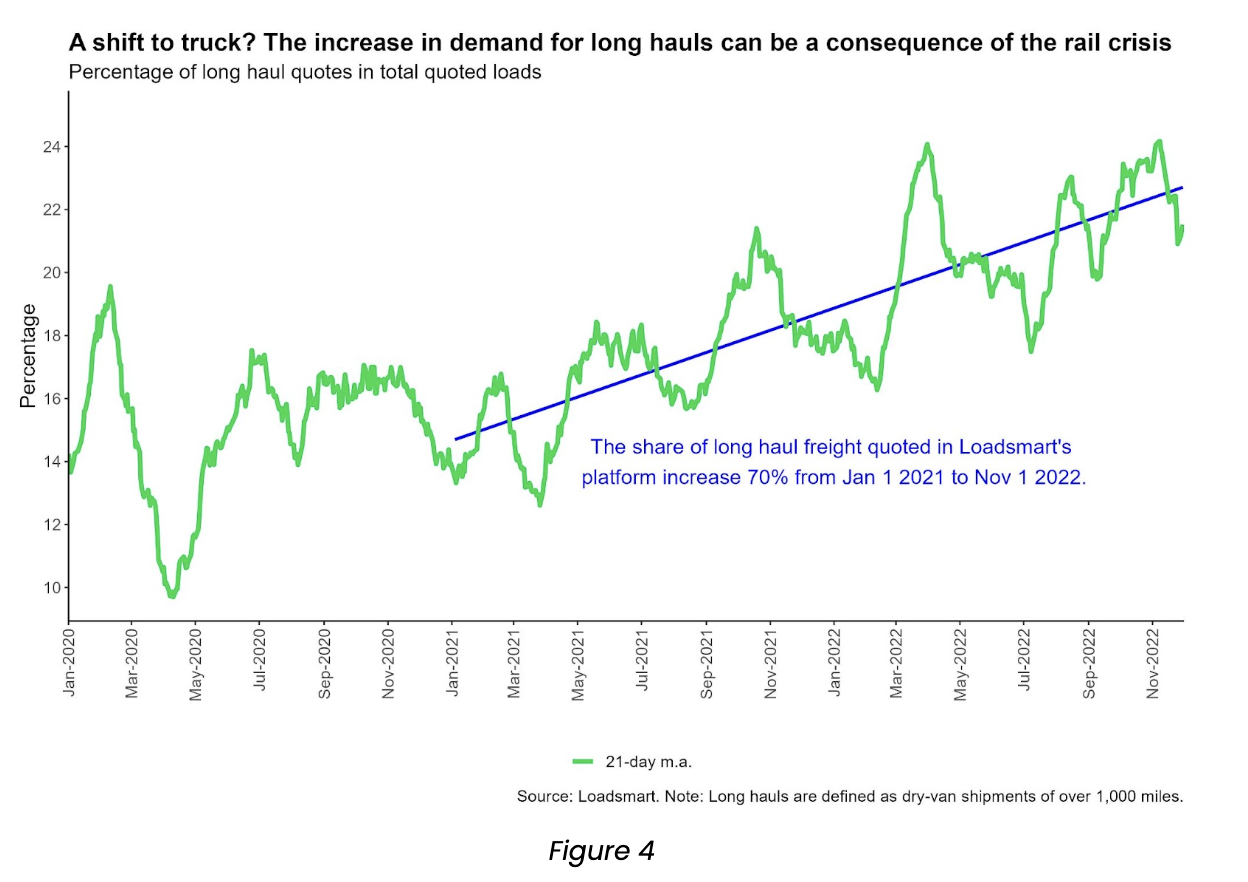

As Loadsmart participates heavily in the truckload market, we wanted to analyze whether the demand for long hauls on our network has been impacted by the recent rail volatility – despite the lack of strike. As displayed in Figure 4 below, there were no clear direct spikes in long-haul freight corresponding to Sep and Dec’s potential strikes. However, it’s worth noting that we have observed a steady increase in the demand for long-distance trips since Jan 2021.

With a worldwide pandemic, record consumer demand levels, volatile weather patterns, global conflict, and severe port congestion, the past three years have been a wild ride for the supply chain industry. Hence, another potential disruption in the supply chain should not come as a surprise. Thankfully the legal strike has been averted for now, but the negotiations over the past year have demonstrated that we must keep a close watch on this as unions will remain pressuring railroaders for more employment benefits going forward.

