Share this

Loadsmart’s Look Ahead: An Analysis of Key Freight & Economic Indicators to Watch in March

As usual, in this Monthly Market Update, we will (a) provide a brief update/analysis of the full truckload market and (b) present compelling economic analysis to provide a macroeconomic view on the state of the freight market.

We hope you enjoy! #movemorewithless

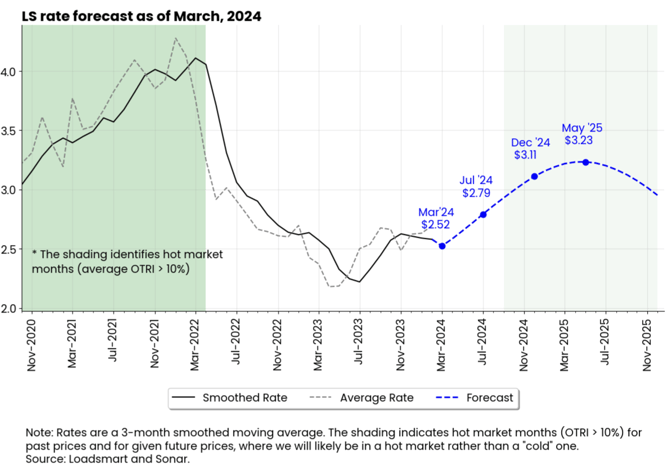

Loadsmart’s top 30 spot rate forecast

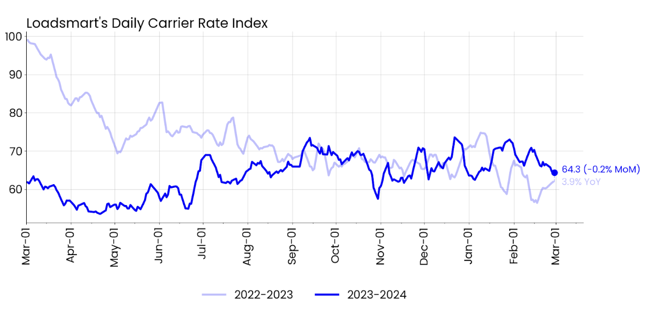

Figure 1

Rates: Our price index fell 0.2% MoM in February. Our price index began the month fluctuating, still maintaining the gains it had made in January; but halfway through the month, the index plummeted.- The decline was not universal, with prices falling 8% and 10% in the Southwest and Midwest, respectively, and rising slightly in the West, Midwest; and Southeast - about 2% in each region.

- Sonar's OTRI also plummeted in February. The rejection rate started the month at 5.3% and ended the month at 3.7%.

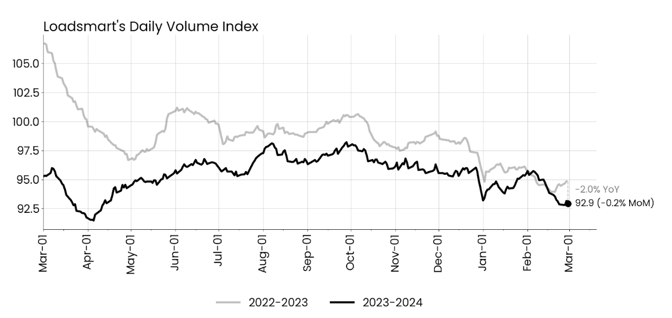

Figure 2

Volumes: Our volume index dropped 0.2% MoM in February. At the beginning of the month, our volumes returned to December levels and for the first time this year, we posted year-on-year gains. However, volumes declined throughout the month.

Sonar's OTRI was up 2.5% for the same month. Volumes declined in the first two weeks of February but later recovered towards the end of the month.

- Spot rates had recovered from the July low in 2H2023, reaching $2.62 in November, but have been flat since early 2024;

- The uptrend in prices should resume in April. Prices are expected to relach $2.79 in July and $3.11 in December 2024, and continue to rise until May 2025, when prices peak at $3.23, 27% below the March 2022 high.

