Share this

January’s Inside Look: An Analysis of Loadsmart’s Data & Market Indices

by jpallmerine

As usual, in this Monthly Market Update, we will (a) provide a brief update/analysis of the full truckload market and (b) present some compelling trucking-related economic analysis to provide a macroeconomic view on the state of the market. We hope you enjoy! #movemorewithless

Full Truckload Market Overview

Volumes

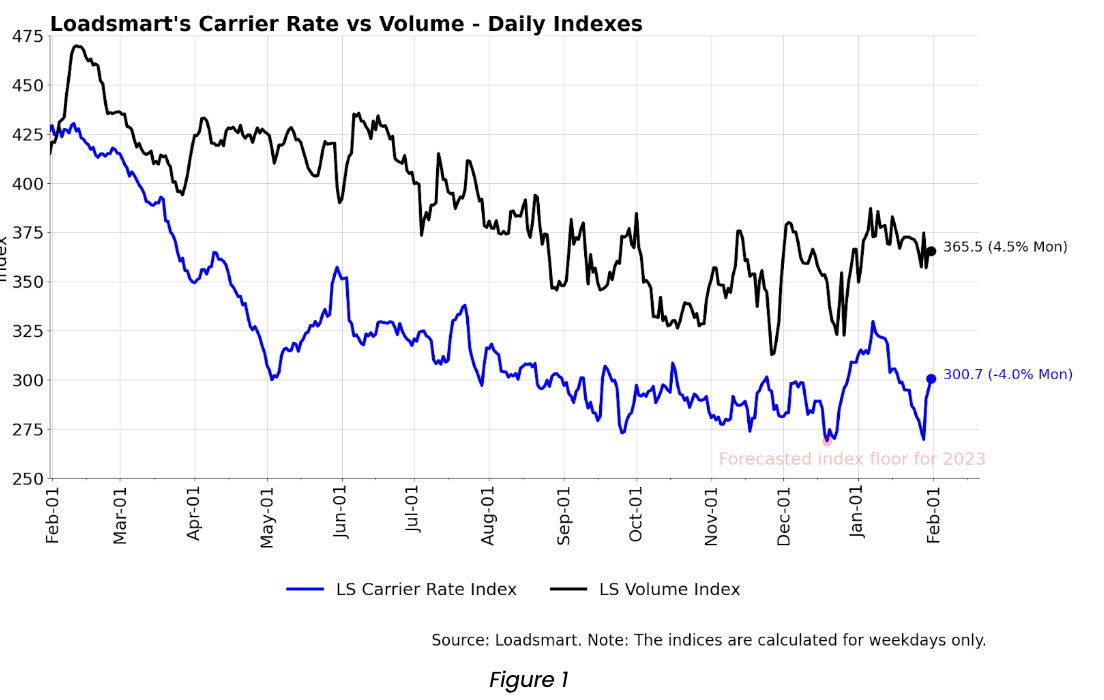

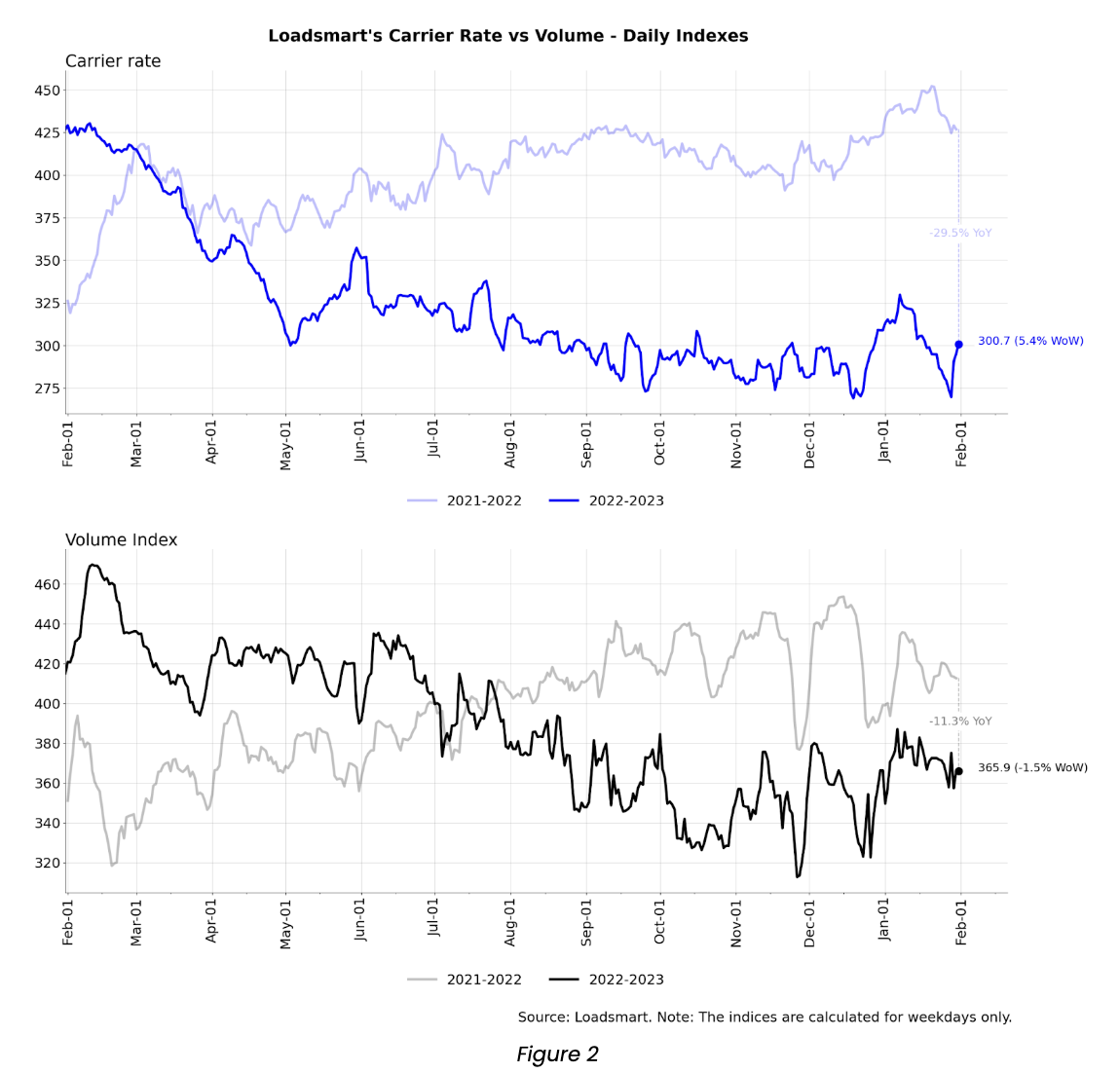

Our volume index increased by 4.5% in January (day 01 to 31). The daily average of volumes for January rose to the highest since August 2022. This volume hike was unexpected as the January to March period is typically defined as a “quiet post-peak season”, but we speculate this could have been a delayed effect of the holiday shipping season, which was largely muted in Q4’22. The Midwest (Illinois, Ohio, Missouri, and Wisconsin) contributed the most to the rise in volumes, as 44% of LS volumes moved in January came from this region.

Rates

Our price index decreased by 4% in January (day 01 to 31). Prices peaked in the first week of the month – likely still boosted by the holiday season’s tightened capacity; then they fell back to December 2022’s floor, and mildly recovered after. The first week’s price surge was sharper in the West (California, Oregon, Colorado, and Utah), where prices hit their highest level since October 2022.

Loadsmart’s Look Ahead:

Contract rates & spot floor: As we have mentioned in the past few monthly updates, we expect the spread between contract rates and spot rates to shrink over the next two quarters. Not only are network bids resetting contract rates 15%+ lower YoY on average (pulled from Loadsmart bid data), but we also believe spot rates have hit their floor for 2023.

- Loadsmart is currently forecasting that the December & January spot rate lows represent the spot rate floor for this down market cycle, but this could change if volumes were to plummet in the back half of Q1 (potentially as a result of economic slowdown).

- Of course, as spot rates slowly start to inch up throughout Q2/Q3 (as we’re currently forecasting), this will draw the contract vs spot spread even closer.

