Share this

Loadsmart’s Look Ahead: An Analysis of Key Freight & Economic Indicators to Watch in June

by jpallmerine

As usual, in this Monthly Market Update, we will provide a brief update & analysis of the full truckload market and present some compelling trucking-related economic analysis to provide a macroeconomic view on the state of the market.

June Spot Rate Forecast

Our latest spot rate forecast, predicts a June bottom for truckload spot rates and a minor recovery through Q3-Q4 as we head into peak retail season. As stated previously, our forecast indicates that we shouldn’t expect a hot market (i.e. primary tender rejections >=10% and spot rates up 15-20% YoY) until Q2 2024. Here’s why:

- The FOMC has given indications that reducing interest rates, and therefore stimulating the consumer/economy, is unlikely to happen any time soon

- Excess capacity in the market continues to absorb any potential market catalysts. Lower fuel and large profits from the bull market have enabled carriers to stick around much longer than expected

- Our enterprise truckload shippers have reduced volumes on their 2023 bids on a YoY basis. There of course can be many different factors at play here, but it certainly points toward reduced freight demand in the second half of the year

Unsurprisingly since contract rates tend to follow spot rates with a 1-2 quarter lag. We expect contract rates to come down another 10-15% over the next 4-5 months

May's Full Truckload Market Overview:

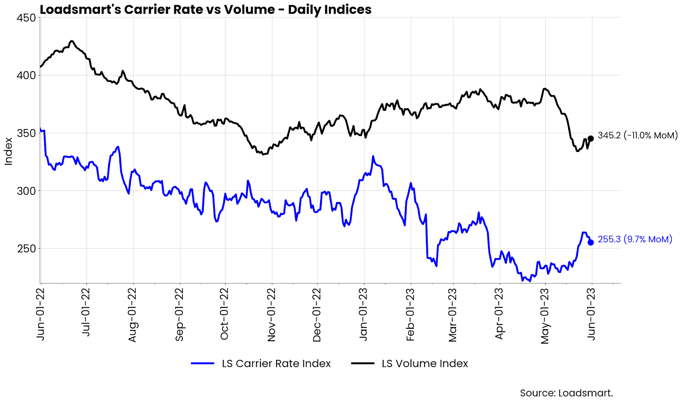

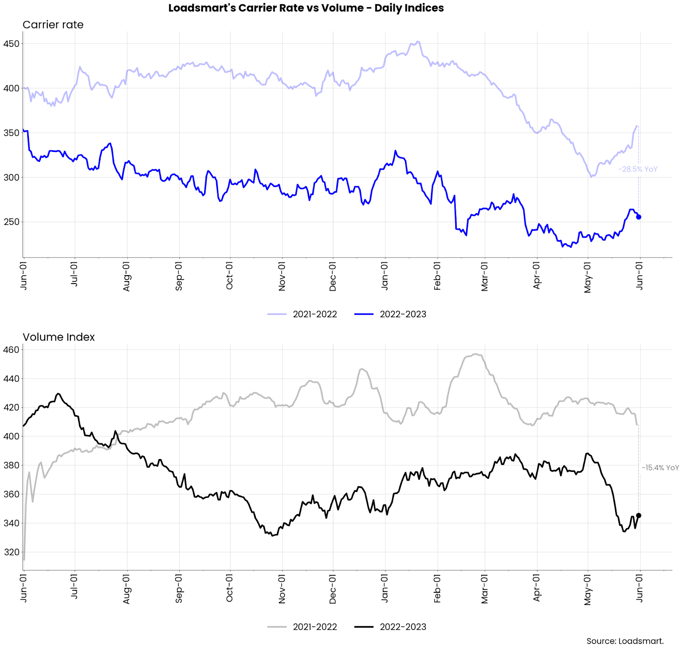

Volumes: Our volumes Index decreased by 11% MoM in May. There was a reversal in the volume growth trend that started in November 2022. From early Nov to the end of May, our index rose 15%, but by mid-May, it plummeted, returning back to November levels.

- The decline in procurement volumes was likely a result of rate increases stemming from minor DOT week & Memorial Day disruptions. Quoted volumes on our platform continued on an upward trend throughout May.

Rates: Our price index increased by 9.7% MoM in May. After the April lows, our prices began a mild upward trend in mid-May, again stemming from DOT week & Memorial Day impacts. However, as rates rose, volumes fell, indicating that there is still excess capacity in the market and that shippers are unwilling to pay higher rates for now.

- The only region unaffected by price sensitivity was the Southeast. Even with higher prices, our volumes in the area continued to grow. This is likely stemming from produce season demand.

