Share this

February's Inside Look: An Analysis of Loadsmart’s Data & Market Indices

by jpallmerine

As usual, in this Monthly Market Update, we will provide a brief update & analysis of the full truckload market and present some compelling trucking-related economic analysis to provide a macroeconomic view on the state of the market. We hope you enjoy! #movemorewithless

Full Truckload Market Overview

Volumes

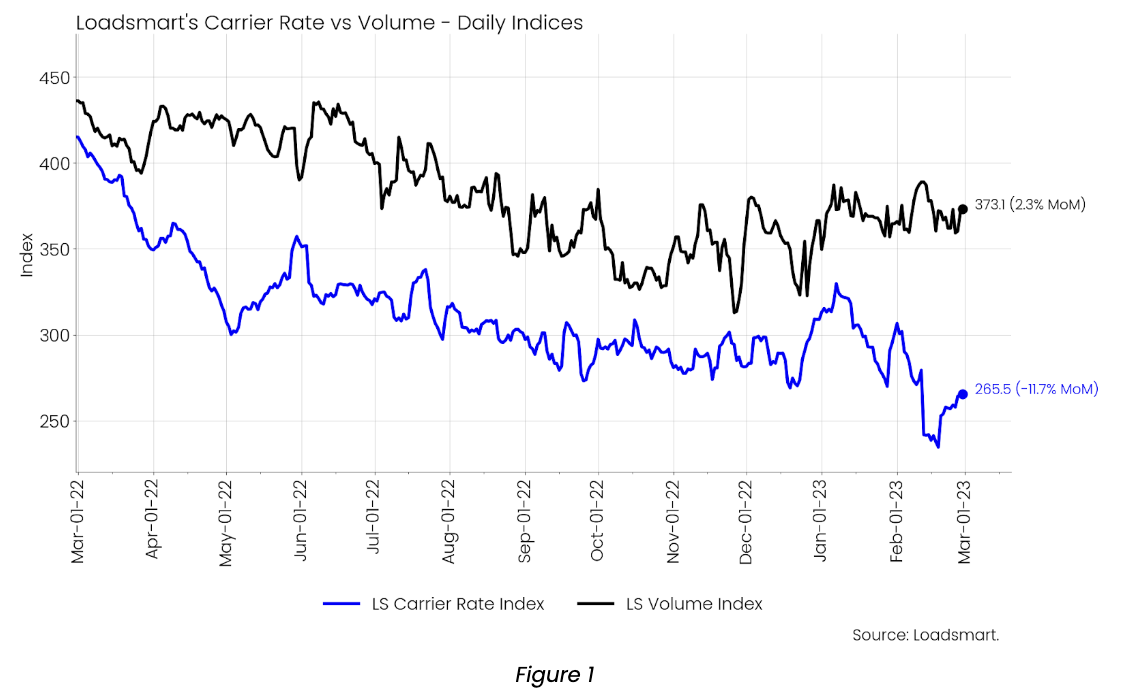

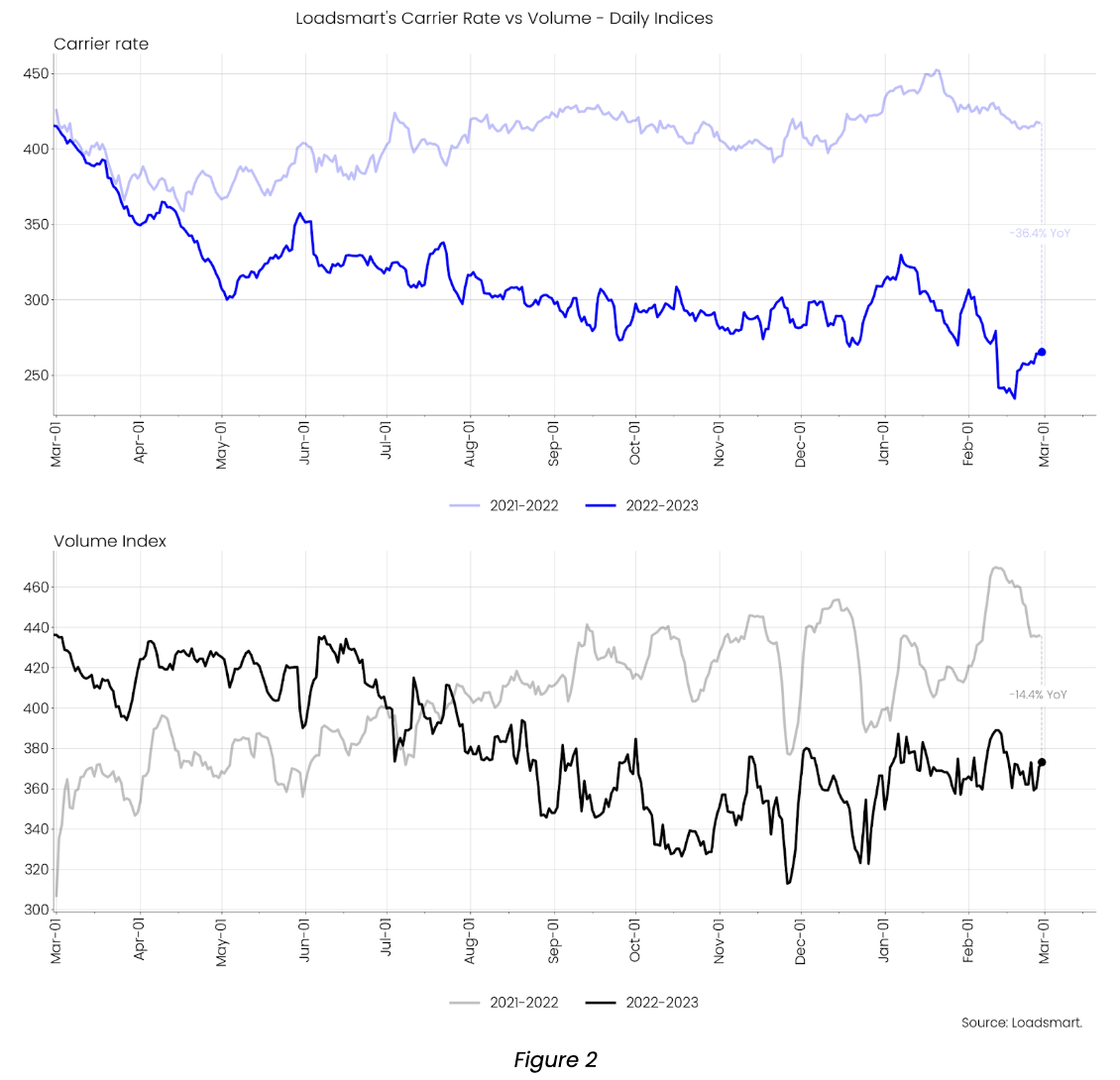

Our volume index increased by 2.3% in February MoM (Jan-31 to Feb-28). The index was rather stable during the month. Despite the fact that we are still in a deflationary trucking market, our volume's performance since Q4’22 has actually been positive. Using the monthly average, the index rose for the fourth consecutive month, resulting in a 10% gain since October 2022.

- This upward trend has been more prominent in the Southeast so far (maybe early signs of produce season?), where the index already increased by 24% since October; followed by the Southwest, Northeast, and West - which all had similar increases of around 15%. The only region where volumes are still near October’s bottom is the Midwest.

Rates

Our price index decreased by 11.7% in February (day 01 to 28). By mid-February, the index reached its lowest point yet in this market cycle. Prices dropped in all regions around the second & third week of the month, but then slowly regained steam in the last week of February.

- Note that we previously forecasted that rates would hit their bottom in Mid-February, however we did not expect them to drop as low as they did (-13% drop vs our forecasted 3-5% drop)

Loadsmart’s Look Ahead:

Something that we’re watching closely over the coming months that we should all be familiar with: will the US economy see a soft landing or a hard fall in terms of recessionary impacts in 2023?- Our view on this has shifted more bearish recently due to continued inflation concerns and resulting contractionary financial policies

- For example, for inflation to ease we would need to see unemployment increase, but the labor market is still tight: (i) the unemployment rate is at 3.4%, the lowest level in 54 years; (ii) wages and salaries were up 0.9% in January.

With the further economic contraction as well as Consumption / Industrial Production slowing, we don’t expect the freight market to begin its rebound until Q4’23.