Figure 3

Freight & Economics

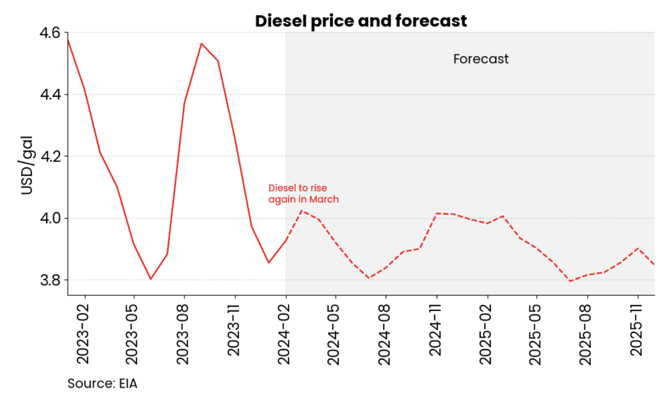

Rising diesel prices contributed to carriers' financial distress in Feb

- The average price of diesel rose from $3.85 to $3.92 in February and is expected to rise further to $4.02 in March, according to the EIA, as shown in Figure 4.

Figure 4

- The decline in U.S. oil production led to the price increase. Refinery utilization fell from 93.50% (Dec-29) to 81.50% (Feb-23) due to reduced plant operations in both the Midwest and Gulf Coast. Activity was reduced in both regions given the cold weather and routine maintenance.