Freight & Economics

June should see further growth in the food industry's demand for freight

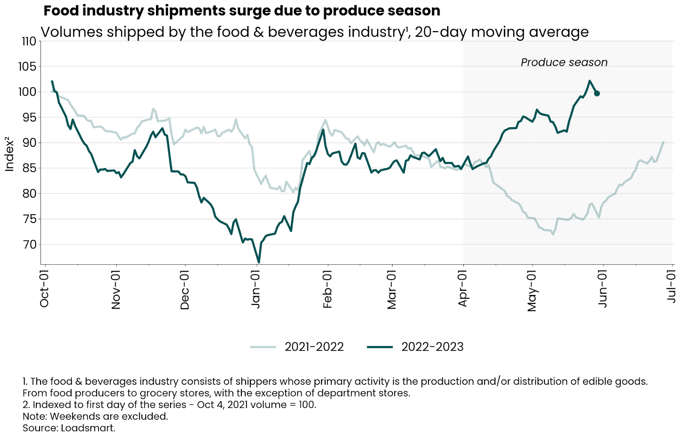

Loadsmart's quoted volumes associated with the food and beverage industry spiked in April and May - as shown below - and the uptrend will likely continue. As we predicted in our Quarterly Report, the volume hike in April was expected to continue throughout the 2Q due to: (i) the production season; and (ii) the fact that the warmer weather leads to an increase in social gatherings, resulting in higher demand for food and beverages.

- The index shown above refers to the demand for all types of equipment. However, when broken down by equipment, the increase in demand for refrigerated trucks was much more pronounced. Reefer quotes from the food & bev industry increased by 40% in May, while dry van quotes increased by around 20%.

- The outlook is positive for June because, so far, the uptrend has been led by the southern regions, but with temperatures rising in more regions across the US, total quoted volumes by this industry should increase further.

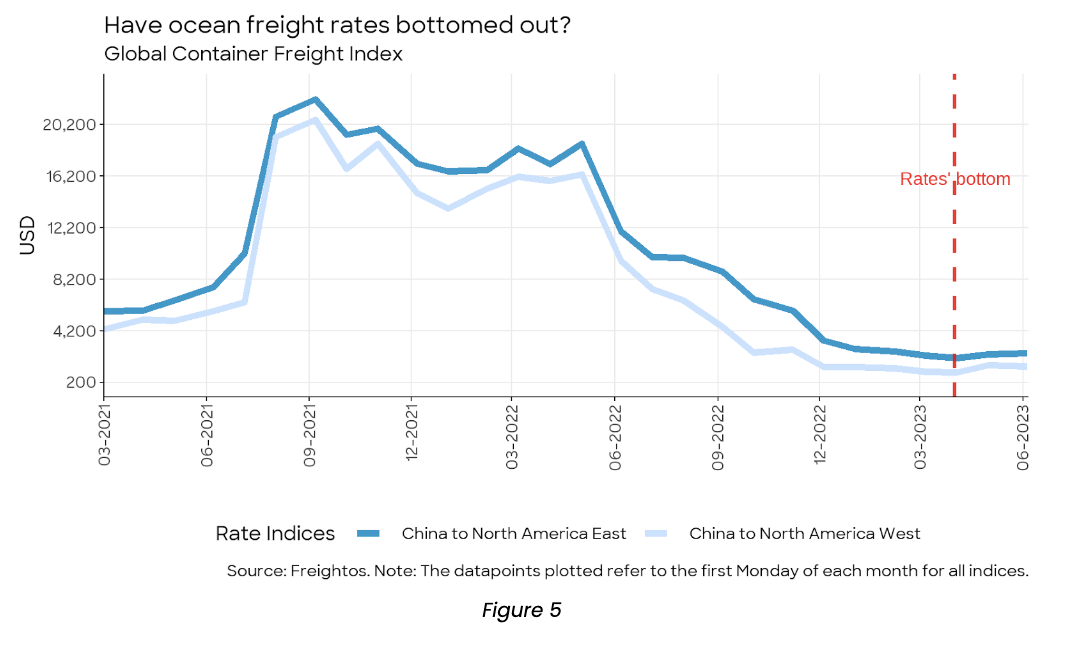

Ocean freight may be heading into a modest peak season this year

Before the Covid-19 supply chain disruption hit the freight industry, ocean shipping typically had a peak season from July through September. As ocean freight rates have bottomed out and stabilized over the past two months, we expect to have this traditional peak back - albeit it will probably be a modest one.- As shown below, US’s most relevant routes reached a floor in April 2023. In that month, rates for containers coming from China to the West Coast and China to the East Coast were around $990 and $2,085, respectively. After that, they both had slight rises and are currently at $1,440 and $2,451.