- That said, it’s good to remember that the freight market can turn inflationary even amidst an economic downturn - if we see substantial amounts of capacity exit the market in Q2, this could rebalance the supply & demand equation and lead to some tightening as early as Q3

Freight & Economics

Rerouting to the East:

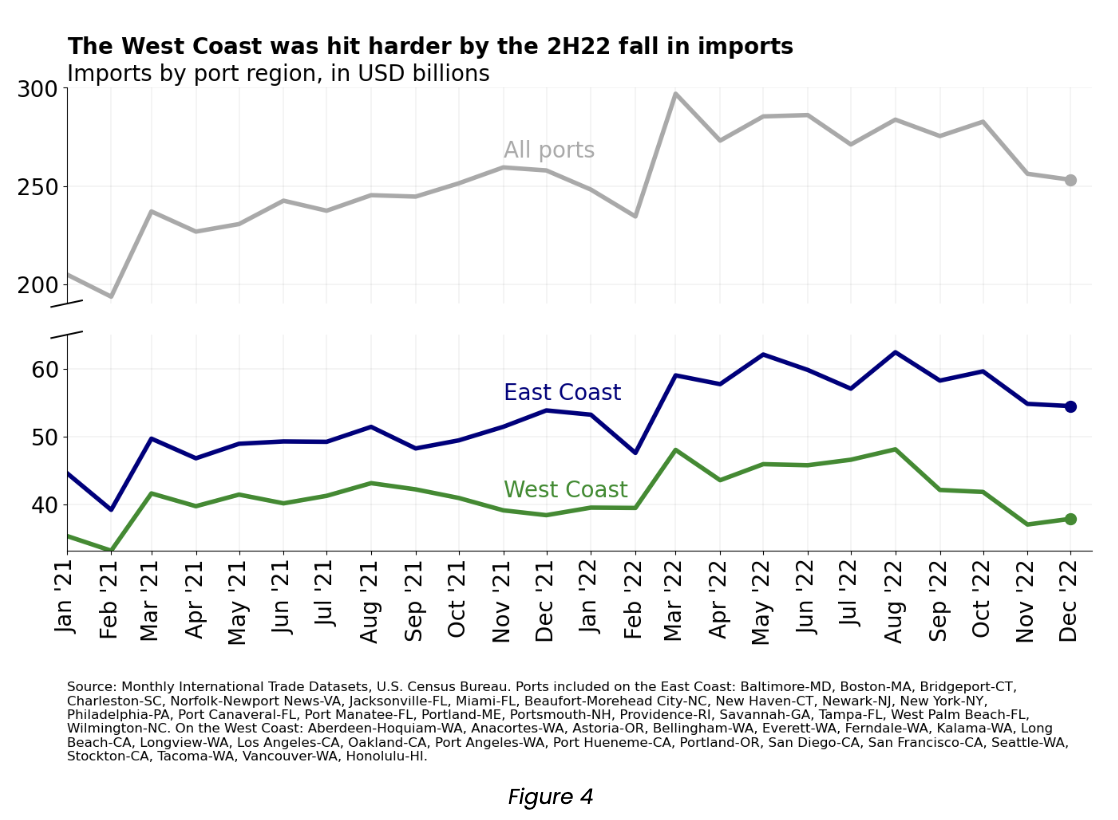

- The decline in imported goods in Q4 2022 was more pronounced on the West Coast. In addition to weakening domestic consumer demand, the fear of operational disruptions stemming from dockworkers' strikes in the region has led US industries to shift their import activities to the East Coast.

- Figure 4 shows that from October to December, total imports had a sharp decline. But on the West Coast, the downfall started more severely in August 2022. In December, the level of imports in the region was already 23% down from its peak in August of 2022.

The fear of port strikes stems from the fact that over 22,000 dockworkers from main West Coast ports have been working without a contract since July 2022. The bargaining between workers and ports is still ongoing. No strikes have been scheduled so far but negotiations are not open to the media, which creates an atmosphere of uncertainty among importers (check here for the official joint statement from the parties in negotiation).

