Share this

Loadsmart’s Look Ahead: An Analysis of Key Freight & Economic Indicators to Watch in January

by jpallmerine

As usual, in this Monthly Market Update, we will provide a brief update & analysis of the full truckload market and present some compelling trucking-related economic analysis to provide a macroeconomic view on the state of the market. Please reach out to Stella Carneiro (stella.carneiro@loadsmart.com) with any questions, suggestions, thoughts, etc. Thank you! We hope you enjoy! #movemorewithless

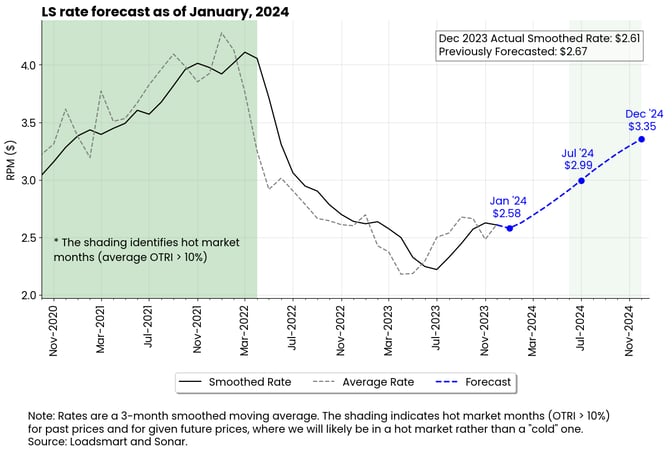

Loadsmart’s top 30 spot rate forecast

Figure 1

Our model predicts that spot rates will decline from $2.61 in December to $2.58 in January.- The 3-month smoothed rate used in the forecast declined in December due to the negative performance of the October and November average rates.

- This deceleration of rates in Q4 2023 impacted our prospects of recovery for next year.

- The model calls for another rate drop in January and a further slowdown in the recovery cycle.

Full Truckload Market Overview:

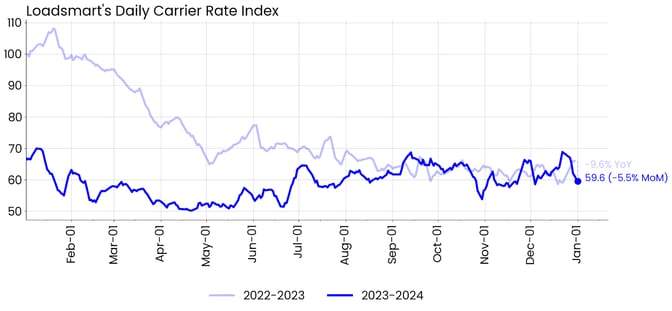

Figure 2

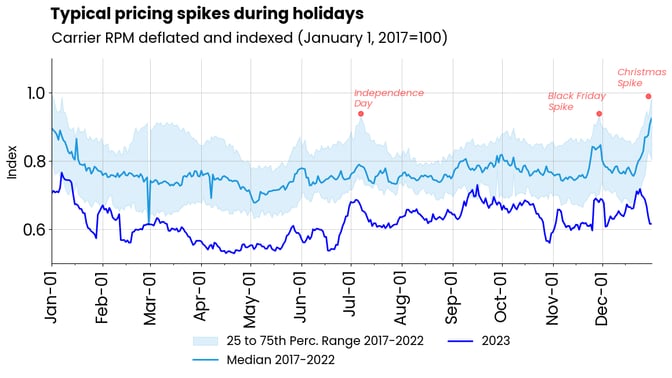

Rates: Our price index declined 5.5% MoM in December. Prices followed an upward trend in early to mid-December, but declined thereafter.- In 2023, the Christmas-related price peak was earlier than normally expected, as shown in Figure 3. The prices reached their highest level around the 18th, whereas in the previous years they continued to rise into the New Year's eve.

Figure 3

Figure 3

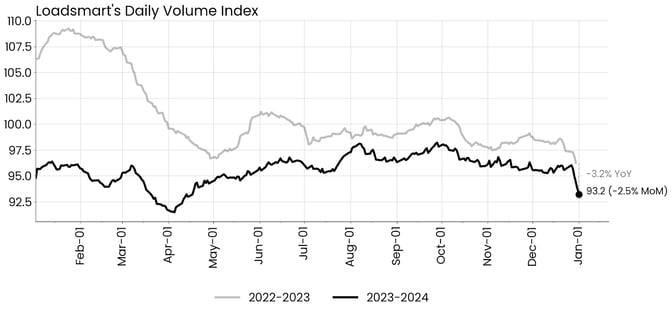

Figure 4

Volumes: Our volume index was down 2.5% MoM in December. We have observed a similar seasonal behavior in the volume curves of '2022 - 2023' and '2023 - 2024' in December, with a typical drop in freight volumes after the second week of the month.- Sonar's OTVI has followed a similar trend during December, dropping over 50% from the second to the fourth week of the month.