Now that prices have normalized to levels below the pre-covid period, carriers are ready to test new rate increases as soon as there is a seasonal rise in demand to justify it.

-------------------------------------------------------------------------------------------

For more about how you can understand the current market to plan for the future, download our quarterly report.

Please reach out to Stella Carneiro (stella.carneiro@loadsmart.com) with any questions, suggestions, thoughts, etc. Thank you! We hope you enjoy! #movemorewithless

Share this

- Loadsmart Blog (159)

- Blog (121)

- Shipper (106)

- Market Trends (101)

- Enterprise Shipper (69)

- Carrier (66)

- News (62)

- Data Insights (51)

- Thought Leadership (45)

- Warehouse (41)

- SMB Shipper (38)

- Our Partners (34)

- ShipperGuide TMS (31)

- Opendock (30)

- Product Updates (29)

- Mode Optimization (25)

- Loadsmart (23)

- Mid-Market Shipper (18)

- Case Study (17)

- Brokerage Services (15)

- Managed Transportation (11)

- Video (9)

- Award (7)

- FreightIntel AI (5)

- Instant Execution (4)

- Asset (3)

- Food and Beverage (3)

- Freight Management (3)

- Logistics Solutions (3)

- YMS (3)

- eBook (3)

- 4PL (2)

- International (2)

- NavTrac (2)

- Podcast (2)

- UK (2)

- Yard Management System (2)

- Cold Storage (1)

- Faces of Loadsmart (1)

- Paper Packaging (1)

- Retail (1)

- Security (1)

- Transportation Management System (1)

- January 2026 (1)

- December 2025 (1)

- November 2025 (1)

- October 2025 (2)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (7)

- April 2025 (6)

- March 2025 (3)

- February 2025 (10)

- January 2025 (4)

- December 2024 (4)

- November 2024 (5)

- October 2024 (11)

- September 2024 (11)

- August 2024 (5)

- July 2024 (5)

- June 2024 (9)

- May 2024 (7)

- April 2024 (6)

- March 2024 (2)

- February 2024 (2)

- January 2024 (5)

- December 2023 (6)

- November 2023 (2)

- October 2023 (12)

- September 2023 (5)

- August 2023 (3)

- July 2023 (4)

- June 2023 (10)

- May 2023 (5)

- April 2023 (5)

- March 2023 (7)

- February 2023 (5)

- January 2023 (7)

- December 2022 (4)

- November 2022 (13)

- October 2022 (4)

- September 2022 (7)

- August 2022 (11)

- July 2022 (6)

- June 2022 (5)

- May 2022 (2)

- April 2022 (4)

- March 2022 (6)

- February 2022 (7)

- January 2022 (9)

- December 2021 (3)

- November 2021 (5)

- October 2021 (7)

- September 2021 (2)

- August 2021 (2)

- July 2021 (4)

- June 2021 (6)

- May 2021 (6)

- April 2021 (5)

- March 2021 (8)

- February 2021 (3)

- January 2021 (3)

- December 2020 (7)

- November 2020 (9)

- October 2020 (7)

- September 2020 (6)

- August 2020 (10)

- July 2020 (8)

- June 2020 (3)

- May 2020 (1)

- April 2020 (2)

- March 2020 (2)

- February 2020 (1)

- January 2020 (1)

- November 2019 (2)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- June 2019 (2)

- May 2019 (3)

- March 2019 (1)

- February 2019 (3)

- December 2018 (1)

- November 2018 (2)

- October 2018 (1)

- September 2018 (2)

- August 2018 (1)

- July 2018 (1)

- June 2018 (3)

- May 2018 (4)

- April 2018 (1)

- February 2018 (1)

- January 2018 (4)

- November 2017 (1)

- October 2017 (2)

- June 2017 (1)

- May 2017 (2)

- April 2017 (1)

- February 2017 (1)

- January 2017 (2)

- October 2016 (1)

- August 2016 (1)

- July 2016 (2)

- June 2016 (1)

- March 2016 (1)

- January 2016 (1)

- December 2015 (3)

- November 2015 (2)

- October 2015 (6)

- July 2015 (1)

- June 2015 (1)

- April 2015 (2)

- March 2015 (13)

- February 2015 (17)

- January 2015 (15)

- December 2014 (35)

- November 2014 (26)

- October 2014 (60)

- September 2014 (2)