Share this

Loadsmart’s Look Ahead: An Analysis of Key Freight & Economic Indicators to Watch in September 2024

In this Monthly Market Update, we will (a) provide a brief update/analysis of the full truckload market and (b) present a compelling economic analysis to provide a macroeconomic view of the state of the freight market.

Full Truckload Market Overview

Loadsmart’s top 30 spot rate forecast

Figure 1

Rates: Our price index rose 19.17% MoM in August. Atypically, this year's Labor Day holiday led rates to spike as some areas of the country experienced capacity tightness. As shown in Figure 2, Labor Day is not historically known for causing price spikes.

- According to Sonar, Labor Day had little impact on tender rejections, the OTRI only increased from 4.3% to 4.8% during the holiday week.

- The average OTRI decreased 0.8 percentage points from 5.3% in July to 4.5% in August.

Figure 2

Figure 3

Volumes: Our volume index rose 20.1% MoM in August. Our volumes spiked in the last week of August due to pre-holiday demand.

- Despite daily oscillations, on average, our shipped volumes have been trending upward in Q3 due to an increase in demand for consumer goods.

- Meanwhile, Sonar's OTVI remained flat MoM and showed a modest increase of approximately 2% YoY, suggesting a more stagnant trend moving into Q4.

Quote rate performance by region

The map shows the average MoM percentage change in quote rate-per-mile for various US Key Market Areas (KMAs).

- Prices in the South cooled in August, dropping approximately 6% MoM, with most KMAs experiencing slight rate declines.

- In the West, rates are trending downward as they declined in most California KMAs, where quotes are generally concentrated, but Washington and Oregon saw moderate rate increases.

- The Midwest also shows mixed trends, but parts of Minnesota and Missouri experienced rate decreases and average quote rate points to price stagnation.

- The Northeast is the only region with an upward trend, likely driven by the KMAs in states such as New York and Pennsylvania showing positive rate changes.

Figure 4

Figure 5

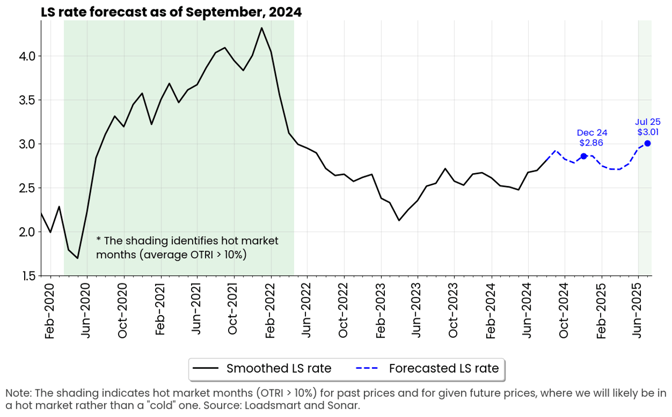

Loadsmart’s spot rate forecast / look ahead

Our model predicts that spot prices will rise from $2.81 in August to $2.93 in September, which should be the peak price in 2024.

- After September, prices are expected to stabilize and remain at ~$2.8 in Q4.

- From a macroeconomic standpoint, there is no demand catalyst to drive a sustained long-term uptrend. Consequently, our projections continue to interpret the recent rate increases as seasonal.

- The steady increase in the volume of consumer goods shipped during July and August, which has driven rates higher, supports the theory that we could be experiencing a peak season pull-ahead, similar to last year.

- Consequently, rate behavior is expected to closely follow last year’s pattern, when prices peaked in September before declining by 2-5% in the Q4.

Figure 6

Freight & Economics

Import activity to decline after September

- According to NRF estimates, August likely marked the annual peak in import activity as retailers had ramped up shipments in anticipation of a potential strike at East and Gulf Coast ports this fall - see Figure 7.

Figure 7

- The contract between the maritime union and the East and Gulf Coast ports expires on September 30. With negotiations currently stalled, a strike could begin in October if a new agreement is not reached by then.

- Importers are expected to shift their cargo to the West Coast in the next months as a precaution against potential labor disruptions, which will further increase the volume of imports at these ports.

- In July, the volume of imports received by the ports of Los Angeles/Long Beach jumped 40% YoY, while for the ports of New York/New Jersey the difference was only 11% YoY - Figure 8.

Figure 8

- For truckers, this means: (1) a potential slowdown in import-driven demand in Q, as import levels are expected to decline and remain similar to last year, and (2) the shift in coastal activity due to strike concerns may result in higher demand for over-the-road transportation from Southern California ports.

- Rates in the Los Angeles/Long Beach key market areas (KMAs) reached a YTD high in August, with an average all-in spot rate of $3.20 per mile - despite the general slowdown in rates across California (see Figure 9). Meanwhile, spot rates at the ports of New York/New Jersey and Houston are approximately 8% below their YTD highs - which occurred in the Q1.