Freight & Economics Review

Red Sea attacks to pressure global supply chains

The Israel-Gaza war has started to impact supply chains, which could be reflected in domestic freight inflation in the coming months. This is because one of the regions at the center of the conflict is the Suez Canal, through which one-third of the world's containerized cargo passes.

Commercial vessels passing through the Suez Canal are being targeted by Houthi rebels in response to Israel's bombardment of Gaza - prompting shipping lines to halt all cargo traffic through the area.

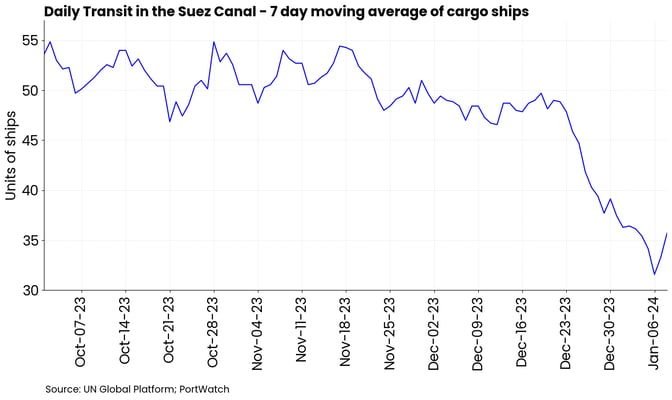

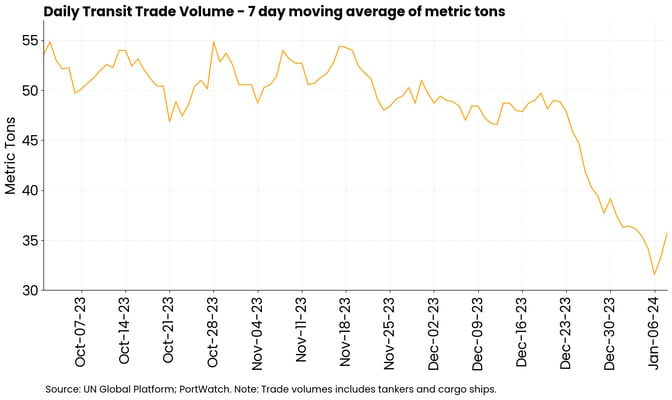

Shipping insurances do not cover wartime attacks. So to avoid losses, shipping companies are forced to change their routes and go through Asia to the West, around Africa and the Cape of Good Hope.- The 7-day moving average of cargo ships circulating on the Suez Canal has fallen 15% MoM and transit trade volume is down 17% MoM (as of 01-08-2024, see Figures 5 and 6).

Figure 5

Figure 6

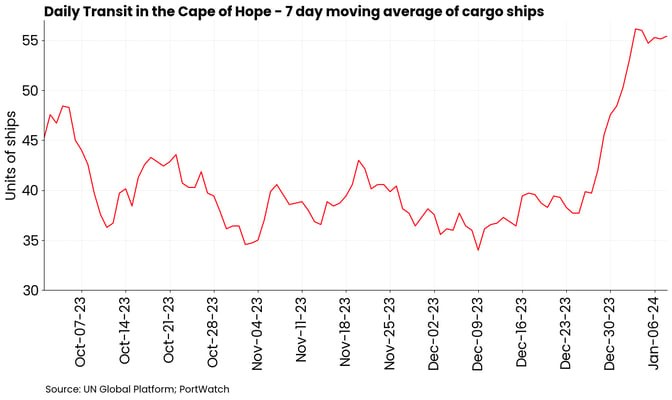

While 7-day moving average of cargo ships circulating on the Cape of hope has rose 48% MoM (as of 01-08-2024, see Figure 7).

Figure 7

The rerouting of vessels is leading to longer transit times and increased costs.

U.S. retailers seeking to avoid stocking delays are asking freight brokers to bypass the Panama (where routes are limited due to drought) and Suez Canal and ship goods across the Pacific Ocean to California, where they can be transported by rail or trucking to the East Coast.

- If the situation continues, we expect to see an increase in truck/intermodal demand out-bounding from the West Coast.

- The conflict's impact is small for now, given that it comes at a time when demand for imported goods is falling and inventories are high.