Freight & Economics

Retailers Inventory-To-Sales Ratio

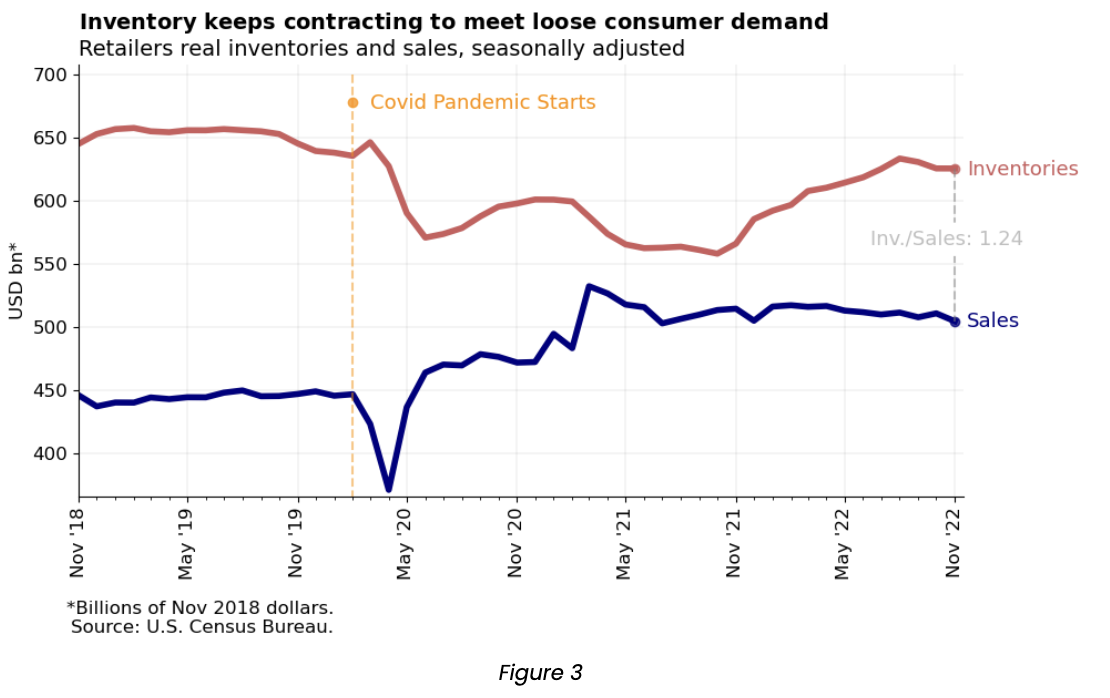

- November data reveals that retail inventory levels remained constant MoM but are down 1.2% from their 2022 peak reached in August- Figure 3.

- 2H 2022 was marked by a shrinkage in inventory levels as stores doubled down their efforts to clear up inventory amidst recession fears – stemming from worries that high inflation and credit card delinquency rates rising may dampen personal consumption in 2023.

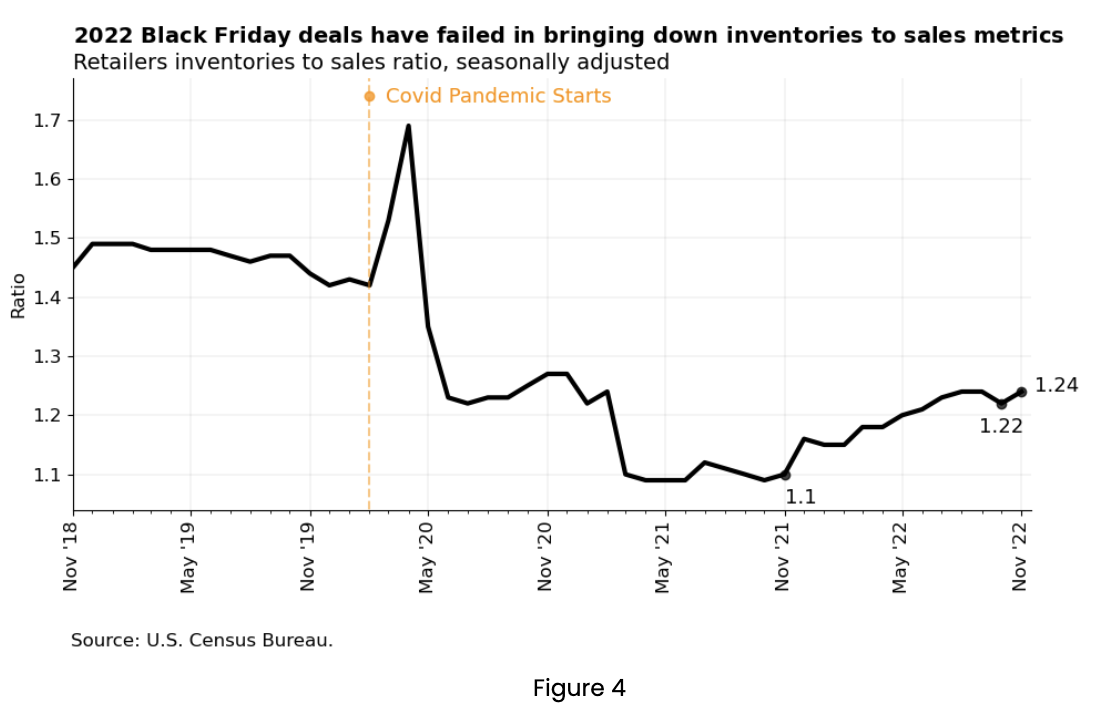

- But, despite retailers’ efforts to bring down inventories and lower the inventory to sales ratio, the ratio has remained consistently high since August – Figure 4.