Contract to Spot Spreads:

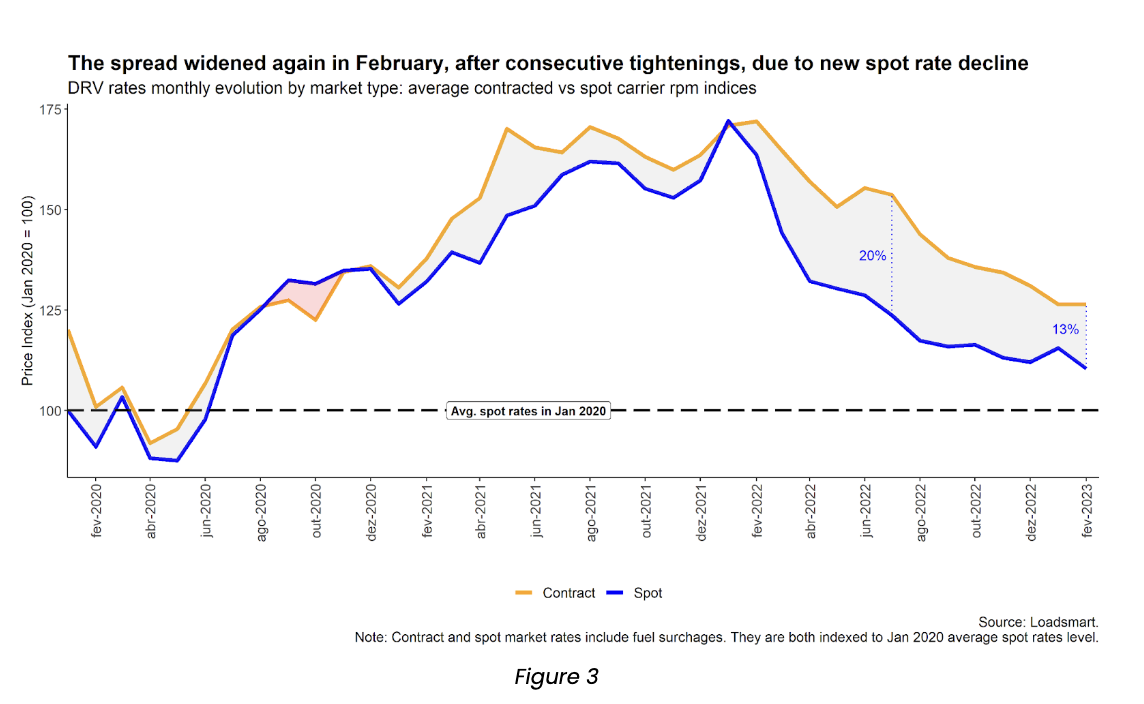

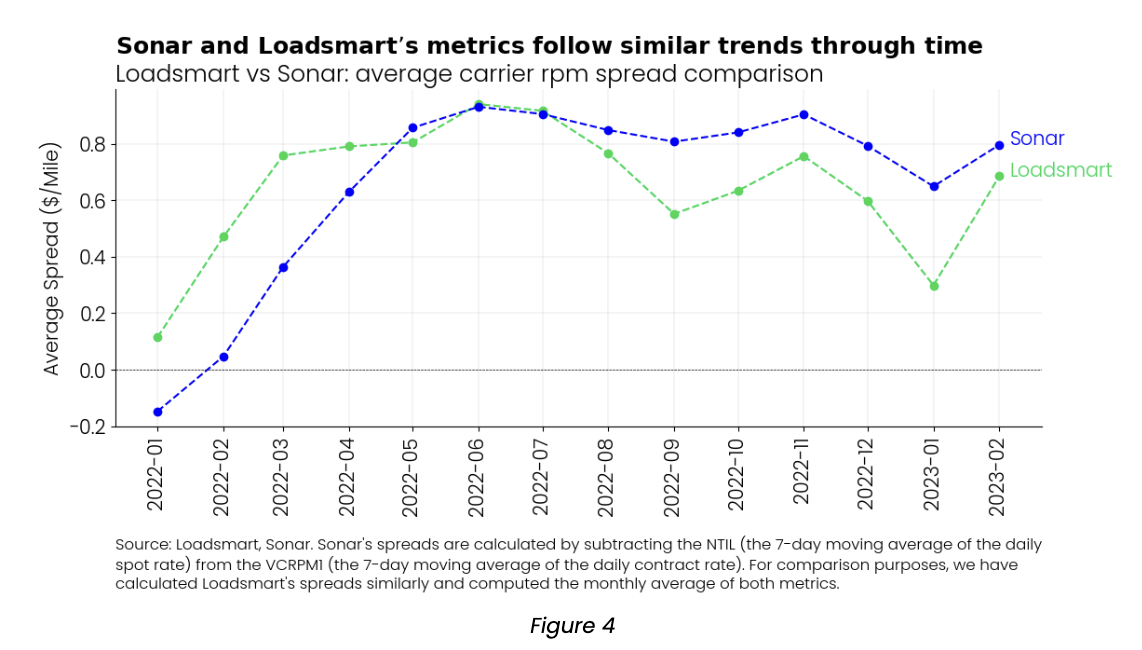

As we predicted at the end of last year, check out this LinkedIn post from December, the spread between contract and spot rates started the year on a downward trajectory. The reasoning behind our forecast was that shippers would take advantage of the soft freight demand & excess capacity, pushing contract rates down to follow spot levels; carriers, in turn, would keep an effort to maintain minimum contracted volumes in 1H 2023 bidding season.

We are now seeing this trend take shape rapidly: from July 2022 to January 2023, Loadsmart's average monthly spread dropped 10 p.p., from 20% to 9% - Figure 4. However, the additional spot rate contraction in February brought the spread back up to 13%.