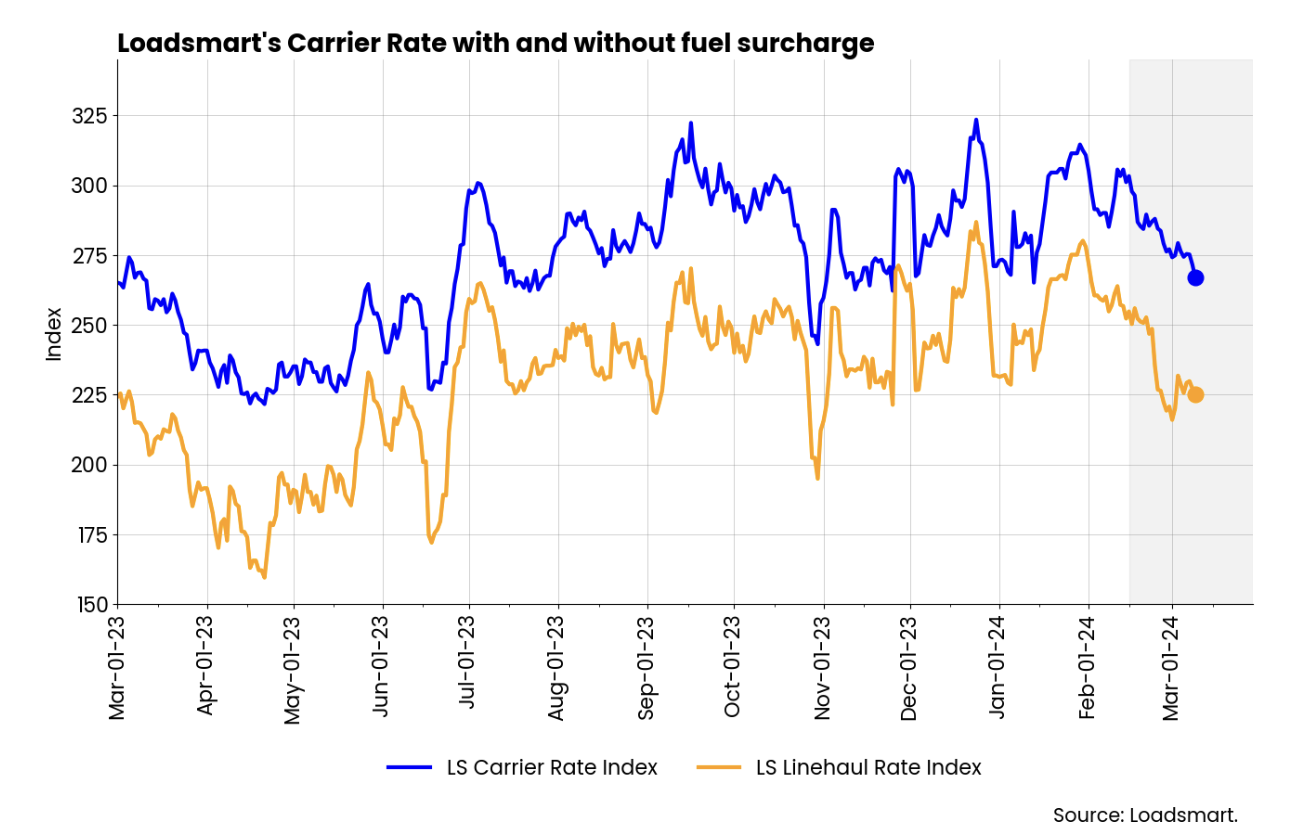

- The sudden spike in diesel prices will weigh on carriers' financial performance in 1Q2024. All-in spot rates are declining despite the rise in fuel surcharges, which suggests that linehaul-only rates are dropping even further. According to Loadmart's price index, linehaul-only rates dropped back to October '23 levels at the end of February, as shown in Figure 4.

