Share this

Loadsmart’s Look Ahead: An Analysis of Key Freight & Economic Indicators to Watch in December and Beyond..

by jpallmerine

As usual, in this Monthly Market Update, we will provide a brief update & analysis of the full truckload market and present some compelling trucking-related economic analysis to provide a macroeconomic view on the state of the market. Please reach out to Stella Carneiro (stella.carneiro@loadsmart.com) with any questions, suggestions, thoughts, etc. Thank you! We hope you enjoy! #movemorewithless

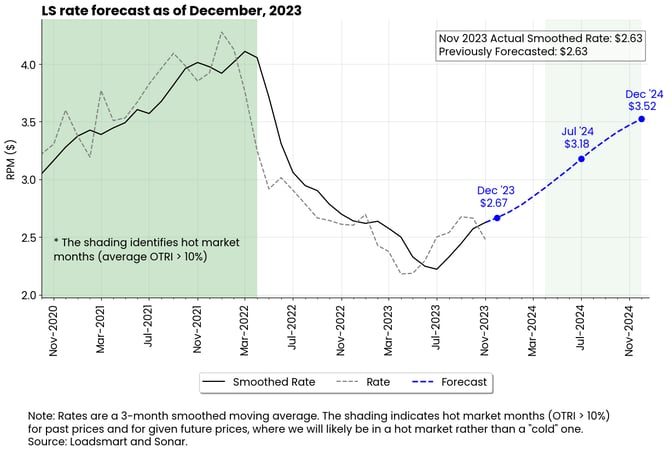

- The 3-month smoothed rate increased in November, reflecting the significant increase in the average monthly rate in September.

- But the deceleration is notable. The rate grew by about 5% per month from August to October, but growth has halved from October to November.

- In the first quarter of '24, we expect the rate recovery cycle to slow a bit more, as January through March is typically a slow season for freight.

Figure 1

November's Full Truckload Market Review:

Figure 2

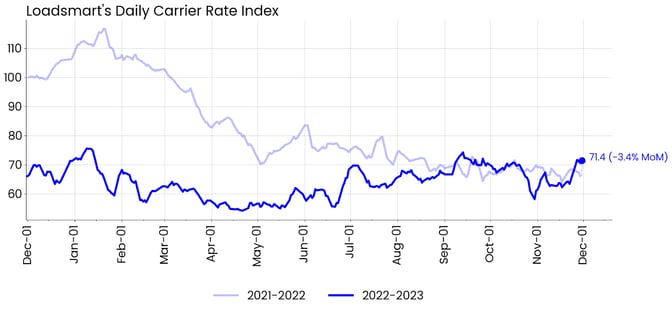

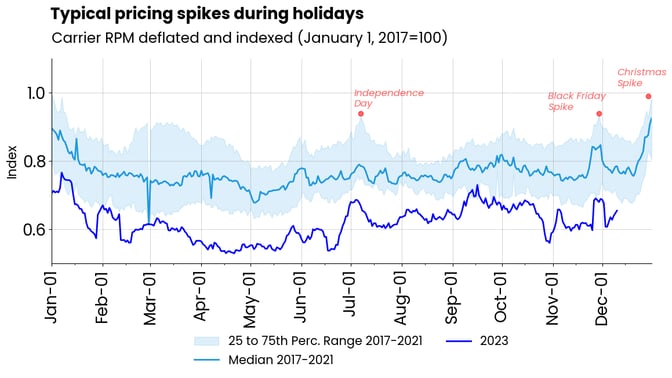

Rates: Our price index declined 3.4% MoM. Our prices partially recovered from October's sharp decline in early November. However, it was not until the week before Thanksgiving that they jumped.- Prices surged 15% three days before the holiday, in line with in previous years.

- These temporary price spikes during the holidays indicate that capacity is tightening as, unlike last year, rates have reacted to temporary surges in demand - see Figure 3.

- Sonar's OTRI behaved similarly to our index - it had a weak start to the month, followed by a rebound during the week leading up to the holidays.

Figure 3

Figure 3

Figure 4

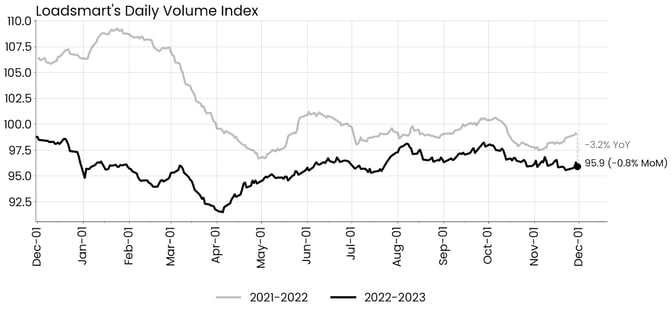

Volumes: Our volume index was down 0.8% MoM in November. Since the beginning of October, our volumes have been on a slight downtrend.- In contrast to our index, Sonar's OTVI increased in November on a MoM basis and reached its YTD high in the days leading up to the holidays.

