Share this

April's Inside Look: An Analysis of Loadsmart’s Data & Market Indices

by jpallmerine

As usual, in this Monthly Market Update, we will provide a brief update & analysis of the full truckload market and present some compelling trucking-related economic analysis to provide a macroeconomic view on the state of the market.

Please reach out to Stella Carneiro (stella.carneiro@loadsmart.com) with any questions, suggestions, thoughts, etc. Thank you! We hope you enjoy! #movemorewithless

Loadsmart's 2023 Truckload Market Outlook:

In our view, Q2’23 will represent the spot market bottom, but a notable short-term recovery is unlikely given the current economic environment. We forecast a 10-15% increase in our spot rate index by the end of Q4’23, with a significant spot market recovery coming in 1H’24- According to the data presented in a section below, the arrival of spring should warm up the consumer market. As a result of this and produce season, we expect 2Q2023 to be better or equal to the previous quarter, but definitely worse than 2Q2022.

- Despite the hope for seasonal improvement, the broader macro environment for the freight transportation market will continue to be challenging. The April jobs report signaled that the U.S. labor market remains tight, making it less likely that inflation will ease next month. As a result, consumption of goods may continue to slow down, further delaying excess truckload capacity rebalancing with demand.

April 2023 Truckload Market Update:

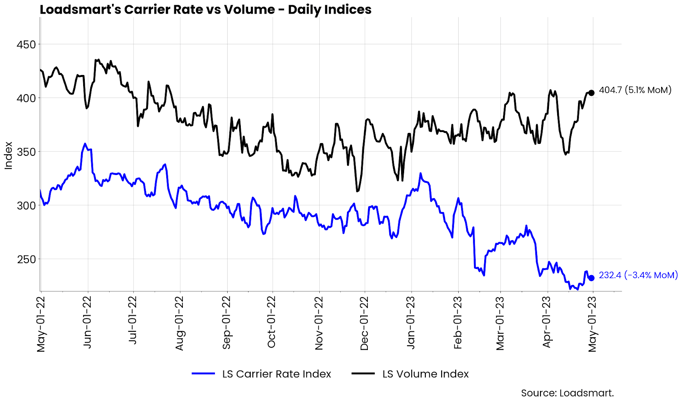

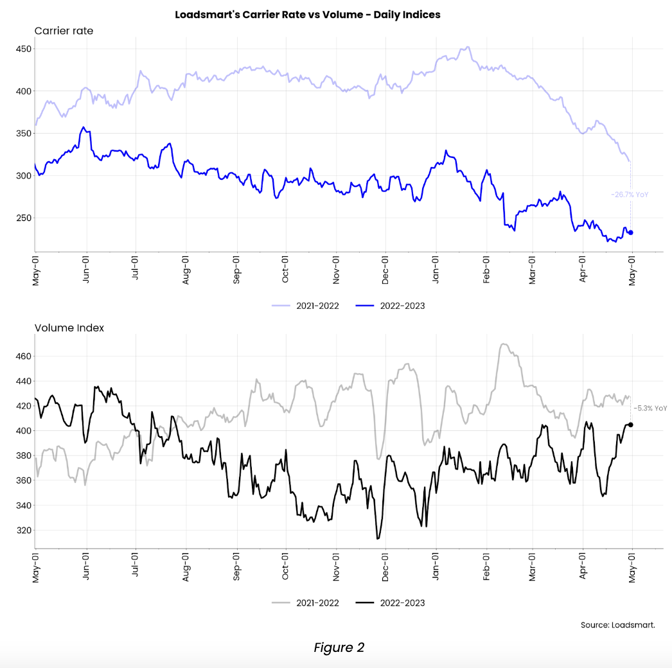

Figure 1

Figure 1

-

- Our year-over-year volume performance continues to be negative but has outpaced the market so far: Sonar's OTVI data is down 16% YoY, while we are down only 5% YoY.

- Rates were down in all regions, except for the Midwest, where they rose 9% MoM. The Midwest region has, in fact, surpassed the traditionally more expensive Northeast region as the nation's highest carrier RPM for the first time this year, which can be an outcome of the growing volumes outbound from the region. Since March, the total volume sourced in the region has grown by 17%.

