Share this

Loadsmart’s Look Ahead: An Analysis of Key Freight & Economic Indicators to Watch in May

As usual, in this Monthly Market Update, we will (a) provide a brief update/analysis of the full truckload market and (b) present a compelling economic analysis to provide a macroeconomic view on the state of the freight market.

We hope you enjoy! #movemorewithless

Loadsmart’s top 30 spot rate forecast

Figure 1

Rates: Our price index declined 8.5% MoM in April. As we predicted last month, rates continued to hover near March lows without much strength for a sustained appreciation. This is because rates are rising in the southern states while falling in the northern states, creating a counterbalance that keeps the index stable.- In the last week of the month, prices fell in Texas and Georgia, bringing the index to a new YTD low. However, this drop should be temporary as both regions are experiencing pent-up demand this spring.

Sonar's OTRI behaved similarly to our price index. Rejections started the month at 3.7%. There was a small bump in the middle of the month, and they rose above 4%, but around the 18th, a downward trend set in, and they ended the month at 3%.

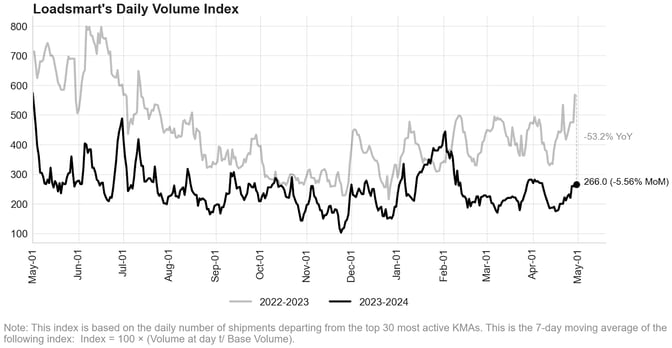

Figure 2

Volumes: Our volume index decreased 5.5% MoM in March. Volumes were strong in the first week due to an increase in bookings in Texas, declined in the second week and quickly recovered as bookings increased in Ohio and again in Texas.

- Key sectors such as consumer goods and food & beverages lost momentum in April.

Sonar's OTVI was up 5% MoM. After falling ~8% in late March/early April, the index gradually recovered to levels near its year-to-date high.

- Rates are expected to improve modestly in the coming months, driven by seasonality. They should end the year with an increase of only ~10% from current levels.

We do not foresee any structural changes in the truckload market that would lead to more robust rate increases in the near term. The market is oversupplied with carriers and will remain so until about Jul '25.

Prices are expected to reach $2.64 in July and $2.76 in Dec '24 and continue to rise until Mar '25, when they peak at $2.81, 27% below the Jan'22 high.

Figure 3

Freight & Economics

Is the weather catalyzing more freight demand?

- Based on the latest forecast, we expect the truckload market to remain soft for the remainder of the year. However, the $2.5 average all-in rate observed in March is likely the floor for 2024 as we see signs of seasonal rate increases in specific regions that may help keep the national dry van rate above this level.

- Figure 4 illustrates the month-over-month change in average monthly rates for key market areas (KMAs) in the U.S. as of April. The map shows a widespread recovery of carrier rates across the southern U.S., extending into Arizona and California, likely spurred by the produce season.

Figure 4

- Average rates in Florida, Alabama, Mississippi, Texas, and California began to trend downward after December, and it was only in April that rates started to rise again.

- Conversely, in the northern states, excluding the Northwest, rates continued to fall during March and April, reaching levels close to their 2023 lows.

If this trend continues in the northern regions, we expect the national spot rate to increase slightly as warmer summer weather could drive more market activity.

The "rebirth" of industrial production and freight demand

- Industrial production rebounded in Q1 2024, driven by high-value-added industries such as chemicals and automobiles. Total industrial production rose 0.44% in Feb and 0.4% in Mar.

- We may soon be at a tipping point for the manufacturing industry. The Infrastructure Investment and Jobs Act, the CHIPS Act, and the Inflation Reduction Act legislation passed in 2021-2022 helped fuel an unprecedented manufacturing investment cycle. Total construction spending associated with manufacturing grew by ~200% from 2021 to 2023 - Figure 5.

Figure 5

- All of the investments to expand industrial capacity are expected to pay off slowly. Oregon Economic Analysis expects industrial production to be flat in 2024 but to grow by an average of 1% QoQ in 2025-2030.