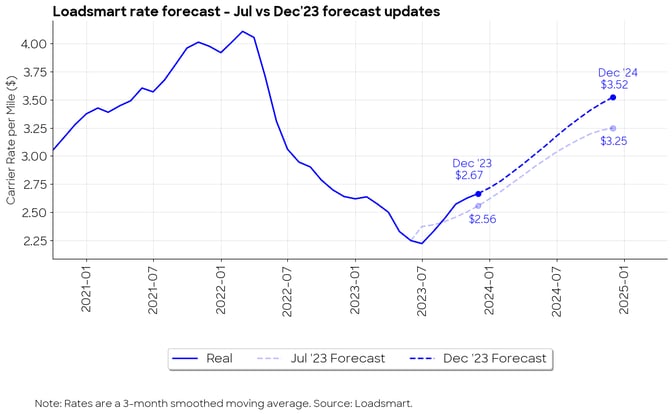

Loadsmart’s Spot Rate Forecast Then & Now:

Figure 5 shows how our forecast evolved over the year. In June, when we first started our forecast, we predicted that the recovery would begin in that month, but it took a month longer.

After that, as we had predicted, there was a steady recovery in prices, but this rebound was better than initially expected. This is due to:

- The unexpected increase in diesel prices at the end of August - as our rate calculation includes fuel surcharges.

- The strong performance of consumer spending (especially durable goods) in Q3 2023. Our forecast model uses past consumer spending to predict future rates.

Figure 5

Figure 5

Freight & Economics Review

Contract-to-spot spreads

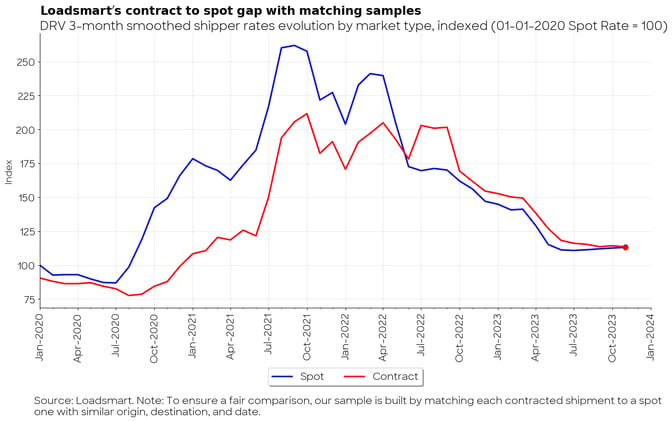

We reformulated our contract-to-spot indicators to make a fair comparison between the two markets. The sample that generated Figure 6 was compiled so that for each contracted shipment, we look for a spot one with a similar origin, destination, and date.

This shows that the recovery in spot rates is still very small in markets where our contract presence is greater.

Figure 6

The weak recovery in spot rates in regions where we have more contracts has pushed contract rates to their lowest levels since January 2021, and average contract-to-spot spreads to zero.

This still leaves shippers in a good position to downplay the market in the upcoming bidding season. As a result, we do not expect contract rates to rise in Q1 2024.

The year ahead for consumer spending

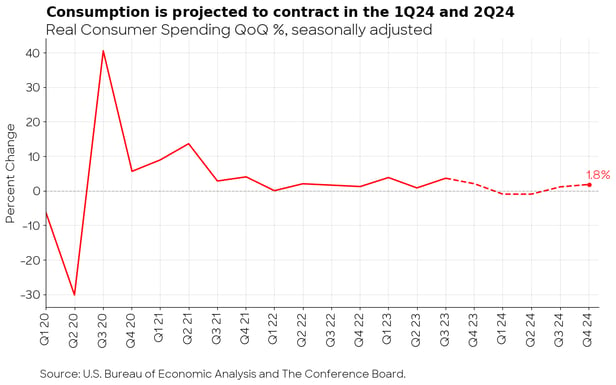

The Conference Board Economic Forecast report, released on November 15, predicts that consumer spending will shrink in Q1 2024 and Q2 2024.