Figure 5

Figure 5

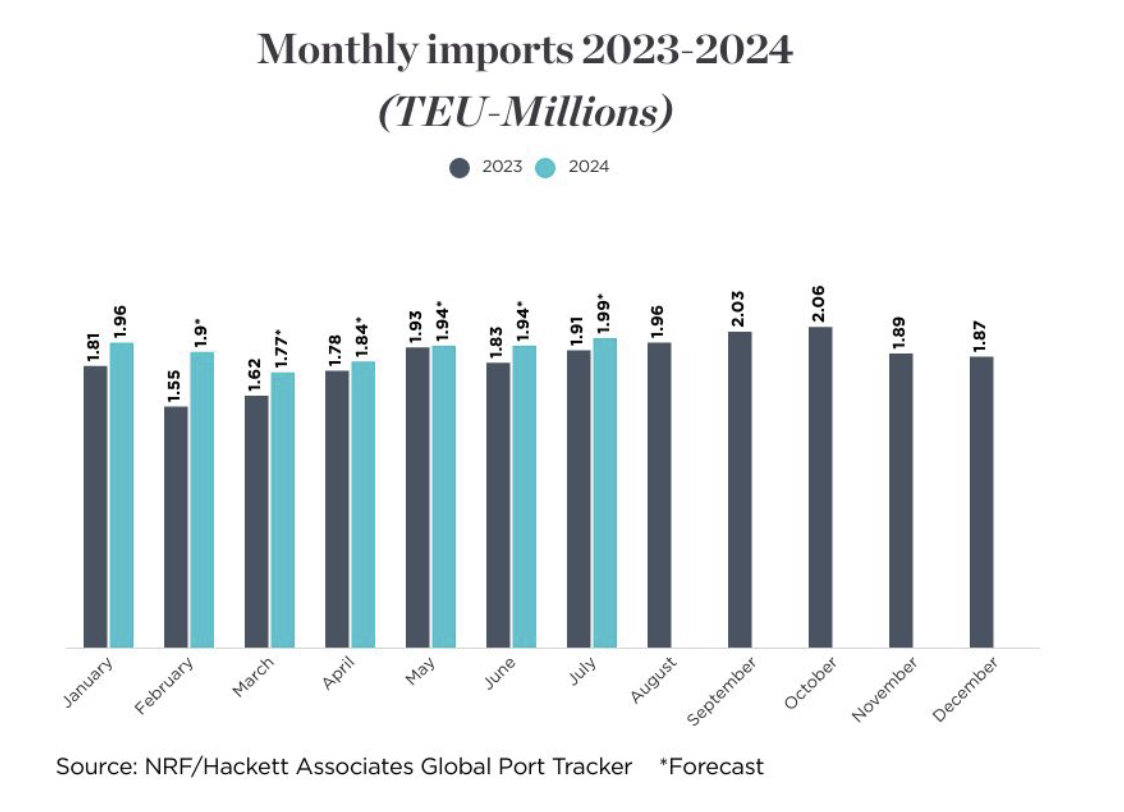

Cargo volumes are expected to rise throughout the 1H2024

- January cargo volumes were up 8.6% YoY and they should continue to show gains relative to their YoY comps, according to Global Port Tracker. Volumes are expected to rise 7.8% total in the 1H2024 - Figure 6.

Figure 6

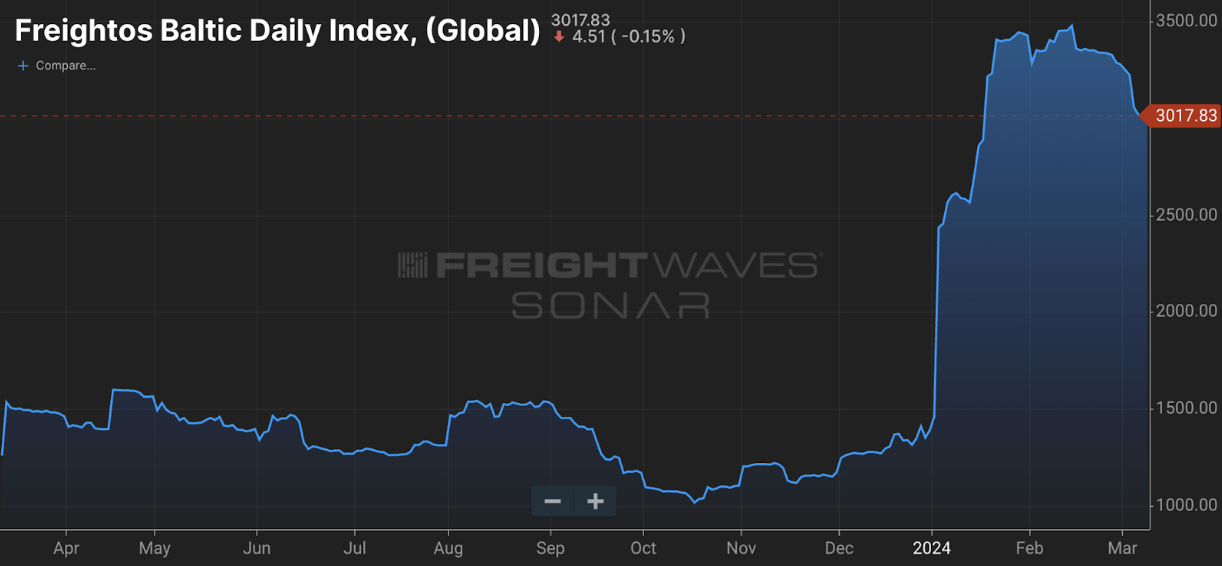

- The increase in import volumes compared to 2022 comes despite worsening global supply chain pressures and higher shipping costs compared to last year. Freighto's Baltic Index more than doubled at the beginning of the year due to reroutings made to avoid the Red Sea corridor after the Houthi attacks began.

- As capacity adjusted to the new routes, ocean freight rates began to decline again in February. But if Global Port Tracker's predictions are correct, an increase in the volume of imports into the U.S. could eventually cause rates to stabilize at higher levels than last year.

Figure 7

Please reach out to Stella Carneiro (stella.carneiro@loadsmart.com) with any questions, suggestions, thoughts, etc. Thank you!