Freight & Economics Outlook

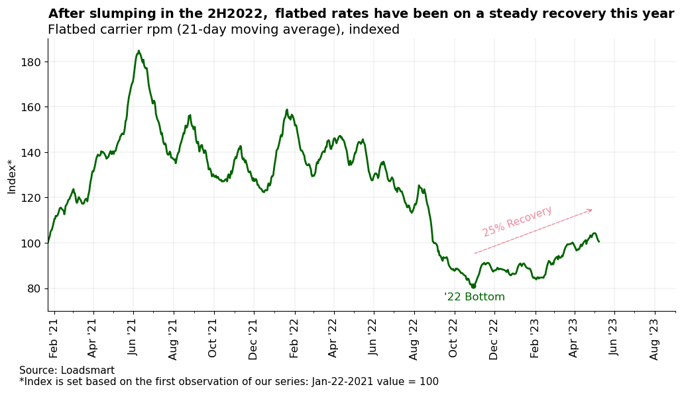

Flatbed Recovery

While there is still uncertainty in the truckload industry as to whether dry van rates have bottomed out, there are reasons to be optimistic about the flatbed share of the market. Loadsmart’s flatbed index started recovering in November ‘22 and is currently 25% up from the ‘22 bottom.

Figure 3

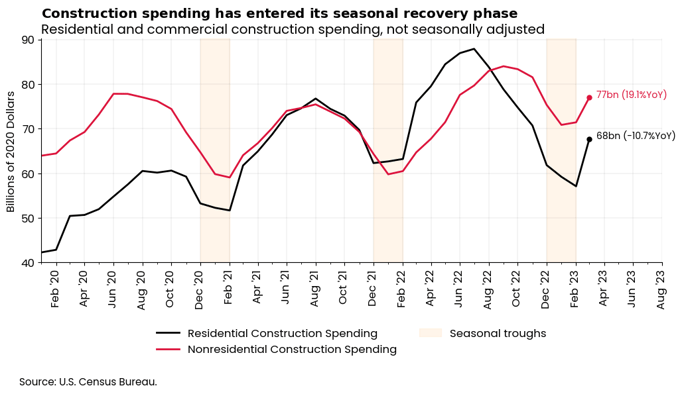

We have reasons to believe flatbed rates will continue upward from November’s bottom because:- Non-residential construction is booming and the uptrend should remain in the next months. U.S. manufacturers are in a re-shoring process, which intensified the demand for commercial and industrial buildings over the last year. The current construction spending expansion is being driven by this.

Manufacturers began re-shoring during the pandemic as they felt the need to regain control of their end-to-end supply chain. However, the re-shoring trend has intensified in the last two years, spurred by U.S. government policies, namely the bipartisan infrastructure bill and the recent CHIPS and Science Act.

These public initiatives are expected to continue to fuel the construction sector in 2023, driving further spending growth that should leverage flatbed demand. - Seasonal Recovery: The construction sector is characterized by a strong seasonality, with construction booming in the summer and slowing down in the winter. As shown in Figure 4, February is typically when the construction spending cycle troughs and moves into the expansion phase. Hence, we expected the seasonal rebound in construction spending to also boost flatbed rates in the next two quarters.

Figure 4

Figure 4

Retailers May Have a Soft Start To Spring

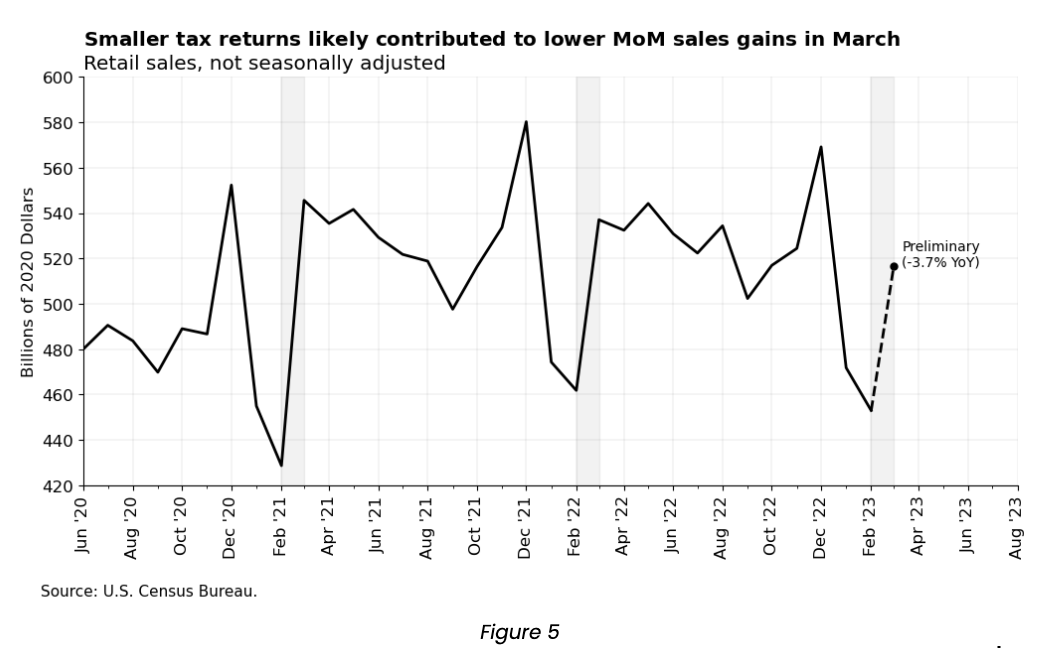

February to March is typically the time of year for retail sales to pick up given the combination of warmer weather and tax refunds. Still, preliminary data from March (in Figure 5) shows that sales growth was not as strong as in previous years.