Please reach out to Stella Carneiro (stella.carneiro@loadsmart.com) or Jon Payne (jonathan.payne@loadsmart.com) with any questions, suggestions, thoughts, etc. Thank you!

Share this

- Loadsmart Blog (159)

- Blog (121)

- Shipper (106)

- Market Trends (101)

- Enterprise Shipper (69)

- Carrier (66)

- News (62)

- Data Insights (51)

- Thought Leadership (45)

- Warehouse (41)

- SMB Shipper (38)

- Our Partners (34)

- ShipperGuide TMS (31)

- Opendock (30)

- Product Updates (29)

- Mode Optimization (25)

- Loadsmart (23)

- Mid-Market Shipper (18)

- Case Study (17)

- Brokerage Services (15)

- Managed Transportation (11)

- Video (9)

- Award (7)

- FreightIntel AI (5)

- Instant Execution (4)

- Asset (3)

- Food and Beverage (3)

- Freight Management (3)

- Logistics Solutions (3)

- YMS (3)

- eBook (3)

- 4PL (2)

- International (2)

- NavTrac (2)

- Podcast (2)

- UK (2)

- Yard Management System (2)

- Cold Storage (1)

- Faces of Loadsmart (1)

- Paper Packaging (1)

- Retail (1)

- Security (1)

- Transportation Management System (1)

- January 2026 (1)

- December 2025 (1)

- November 2025 (1)

- October 2025 (2)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (7)

- April 2025 (6)

- March 2025 (3)

- February 2025 (10)

- January 2025 (4)

- December 2024 (4)

- November 2024 (5)

- October 2024 (11)

- September 2024 (11)

- August 2024 (5)

- July 2024 (5)

- June 2024 (9)

- May 2024 (7)

- April 2024 (6)

- March 2024 (2)

- February 2024 (2)

- January 2024 (5)

- December 2023 (6)

- November 2023 (2)

- October 2023 (12)

- September 2023 (5)

- August 2023 (3)

- July 2023 (4)

- June 2023 (10)

- May 2023 (5)

- April 2023 (5)

- March 2023 (7)

- February 2023 (5)

- January 2023 (7)

- December 2022 (4)

- November 2022 (13)

- October 2022 (4)

- September 2022 (7)

- August 2022 (11)

- July 2022 (6)

- June 2022 (5)

- May 2022 (2)

- April 2022 (4)

- March 2022 (6)

- February 2022 (7)

- January 2022 (9)

- December 2021 (3)

- November 2021 (5)

- October 2021 (7)

- September 2021 (2)

- August 2021 (2)

- July 2021 (4)

- June 2021 (6)

- May 2021 (6)

- April 2021 (5)

- March 2021 (8)

- February 2021 (3)

- January 2021 (3)

- December 2020 (7)

- November 2020 (9)

- October 2020 (7)

- September 2020 (6)

- August 2020 (10)

- July 2020 (8)

- June 2020 (3)

- May 2020 (1)

- April 2020 (2)

- March 2020 (2)

- February 2020 (1)

- January 2020 (1)

- November 2019 (2)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- June 2019 (2)

- May 2019 (3)

- March 2019 (1)

- February 2019 (3)

- December 2018 (1)

- November 2018 (2)

- October 2018 (1)

- September 2018 (2)

- August 2018 (1)

- July 2018 (1)

- June 2018 (3)

- May 2018 (4)

- April 2018 (1)

- February 2018 (1)

- January 2018 (4)

- November 2017 (1)

- October 2017 (2)

- June 2017 (1)

- May 2017 (2)

- April 2017 (1)

- February 2017 (1)

- January 2017 (2)

- October 2016 (1)

- August 2016 (1)

- July 2016 (2)

- June 2016 (1)

- March 2016 (1)

- January 2016 (1)

- December 2015 (3)

- November 2015 (2)

- October 2015 (6)

- July 2015 (1)

- June 2015 (1)

- April 2015 (2)

- March 2015 (13)

- February 2015 (17)

- January 2015 (15)

- December 2014 (35)

- November 2014 (26)

- October 2014 (60)

- September 2014 (2)