Share this

Loadsmart’s Look Ahead: An Analysis of Key Freight & Economic Indicators to Watch in June

As usual, in this Monthly Market Update, we will (a) provide a brief update/analysis of the full truckload market and (b) present a compelling economic analysis to provide a macroeconomic view on the state of the freight market.

We hope you find this report insightful! #movemorewithless

Loadsmart’s top 30 spot rate forecast

Figure 1

Rates: Our price index was up 8.9% MoM in May, with a big swing in the middle of the month driven by the pent-up demand of the May 14-16 DOT week.

- During the first two weeks of the month, prices began a downward trend, reaching YTD lows in key regions. Average prices reached $2.05 per mile in South Carolina, $2.11 in Texas, and $2.20 in Georgia - which drove our index down to 110. The YTD average for these states before May was $2.5.

- A brief rally then began after the 16th, driven by pent-up demand during DOT week. Prices remained high for a few days (~5% above the April average, with the index at 130 versus the April average of 123), but began to return to April levels in the last week.

- Sonar's OTRI jumped from 3.1% on May 1 to 4.3% on May 31. The increase began on May 1 and continued throughout the month, driven by an increase in OTRI in the southern states.

- States such as Florida, Georgia, Texas, and Louisiana all experienced an increase in OTRI of more than 2 pp due to the production season.

- OTRI started the year with an average of 5.3% in January and continued to fall sharply, reaching 3% in April, the lowest level in the last 11 months. It was only in May that we began to see signs of a seasonal recovery.

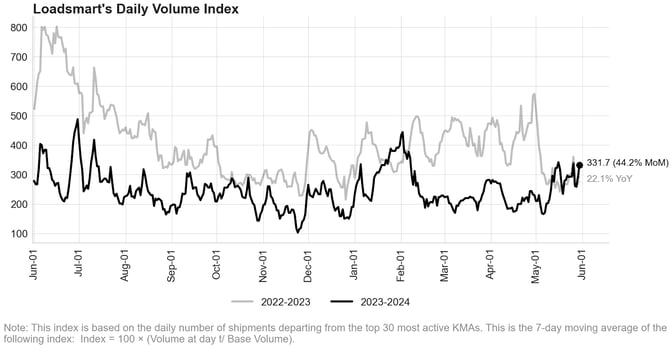

Figure 2

Volumes: Our volume index increased 44.2% MoM in May. The month began with volumes down due to the low freight demand in the Midwest (Illinois, Ohio, and Indiana). But a rebound began after DOT week.

- Much of the demand came from the food, beverages & tobacco, and medical equipment sectors. Freight demand for consumer goods has weakened over the past two months.

- Sonar's OTVI was down 9% MoM. The index rebounded after the second week of the month, similar to our index, peaking around the 26th, but then had a sharp decline on Memorial Day.

Quote rate performance by region

The map shows the average MoM percentage change in quote rate-per-mile for various US Key Market Areas (KMAs).

- Rates are trending lower in about 70% of the KMAs.

- In the Midwest region, low demand has been leading to lower rates since March 2024, and only after the third week of May did we start to see a modest recovery.

- Texas, Louisiana, and Mississippi continue to trend up, given the produce season, but prices cooled down in other Southern regions, such as Florida, Georgia, and Alabama.

- Rates improved in Mountain West regions.

Figure 2

- Rates are expected to improve modestly in the coming months, driven by seasonality. They should end the year with an increase of only ~5-10% from current levels.

- We do not foresee structural changes in the truckload market that would lead to more robust rate increases in the near term. The market is oversupplied with carriers and will remain until about July '25.

- Prices are expected to reach $2.56 in July and $2.63 in December 2024 and continue to rise until March '25, when they peak at $2.66, 31% below the Jan '22 high.

Figure 4

Freight & Economics

Decelerating Retail Sales: A Major Headwind for Trucking Recovery

- Retail sales, excluding auto, were virtually unchanged from March to April (0.2% growth) - as shown in Figure 5. The most significant gains were from electronics (+1.45%) and apparel (+1.62%), while non-store retail had the largest decline (-1.20%).

Figure 5

- Although sales growth is still positive, the slowdown is noticeable: In 2021, retail sales grew by an average of 1.1% per month. This growth rate declined to 0.4% per month in 2022 and 0.2% per month in 2023.

- Retail sales growth is expected to weaken further in the coming quarters due to persistently high inflation and slower wage growth.

- Given the slowdown in the retail sector and the diminishing prospects for a recovery in manufacturing activity, trucking demand is likely to remain soft for the remainder of the year.

Trucking Employment: Seasonal Gains But Persistent Year-Over-Year Declines

- Trucking employment increased in April, adding 7,400 jobs to the sector. This increase is consistent with seasonal trends in the industry, where employment typically declines in January and February before rebounding in March and April due to summer hirings.