Retail sales rose 14% MoM, while the average March gain over the past three years was 23%. In addition to the inflationary scenario and underlying economic uncertainty, this year's smaller tax returns - typically released in March - may have contributed to slowing sales in the 1Q.

Weak retail sales will continue to dampen the chances of freight rates picking up in 2Q2023. From a seasonal perspective, we should have a better 2Q than 1Q2023 due to spring and summer, but in the annual balance, the trend is that trade suffers more year-over-year deceleration.

----------------------------------------------------------------------------

For more about how you can understand the current market to plan for the future, download our quarterly report.

Share this

- Loadsmart Blog (159)

- Blog (121)

- Shipper (106)

- Market Trends (101)

- Enterprise Shipper (69)

- Carrier (66)

- News (62)

- Data Insights (51)

- Thought Leadership (45)

- Warehouse (41)

- SMB Shipper (38)

- Our Partners (34)

- ShipperGuide TMS (31)

- Opendock (30)

- Product Updates (29)

- Mode Optimization (25)

- Loadsmart (23)

- Mid-Market Shipper (18)

- Case Study (17)

- Brokerage Services (15)

- Managed Transportation (11)

- Video (9)

- Award (7)

- FreightIntel AI (5)

- Instant Execution (4)

- Asset (3)

- Food and Beverage (3)

- Freight Management (3)

- Logistics Solutions (3)

- YMS (3)

- eBook (3)

- 4PL (2)

- International (2)

- NavTrac (2)

- Podcast (2)

- UK (2)

- Yard Management System (2)

- Cold Storage (1)

- Faces of Loadsmart (1)

- Paper Packaging (1)

- Retail (1)

- Security (1)

- Transportation Management System (1)

- January 2026 (1)

- December 2025 (1)

- November 2025 (1)

- October 2025 (2)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (7)

- April 2025 (6)

- March 2025 (3)

- February 2025 (10)

- January 2025 (4)

- December 2024 (4)

- November 2024 (5)

- October 2024 (11)

- September 2024 (11)

- August 2024 (5)

- July 2024 (5)

- June 2024 (9)

- May 2024 (7)

- April 2024 (6)

- March 2024 (2)

- February 2024 (2)

- January 2024 (5)

- December 2023 (6)

- November 2023 (2)

- October 2023 (12)

- September 2023 (5)

- August 2023 (3)

- July 2023 (4)

- June 2023 (10)

- May 2023 (5)

- April 2023 (5)

- March 2023 (7)

- February 2023 (5)

- January 2023 (7)

- December 2022 (4)

- November 2022 (13)

- October 2022 (4)

- September 2022 (7)

- August 2022 (11)

- July 2022 (6)

- June 2022 (5)

- May 2022 (2)

- April 2022 (4)

- March 2022 (6)

- February 2022 (7)

- January 2022 (9)

- December 2021 (3)

- November 2021 (5)

- October 2021 (7)

- September 2021 (2)

- August 2021 (2)

- July 2021 (4)

- June 2021 (6)

- May 2021 (6)

- April 2021 (5)

- March 2021 (8)

- February 2021 (3)

- January 2021 (3)

- December 2020 (7)

- November 2020 (9)

- October 2020 (7)

- September 2020 (6)

- August 2020 (10)

- July 2020 (8)

- June 2020 (3)

- May 2020 (1)

- April 2020 (2)

- March 2020 (2)

- February 2020 (1)

- January 2020 (1)

- November 2019 (2)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- June 2019 (2)

- May 2019 (3)

- March 2019 (1)

- February 2019 (3)

- December 2018 (1)

- November 2018 (2)

- October 2018 (1)

- September 2018 (2)

- August 2018 (1)

- July 2018 (1)

- June 2018 (3)

- May 2018 (4)

- April 2018 (1)

- February 2018 (1)

- January 2018 (4)

- November 2017 (1)

- October 2017 (2)

- June 2017 (1)

- May 2017 (2)

- April 2017 (1)

- February 2017 (1)

- January 2017 (2)

- October 2016 (1)

- August 2016 (1)

- July 2016 (2)

- June 2016 (1)

- March 2016 (1)

- January 2016 (1)

- December 2015 (3)

- November 2015 (2)

- October 2015 (6)

- July 2015 (1)

- June 2015 (1)

- April 2015 (2)

- March 2015 (13)

- February 2015 (17)

- January 2015 (15)

- December 2014 (35)

- November 2014 (26)

- October 2014 (60)

- September 2014 (2)