The state of capacity

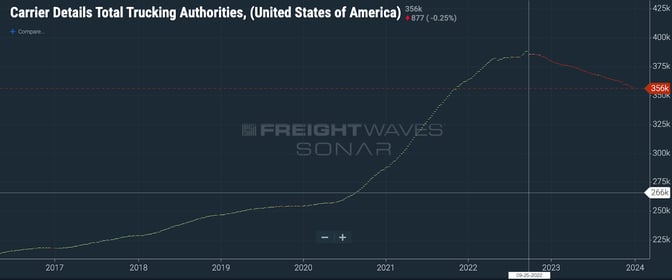

2023 ended with the capacity situation still on a slow correction. The decline in the number of carriers in the freight market has been practically linear from September 2022 until now - from 387k to 356k as seen in Figure 8.

Figure 8

We expect an acceleration of this correction in Q1 2024, as demand is seasonally lower at this time of the year and operating expenses increase with annual revisions of licenses, insurance and taxes.- The period between January and March is known for being the quiet shipping season, where freight volumes are usually lower than the rest of the year.

- The increase in operating costs, especially for small, financially constrained fleets, may accelerate their exit from the market, even with the expectation that payroll and fuel costs will be stable in this first quarter of the year.

Share this

- Loadsmart Blog (159)

- Blog (121)

- Shipper (106)

- Market Trends (101)

- Enterprise Shipper (69)

- Carrier (66)

- News (62)

- Data Insights (51)

- Thought Leadership (45)

- Warehouse (41)

- SMB Shipper (38)

- Our Partners (34)

- ShipperGuide TMS (31)

- Opendock (30)

- Product Updates (29)

- Mode Optimization (25)

- Loadsmart (23)

- Mid-Market Shipper (18)

- Case Study (17)

- Brokerage Services (15)

- Managed Transportation (11)

- Video (9)

- Award (7)

- FreightIntel AI (5)

- Instant Execution (4)

- Asset (3)

- Food and Beverage (3)

- Freight Management (3)

- Logistics Solutions (3)

- YMS (3)

- eBook (3)

- 4PL (2)

- International (2)

- NavTrac (2)

- Podcast (2)

- UK (2)

- Yard Management System (2)

- Cold Storage (1)

- Faces of Loadsmart (1)

- Paper Packaging (1)

- Retail (1)

- Security (1)

- Transportation Management System (1)

- January 2026 (1)

- December 2025 (1)

- November 2025 (1)

- October 2025 (2)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (7)

- April 2025 (6)

- March 2025 (3)

- February 2025 (10)

- January 2025 (4)

- December 2024 (4)

- November 2024 (5)

- October 2024 (11)

- September 2024 (11)

- August 2024 (5)

- July 2024 (5)

- June 2024 (9)

- May 2024 (7)

- April 2024 (6)

- March 2024 (2)

- February 2024 (2)

- January 2024 (5)

- December 2023 (6)

- November 2023 (2)

- October 2023 (12)

- September 2023 (5)

- August 2023 (3)

- July 2023 (4)

- June 2023 (10)

- May 2023 (5)

- April 2023 (5)

- March 2023 (7)

- February 2023 (5)

- January 2023 (7)

- December 2022 (4)

- November 2022 (13)

- October 2022 (4)

- September 2022 (7)

- August 2022 (11)

- July 2022 (6)

- June 2022 (5)

- May 2022 (2)

- April 2022 (4)

- March 2022 (6)

- February 2022 (7)

- January 2022 (9)

- December 2021 (3)

- November 2021 (5)

- October 2021 (7)

- September 2021 (2)

- August 2021 (2)

- July 2021 (4)

- June 2021 (6)

- May 2021 (6)

- April 2021 (5)

- March 2021 (8)

- February 2021 (3)

- January 2021 (3)

- December 2020 (7)

- November 2020 (9)

- October 2020 (7)

- September 2020 (6)

- August 2020 (10)

- July 2020 (8)

- June 2020 (3)

- May 2020 (1)

- April 2020 (2)

- March 2020 (2)

- February 2020 (1)

- January 2020 (1)

- November 2019 (2)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- June 2019 (2)

- May 2019 (3)

- March 2019 (1)

- February 2019 (3)

- December 2018 (1)

- November 2018 (2)

- October 2018 (1)

- September 2018 (2)

- August 2018 (1)

- July 2018 (1)

- June 2018 (3)

- May 2018 (4)

- April 2018 (1)

- February 2018 (1)

- January 2018 (4)

- November 2017 (1)

- October 2017 (2)

- June 2017 (1)

- May 2017 (2)

- April 2017 (1)

- February 2017 (1)

- January 2017 (2)

- October 2016 (1)

- August 2016 (1)

- July 2016 (2)

- June 2016 (1)

- March 2016 (1)

- January 2016 (1)

- December 2015 (3)

- November 2015 (2)

- October 2015 (6)

- July 2015 (1)

- June 2015 (1)

- April 2015 (2)

- March 2015 (13)

- February 2015 (17)

- January 2015 (15)

- December 2014 (35)

- November 2014 (26)

- October 2014 (60)

- September 2014 (2)