- Since 2021/2022, high-value-added industries have shown robust growth trajectories, while low-value-added sectors have continued to decline. This divergence is likely to become more pronounced in the coming years as these government incentives favor high-value-added sectors. Figure 6 displays the growth in industrial production of some of the most freight-intensive industries.

Figure 6

- If the industrial "rebirth" occurs, it will be concentrated in a few sectors, while some large freight-intensive sectors are likely to continue to shrink. Given the decline in these sectors, it is difficult to foresee a recovery in freight demand driven by industrial production in the coming years.

Please reach out to Stella Carneiro (stella.carneiro@loadsmart.com) with any questions, suggestions, thoughts, etc. Thank you!

Share this

- Loadsmart Blog (159)

- Blog (121)

- Shipper (106)

- Market Trends (101)

- Enterprise Shipper (69)

- Carrier (66)

- Data Insights (51)

- Thought Leadership (45)

- Warehouse (41)

- SMB Shipper (38)

- Our Partners (34)

- ShipperGuide TMS (31)

- Opendock (30)

- Product Updates (29)

- Mode Optimization (25)

- Loadsmart (23)

- Mid-Market Shipper (18)

- Case Study (17)

- Brokerage Services (15)

- Managed Transportation (11)

- Video (9)

- Award (7)

- FreightIntel AI (5)

- Instant Execution (4)

- Asset (3)

- Food and Beverage (3)

- Freight Management (3)

- Logistics Solutions (3)

- YMS (3)

- eBook (3)

- 4PL (2)

- International (2)

- NavTrac (2)

- Podcast (2)

- UK (2)

- Yard Management System (2)

- Cold Storage (1)

- Faces of Loadsmart (1)

- Paper Packaging (1)

- Retail (1)

- Security (1)

- Transportation Management System (1)

- January 2026 (1)

- December 2025 (1)

- November 2025 (1)

- October 2025 (2)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (7)

- April 2025 (6)

- March 2025 (3)

- February 2025 (10)

- January 2025 (4)

- December 2024 (4)

- November 2024 (5)

- October 2024 (11)

- September 2024 (11)

- August 2024 (5)

- July 2024 (5)

- June 2024 (9)

- May 2024 (7)

- April 2024 (6)

- March 2024 (2)

- February 2024 (2)

- January 2024 (5)

- December 2023 (6)

- November 2023 (2)

- October 2023 (12)

- September 2023 (5)

- August 2023 (3)

- July 2023 (4)

- June 2023 (10)

- May 2023 (5)

- April 2023 (5)

- March 2023 (7)

- February 2023 (5)

- January 2023 (7)

- December 2022 (4)

- November 2022 (13)

- October 2022 (4)

- September 2022 (7)

- August 2022 (11)

- July 2022 (6)

- June 2022 (5)

- May 2022 (2)

- April 2022 (4)

- March 2022 (6)

- February 2022 (7)

- January 2022 (9)

- December 2021 (3)

- November 2021 (5)

- October 2021 (7)

- September 2021 (2)

- August 2021 (2)

- July 2021 (4)

- June 2021 (6)

- May 2021 (6)

- April 2021 (5)

- March 2021 (8)

- February 2021 (3)

- January 2021 (3)

- December 2020 (7)

- November 2020 (9)

- October 2020 (7)

- September 2020 (6)

- August 2020 (10)

- July 2020 (8)

- June 2020 (3)

- May 2020 (1)

- April 2020 (2)

- March 2020 (2)

- February 2020 (1)

- January 2020 (1)

- November 2019 (2)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- June 2019 (2)

- May 2019 (3)

- March 2019 (1)

- February 2019 (3)

- December 2018 (1)

- November 2018 (2)

- October 2018 (1)

- September 2018 (2)

- August 2018 (1)

- July 2018 (1)

- June 2018 (3)

- May 2018 (4)

- April 2018 (1)

- February 2018 (1)

- January 2018 (4)

- November 2017 (1)

- October 2017 (2)

- June 2017 (1)

- May 2017 (2)

- April 2017 (1)

- February 2017 (1)

- January 2017 (2)

- October 2016 (1)

- August 2016 (1)

- July 2016 (2)

- June 2016 (1)

- March 2016 (1)

- January 2016 (1)

- December 2015 (3)

- November 2015 (2)

- October 2015 (6)

- July 2015 (1)

- June 2015 (1)

- April 2015 (2)

- March 2015 (13)

- February 2015 (17)

- January 2015 (15)

- December 2014 (35)

- November 2014 (26)

- October 2014 (60)

- September 2014 (2)