As shown in Figure 7, consumption is expected to decline by 1% QoQ in the first two quarters and then grow by 1.1% and 1.8% QoQ in the following ones.

- If this happens, it will be the first time since Q2 2020 that we will see a decline in real consumer spending.

Figure 7

According to the report, U.S. consumer spending has held up remarkably well this year despite higher inflation and interest rates. However, they believe that this trend may not be sustainable as household excess savings dwindle and consumer debt rises.

The recovery in our forecast already takes into account the negative scenario for freight demand next year. Since we have started our rate forecast, we have stated that the recovery in rates would be gradual and modest, mainly because it would be synchronized with the adjustment in supply (i.e. more carriers exiting the market) rather than a surge in demand.

Share this

- Loadsmart Blog (159)

- Blog (121)

- Shipper (106)

- Market Trends (101)

- Enterprise Shipper (69)

- Carrier (66)

- News (62)

- Data Insights (51)

- Thought Leadership (45)

- Warehouse (41)

- SMB Shipper (38)

- Our Partners (34)

- ShipperGuide TMS (31)

- Opendock (30)

- Product Updates (29)

- Mode Optimization (25)

- Loadsmart (23)

- Mid-Market Shipper (18)

- Case Study (17)

- Brokerage Services (15)

- Managed Transportation (11)

- Video (9)

- Award (7)

- FreightIntel AI (5)

- Instant Execution (4)

- Asset (3)

- Food and Beverage (3)

- Freight Management (3)

- Logistics Solutions (3)

- YMS (3)

- eBook (3)

- 4PL (2)

- International (2)

- NavTrac (2)

- Podcast (2)

- UK (2)

- Yard Management System (2)

- Cold Storage (1)

- Faces of Loadsmart (1)

- Paper Packaging (1)

- Retail (1)

- Security (1)

- Transportation Management System (1)

- January 2026 (1)

- December 2025 (1)

- November 2025 (1)

- October 2025 (2)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (7)

- April 2025 (6)

- March 2025 (3)

- February 2025 (10)

- January 2025 (4)

- December 2024 (4)

- November 2024 (5)

- October 2024 (11)

- September 2024 (11)

- August 2024 (5)

- July 2024 (5)

- June 2024 (9)

- May 2024 (7)

- April 2024 (6)

- March 2024 (2)

- February 2024 (2)

- January 2024 (5)

- December 2023 (6)

- November 2023 (2)

- October 2023 (12)

- September 2023 (5)

- August 2023 (3)

- July 2023 (4)

- June 2023 (10)

- May 2023 (5)

- April 2023 (5)

- March 2023 (7)

- February 2023 (5)

- January 2023 (7)

- December 2022 (4)

- November 2022 (13)

- October 2022 (4)

- September 2022 (7)

- August 2022 (11)

- July 2022 (6)

- June 2022 (5)

- May 2022 (2)

- April 2022 (4)

- March 2022 (6)

- February 2022 (7)

- January 2022 (9)

- December 2021 (3)

- November 2021 (5)

- October 2021 (7)

- September 2021 (2)

- August 2021 (2)

- July 2021 (4)

- June 2021 (6)

- May 2021 (6)

- April 2021 (5)

- March 2021 (8)

- February 2021 (3)

- January 2021 (3)

- December 2020 (7)

- November 2020 (9)

- October 2020 (7)

- September 2020 (6)

- August 2020 (10)

- July 2020 (8)

- June 2020 (3)

- May 2020 (1)

- April 2020 (2)

- March 2020 (2)

- February 2020 (1)

- January 2020 (1)

- November 2019 (2)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- June 2019 (2)

- May 2019 (3)

- March 2019 (1)

- February 2019 (3)

- December 2018 (1)

- November 2018 (2)

- October 2018 (1)

- September 2018 (2)

- August 2018 (1)

- July 2018 (1)

- June 2018 (3)

- May 2018 (4)

- April 2018 (1)

- February 2018 (1)

- January 2018 (4)

- November 2017 (1)

- October 2017 (2)

- June 2017 (1)

- May 2017 (2)

- April 2017 (1)

- February 2017 (1)

- January 2017 (2)

- October 2016 (1)

- August 2016 (1)

- July 2016 (2)

- June 2016 (1)

- March 2016 (1)

- January 2016 (1)

- December 2015 (3)

- November 2015 (2)

- October 2015 (6)

- July 2015 (1)

- June 2015 (1)

- April 2015 (2)

- March 2015 (13)

- February 2015 (17)

- January 2015 (15)

- December 2014 (35)

- November 2014 (26)

- October 2014 (60)

- September 2014 (2)