- Nonetheless, the job gains in April and March were insufficient to produce a year-over-year increase in employment, which is currently down 1.35%, as shown in Figure 6.

Figure 6

- Employment in the sector began a downward trend in June last year and accelerated in August due to the large layoff and subsequent bankruptcy of Yellow.

- Employment was down by 2.8% YoY In August 2023 and continued to fall by 2% YoY on average per month throughout the 2H2023 - exacerbated by the slowdown in the trucking market.

- Employment will likely remain in the YoY contraction zone through at least August 2024 and possibly beyond if rates do not improve. This year's continued contraction in the truckload market is expected to lead to further layoffs.

Questions? Please reach out to Stella Carneiro (stella.carneiro@loadsmart.com).

Share this

- Loadsmart Blog (159)

- Blog (121)

- Shipper (106)

- Market Trends (101)

- Enterprise Shipper (69)

- Carrier (66)

- News (62)

- Data Insights (51)

- Thought Leadership (45)

- Warehouse (41)

- SMB Shipper (38)

- Our Partners (34)

- ShipperGuide TMS (31)

- Opendock (30)

- Product Updates (29)

- Mode Optimization (25)

- Loadsmart (23)

- Mid-Market Shipper (18)

- Case Study (17)

- Brokerage Services (15)

- Managed Transportation (11)

- Video (9)

- Award (7)

- FreightIntel AI (5)

- Instant Execution (4)

- Asset (3)

- Food and Beverage (3)

- Freight Management (3)

- Logistics Solutions (3)

- YMS (3)

- eBook (3)

- 4PL (2)

- International (2)

- NavTrac (2)

- Podcast (2)

- UK (2)

- Yard Management System (2)

- Cold Storage (1)

- Faces of Loadsmart (1)

- Paper Packaging (1)

- Retail (1)

- Security (1)

- Transportation Management System (1)

- January 2026 (1)

- December 2025 (1)

- November 2025 (1)

- October 2025 (2)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (7)

- April 2025 (6)

- March 2025 (3)

- February 2025 (10)

- January 2025 (4)

- December 2024 (4)

- November 2024 (5)

- October 2024 (11)

- September 2024 (11)

- August 2024 (5)

- July 2024 (5)

- June 2024 (9)

- May 2024 (7)

- April 2024 (6)

- March 2024 (2)

- February 2024 (2)

- January 2024 (5)

- December 2023 (6)

- November 2023 (2)

- October 2023 (12)

- September 2023 (5)

- August 2023 (3)

- July 2023 (4)

- June 2023 (10)

- May 2023 (5)

- April 2023 (5)

- March 2023 (7)

- February 2023 (5)

- January 2023 (7)

- December 2022 (4)

- November 2022 (13)

- October 2022 (4)

- September 2022 (7)

- August 2022 (11)

- July 2022 (6)

- June 2022 (5)

- May 2022 (2)

- April 2022 (4)

- March 2022 (6)

- February 2022 (7)

- January 2022 (9)

- December 2021 (3)

- November 2021 (5)

- October 2021 (7)

- September 2021 (2)

- August 2021 (2)

- July 2021 (4)

- June 2021 (6)

- May 2021 (6)

- April 2021 (5)

- March 2021 (8)

- February 2021 (3)

- January 2021 (3)

- December 2020 (7)

- November 2020 (9)

- October 2020 (7)

- September 2020 (6)

- August 2020 (10)

- July 2020 (8)

- June 2020 (3)

- May 2020 (1)

- April 2020 (2)

- March 2020 (2)

- February 2020 (1)

- January 2020 (1)

- November 2019 (2)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- June 2019 (2)

- May 2019 (3)

- March 2019 (1)

- February 2019 (3)

- December 2018 (1)

- November 2018 (2)

- October 2018 (1)

- September 2018 (2)

- August 2018 (1)

- July 2018 (1)

- June 2018 (3)

- May 2018 (4)

- April 2018 (1)

- February 2018 (1)

- January 2018 (4)

- November 2017 (1)

- October 2017 (2)

- June 2017 (1)

- May 2017 (2)

- April 2017 (1)

- February 2017 (1)

- January 2017 (2)

- October 2016 (1)

- August 2016 (1)

- July 2016 (2)

- June 2016 (1)

- March 2016 (1)

- January 2016 (1)

- December 2015 (3)

- November 2015 (2)

- October 2015 (6)

- July 2015 (1)

- June 2015 (1)

- April 2015 (2)

- March 2015 (13)

- February 2015 (17)

- January 2015 (15)

- December 2014 (35)

- November 2014 (26)

- October 2014 (60)

- September 2014 (2)