- In February, our spot price reached a new floor, while the contract price remained stable at a level similar to January, leading to a widening of the spread. Sonar metrics showed a similar pattern, suggesting that the spot prices slide was widespread in the market.

- Sonar and Loadsmart’s metrics follow similar trends through time, although Loadsmart’s spreads have reached lower levels since the beginning of 2H 2022 - Figure 4.

Heavy Truck Sales:

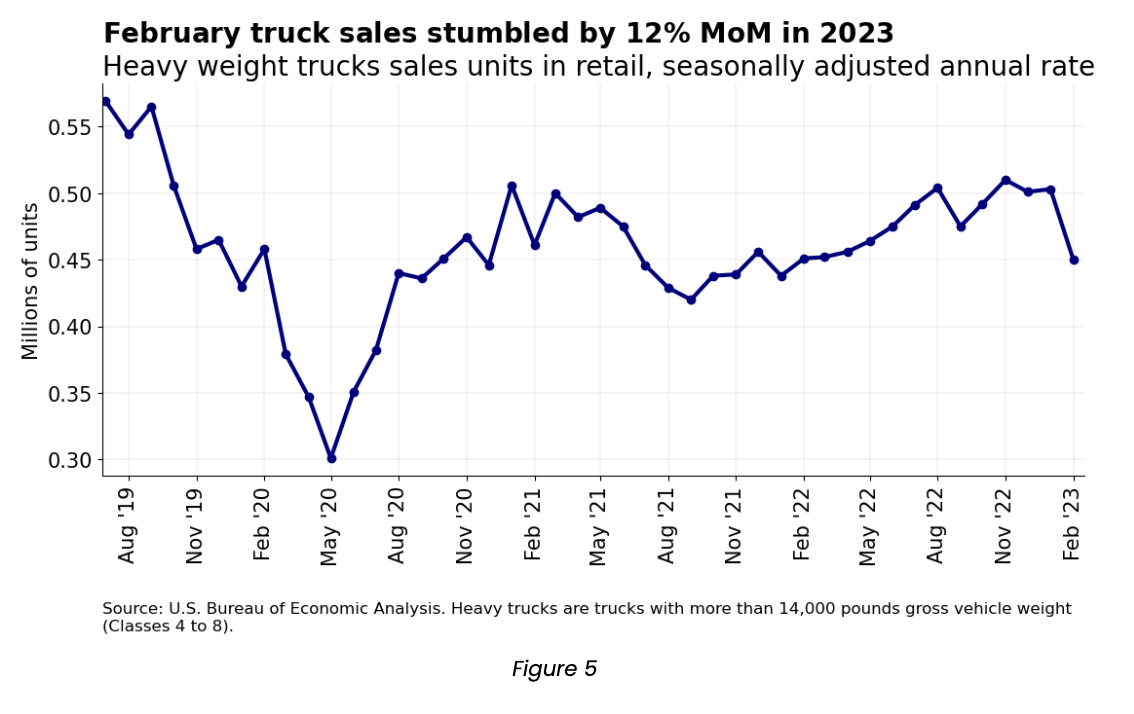

Heavy truck sales are down to 450 thousand units in February, a 12% decline MoM. The biggest monthly decline in sales in over three years - Figure 5.

Despite the recessive freight market during 2022, truck sales continued to rise throughout the year, likely due to the shortage of trucks in inventory during the pandemic period. However, recent data suggest that the late truck replacement cycle that supported the market last year is now over.