- In October there was a small dip in the index from 1.24 to 1.22, but in November it returned to 1.24 – in line with August’s level. Inventory to sales is up 13% YoY although its current level is still far behind pre-pandemic ratios.

- The ratio is not expected to get back to its pre-pandemic levels because supply-chain management developments are making retailers more capable of quickly adjusting the mismatches between demand and inventory availability, without the need of piling up excessive inventory.

We predict another increase in inventory to sales metrics as the Advance Retail Sales Survey reported a decline in sales for December – which suggests that holiday deals were not enough to provoke a shopping spree large enough to take significant inventory off the shelves.

Industrial production

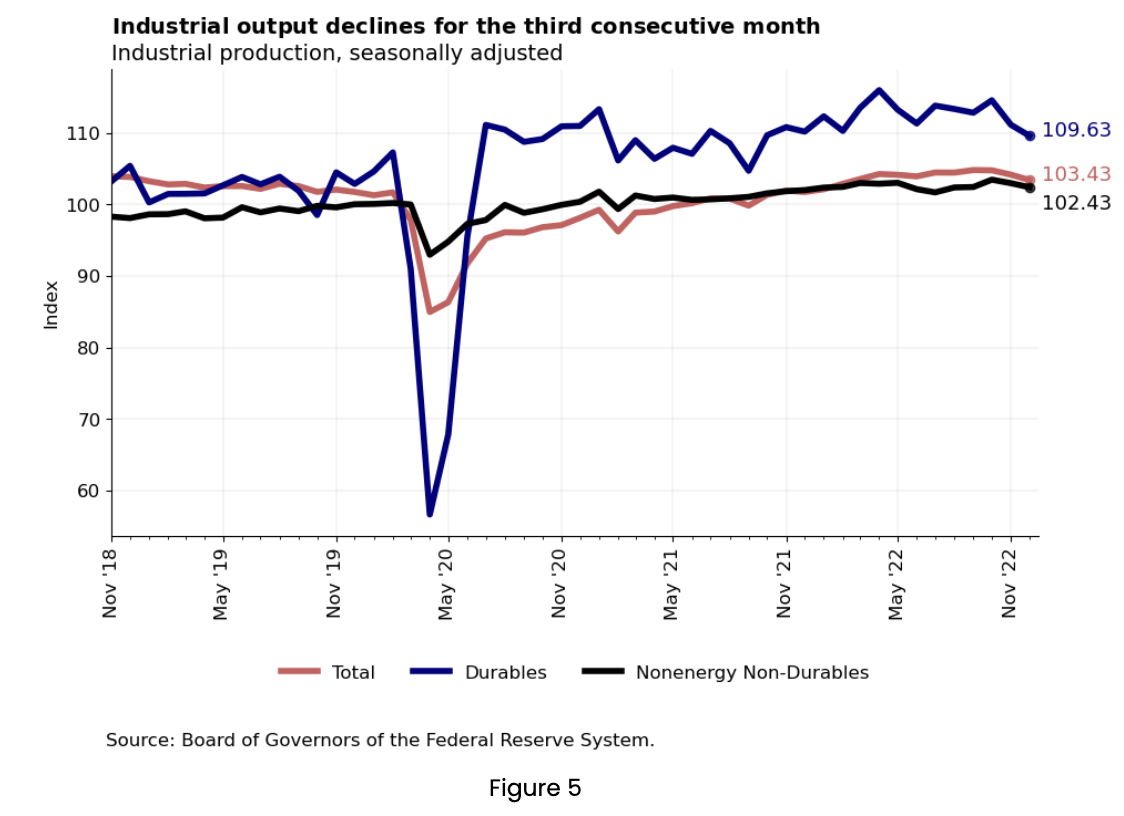

Industrial production slumped 0.7% MoM. The index has been declining since September 2022, potentially due to weaker consumer demand. As expected, the fall in production was more pronounced for cyclical sectors, which are more likely to have their consumption postponed during recessions: durable goods output fell 1.3%, while non-energy nondurable goods production fell only 0.5% – see Figure 5.