Share this

- Loadsmart Blog (159)

- Blog (121)

- Shipper (106)

- Market Trends (101)

- Enterprise Shipper (69)

- Carrier (66)

- News (62)

- Data Insights (51)

- Thought Leadership (45)

- Warehouse (41)

- SMB Shipper (38)

- Our Partners (34)

- ShipperGuide TMS (31)

- Opendock (30)

- Product Updates (29)

- Mode Optimization (25)

- Loadsmart (23)

- Mid-Market Shipper (18)

- Case Study (17)

- Brokerage Services (15)

- Managed Transportation (11)

- Video (9)

- Award (7)

- FreightIntel AI (5)

- Instant Execution (4)

- Asset (3)

- Food and Beverage (3)

- Freight Management (3)

- Logistics Solutions (3)

- YMS (3)

- eBook (3)

- 4PL (2)

- International (2)

- NavTrac (2)

- Podcast (2)

- UK (2)

- Yard Management System (2)

- Cold Storage (1)

- Faces of Loadsmart (1)

- Paper Packaging (1)

- Retail (1)

- Security (1)

- Transportation Management System (1)

- January 2026 (1)

- December 2025 (1)

- November 2025 (1)

- October 2025 (2)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (7)

- April 2025 (6)

- March 2025 (3)

- February 2025 (10)

- January 2025 (4)

- December 2024 (4)

- November 2024 (5)

- October 2024 (11)

- September 2024 (11)

- August 2024 (5)

- July 2024 (5)

- June 2024 (9)

- May 2024 (7)

- April 2024 (6)

- March 2024 (2)

- February 2024 (2)

- January 2024 (5)

- December 2023 (6)

- November 2023 (2)

- October 2023 (12)

- September 2023 (5)

- August 2023 (3)

- July 2023 (4)

- June 2023 (10)

- May 2023 (5)

- April 2023 (5)

- March 2023 (7)

- February 2023 (5)

- January 2023 (7)

- December 2022 (4)

- November 2022 (13)

- October 2022 (4)

- September 2022 (7)

- August 2022 (11)

- July 2022 (6)

- June 2022 (5)

- May 2022 (2)

- April 2022 (4)

- March 2022 (6)

- February 2022 (7)

- January 2022 (9)

- December 2021 (3)

- November 2021 (5)

- October 2021 (7)

- September 2021 (2)

- August 2021 (2)

- July 2021 (4)

- June 2021 (6)

- May 2021 (6)

- April 2021 (5)

- March 2021 (8)

- February 2021 (3)

- January 2021 (3)

- December 2020 (7)

- November 2020 (9)

- October 2020 (7)

- September 2020 (6)

- August 2020 (10)

- July 2020 (8)

- June 2020 (3)

- May 2020 (1)

- April 2020 (2)

- March 2020 (2)

- February 2020 (1)

- January 2020 (1)

- November 2019 (2)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- June 2019 (2)

- May 2019 (3)

- March 2019 (1)

- February 2019 (3)

- December 2018 (1)

- November 2018 (2)

- October 2018 (1)

- September 2018 (2)

- August 2018 (1)

- July 2018 (1)

- June 2018 (3)

- May 2018 (4)

- April 2018 (1)

- February 2018 (1)

- January 2018 (4)

- November 2017 (1)

- October 2017 (2)

- June 2017 (1)

- May 2017 (2)

- April 2017 (1)

- February 2017 (1)

- January 2017 (2)

- October 2016 (1)

- August 2016 (1)

- July 2016 (2)

- June 2016 (1)

- March 2016 (1)

- January 2016 (1)

- December 2015 (3)

- November 2015 (2)

- October 2015 (6)

- July 2015 (1)

- June 2015 (1)

- April 2015 (2)

- March 2015 (13)

- February 2015 (17)

- January 2015 (15)

- December 2014 (35)

- November 2014 (26)

- October 2014 (60)

- September 2014 (2)