In addition to the recessionary scenario for trucking, vehicle financing conditions worsened due to consecutive interest rate hikes in 2022. This will make it harder for truck sales to return to pre-crisis levels this year.

As always, please reach out to Stella Carneiro (stella.carneiro@loadsmart.com) with any questions, suggestions, thoughts, etc. Thank you!

---------------------------------------------------

For more about how you can understand the current market to plan for the future, download our quarterly report.

Share this

- Loadsmart Blog (159)

- Blog (121)

- Shipper (106)

- Market Trends (101)

- Enterprise Shipper (69)

- Carrier (66)

- News (62)

- Data Insights (51)

- Thought Leadership (45)

- Warehouse (41)

- SMB Shipper (38)

- Our Partners (34)

- ShipperGuide TMS (31)

- Opendock (30)

- Product Updates (29)

- Mode Optimization (25)

- Loadsmart (23)

- Mid-Market Shipper (18)

- Case Study (17)

- Brokerage Services (15)

- Managed Transportation (11)

- Video (9)

- Award (7)

- FreightIntel AI (5)

- Instant Execution (4)

- Asset (3)

- Food and Beverage (3)

- Freight Management (3)

- Logistics Solutions (3)

- YMS (3)

- eBook (3)

- 4PL (2)

- International (2)

- NavTrac (2)

- Podcast (2)

- UK (2)

- Yard Management System (2)

- Cold Storage (1)

- Faces of Loadsmart (1)

- Paper Packaging (1)

- Retail (1)

- Security (1)

- Transportation Management System (1)

- January 2026 (1)

- December 2025 (1)

- November 2025 (1)

- October 2025 (2)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (7)

- April 2025 (6)

- March 2025 (3)

- February 2025 (10)

- January 2025 (4)

- December 2024 (4)

- November 2024 (5)

- October 2024 (11)

- September 2024 (11)

- August 2024 (5)

- July 2024 (5)

- June 2024 (9)

- May 2024 (7)

- April 2024 (6)

- March 2024 (2)

- February 2024 (2)

- January 2024 (5)

- December 2023 (6)

- November 2023 (2)

- October 2023 (12)

- September 2023 (5)

- August 2023 (3)

- July 2023 (4)

- June 2023 (10)

- May 2023 (5)

- April 2023 (5)

- March 2023 (7)

- February 2023 (5)

- January 2023 (7)

- December 2022 (4)

- November 2022 (13)

- October 2022 (4)

- September 2022 (7)

- August 2022 (11)

- July 2022 (6)

- June 2022 (5)

- May 2022 (2)

- April 2022 (4)

- March 2022 (6)

- February 2022 (7)

- January 2022 (9)

- December 2021 (3)

- November 2021 (5)

- October 2021 (7)

- September 2021 (2)

- August 2021 (2)

- July 2021 (4)

- June 2021 (6)

- May 2021 (6)

- April 2021 (5)

- March 2021 (8)

- February 2021 (3)

- January 2021 (3)

- December 2020 (7)

- November 2020 (9)

- October 2020 (7)

- September 2020 (6)

- August 2020 (10)

- July 2020 (8)

- June 2020 (3)

- May 2020 (1)

- April 2020 (2)

- March 2020 (2)

- February 2020 (1)

- January 2020 (1)

- November 2019 (2)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- June 2019 (2)

- May 2019 (3)

- March 2019 (1)

- February 2019 (3)

- December 2018 (1)

- November 2018 (2)

- October 2018 (1)

- September 2018 (2)

- August 2018 (1)

- July 2018 (1)

- June 2018 (3)

- May 2018 (4)

- April 2018 (1)

- February 2018 (1)

- January 2018 (4)

- November 2017 (1)

- October 2017 (2)

- June 2017 (1)

- May 2017 (2)

- April 2017 (1)

- February 2017 (1)

- January 2017 (2)

- October 2016 (1)

- August 2016 (1)

- July 2016 (2)

- June 2016 (1)

- March 2016 (1)

- January 2016 (1)

- December 2015 (3)

- November 2015 (2)

- October 2015 (6)

- July 2015 (1)

- June 2015 (1)

- April 2015 (2)

- March 2015 (13)

- February 2015 (17)

- January 2015 (15)

- December 2014 (35)

- November 2014 (26)

- October 2014 (60)

- September 2014 (2)