For the truckload market, the slowdown in manufacturing suggests further declines in freight volumes in the near term.

On the positive side, however, this is another indication that diesel prices will continue to drop in the coming months due to an excess of oil supply over demand (see the latest EIA forecast).

As always, please reach out to Stella Carneiro (stella.carneiro@loadsmart.com) with any questions, suggestions, thoughts, etc. Thank you!

------------------------------------------------------------------

For more about how you can understand the current market to plan for the future, download our quarterly report.

Share this

- Loadsmart Blog (159)

- Blog (121)

- Shipper (106)

- Market Trends (101)

- Enterprise Shipper (69)

- Carrier (66)

- News (62)

- Data Insights (51)

- Thought Leadership (45)

- Warehouse (41)

- SMB Shipper (38)

- Our Partners (34)

- ShipperGuide TMS (31)

- Opendock (30)

- Product Updates (29)

- Mode Optimization (25)

- Loadsmart (23)

- Mid-Market Shipper (18)

- Case Study (17)

- Brokerage Services (15)

- Managed Transportation (11)

- Video (9)

- Award (7)

- FreightIntel AI (5)

- Instant Execution (4)

- Asset (3)

- Food and Beverage (3)

- Freight Management (3)

- Logistics Solutions (3)

- YMS (3)

- eBook (3)

- 4PL (2)

- International (2)

- NavTrac (2)

- Podcast (2)

- UK (2)

- Yard Management System (2)

- Cold Storage (1)

- Faces of Loadsmart (1)

- Paper Packaging (1)

- Retail (1)

- Security (1)

- Transportation Management System (1)

- January 2026 (1)

- December 2025 (1)

- November 2025 (1)

- October 2025 (2)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (7)

- April 2025 (6)

- March 2025 (3)

- February 2025 (10)

- January 2025 (4)

- December 2024 (4)

- November 2024 (5)

- October 2024 (11)

- September 2024 (11)

- August 2024 (5)

- July 2024 (5)

- June 2024 (9)

- May 2024 (7)

- April 2024 (6)

- March 2024 (2)

- February 2024 (2)

- January 2024 (5)

- December 2023 (6)

- November 2023 (2)

- October 2023 (12)

- September 2023 (5)

- August 2023 (3)

- July 2023 (4)

- June 2023 (10)

- May 2023 (5)

- April 2023 (5)

- March 2023 (7)

- February 2023 (5)

- January 2023 (7)

- December 2022 (4)

- November 2022 (13)

- October 2022 (4)

- September 2022 (7)

- August 2022 (11)

- July 2022 (6)

- June 2022 (5)

- May 2022 (2)

- April 2022 (4)

- March 2022 (6)

- February 2022 (7)

- January 2022 (9)

- December 2021 (3)

- November 2021 (5)

- October 2021 (7)

- September 2021 (2)

- August 2021 (2)

- July 2021 (4)

- June 2021 (6)

- May 2021 (6)

- April 2021 (5)

- March 2021 (8)

- February 2021 (3)

- January 2021 (3)

- December 2020 (7)

- November 2020 (9)

- October 2020 (7)

- September 2020 (6)

- August 2020 (10)

- July 2020 (8)

- June 2020 (3)

- May 2020 (1)

- April 2020 (2)

- March 2020 (2)

- February 2020 (1)

- January 2020 (1)

- November 2019 (2)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- June 2019 (2)

- May 2019 (3)

- March 2019 (1)

- February 2019 (3)

- December 2018 (1)

- November 2018 (2)

- October 2018 (1)

- September 2018 (2)

- August 2018 (1)

- July 2018 (1)

- June 2018 (3)

- May 2018 (4)

- April 2018 (1)

- February 2018 (1)

- January 2018 (4)

- November 2017 (1)

- October 2017 (2)

- June 2017 (1)

- May 2017 (2)

- April 2017 (1)

- February 2017 (1)

- January 2017 (2)

- October 2016 (1)

- August 2016 (1)

- July 2016 (2)

- June 2016 (1)

- March 2016 (1)

- January 2016 (1)

- December 2015 (3)

- November 2015 (2)

- October 2015 (6)

- July 2015 (1)

- June 2015 (1)

- April 2015 (2)

- March 2015 (13)

- February 2015 (17)

- January 2015 (15)

- December 2014 (35)

- November 2014 (26)

- October 2014 (60)

- September 2014 (2)