Figure 9

Retailers

- U.S. Census data show that retailers' restocking activity intensified in Q2, leading to an increase in their inventories to sales of about 3% YoY, adding to the evidence that the recent surge in container imports was likely aimed at restocking rather than reflecting a genuine increase in consumer demand.

Figure 10

- In contrast, manufacturers and wholesalers maintained relatively stable inventory levels YoY, with their inventory-to-sales ratio dropping by about 2% YoY.

- From our brokerage perspective, the restocking trend was notable in Q3 as retail demand - particularly from consumer goods companies - was the main driver of our spot volume growth.

-------------------------------------------------------------------------------------------

Please reach out to Stella Carneiro (stella.carneiro@loadsmart.com) with any questions, suggestions, thoughts, etc. #movemorewithless

Share this

- Loadsmart Blog (159)

- Blog (121)

- Shipper (106)

- Market Trends (101)

- Enterprise Shipper (69)

- Carrier (66)

- News (62)

- Data Insights (51)

- Thought Leadership (45)

- Warehouse (41)

- SMB Shipper (38)

- Our Partners (34)

- ShipperGuide TMS (31)

- Opendock (30)

- Product Updates (29)

- Mode Optimization (25)

- Loadsmart (23)

- Mid-Market Shipper (18)

- Case Study (17)

- Brokerage Services (15)

- Managed Transportation (11)

- Video (9)

- Award (7)

- FreightIntel AI (5)

- Instant Execution (4)

- Asset (3)

- Food and Beverage (3)

- Freight Management (3)

- Logistics Solutions (3)

- YMS (3)

- eBook (3)

- 4PL (2)

- International (2)

- NavTrac (2)

- Podcast (2)

- UK (2)

- Yard Management System (2)

- Cold Storage (1)

- Faces of Loadsmart (1)

- Paper Packaging (1)

- Retail (1)

- Security (1)

- Transportation Management System (1)

- January 2026 (1)

- December 2025 (1)

- November 2025 (1)

- October 2025 (2)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (7)

- April 2025 (6)

- March 2025 (3)

- February 2025 (10)

- January 2025 (4)

- December 2024 (4)

- November 2024 (5)

- October 2024 (11)

- September 2024 (11)

- August 2024 (5)

- July 2024 (5)

- June 2024 (9)

- May 2024 (7)

- April 2024 (6)

- March 2024 (2)

- February 2024 (2)

- January 2024 (5)

- December 2023 (6)

- November 2023 (2)

- October 2023 (12)

- September 2023 (5)

- August 2023 (3)

- July 2023 (4)

- June 2023 (10)

- May 2023 (5)

- April 2023 (5)

- March 2023 (7)

- February 2023 (5)

- January 2023 (7)

- December 2022 (4)

- November 2022 (13)

- October 2022 (4)

- September 2022 (7)

- August 2022 (11)

- July 2022 (6)

- June 2022 (5)

- May 2022 (2)

- April 2022 (4)

- March 2022 (6)

- February 2022 (7)

- January 2022 (9)

- December 2021 (3)

- November 2021 (5)

- October 2021 (7)

- September 2021 (2)

- August 2021 (2)

- July 2021 (4)

- June 2021 (6)

- May 2021 (6)

- April 2021 (5)

- March 2021 (8)

- February 2021 (3)

- January 2021 (3)

- December 2020 (7)

- November 2020 (9)

- October 2020 (7)

- September 2020 (6)

- August 2020 (10)

- July 2020 (8)

- June 2020 (3)

- May 2020 (1)

- April 2020 (2)

- March 2020 (2)

- February 2020 (1)

- January 2020 (1)

- November 2019 (2)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- June 2019 (2)

- May 2019 (3)

- March 2019 (1)

- February 2019 (3)

- December 2018 (1)

- November 2018 (2)

- October 2018 (1)

- September 2018 (2)

- August 2018 (1)

- July 2018 (1)

- June 2018 (3)

- May 2018 (4)

- April 2018 (1)

- February 2018 (1)

- January 2018 (4)

- November 2017 (1)

- October 2017 (2)

- June 2017 (1)

- May 2017 (2)

- April 2017 (1)

- February 2017 (1)

- January 2017 (2)

- October 2016 (1)

- August 2016 (1)

- July 2016 (2)

- June 2016 (1)

- March 2016 (1)

- January 2016 (1)

- December 2015 (3)

- November 2015 (2)

- October 2015 (6)

- July 2015 (1)

- June 2015 (1)

- April 2015 (2)

- March 2015 (13)

- February 2015 (17)

- January 2015 (15)

- December 2014 (35)

- November 2014 (26)

- October 2014 (60)

- September 2014 (2)