Share this

Warehousing Trends Amidst The E-Commerce Era

by jpallmerine

Warehouses are the central nodes in the logistics network, and understanding the trends in this industry is key for carriers. In this article, we explore the two main trends that arose from warehousing’s adaptation to the e-commerce era, which are (i) spatial decentralization - the movement of facilities away from urban to sub/exurban areas; and (ii) the densification of logistics networks.

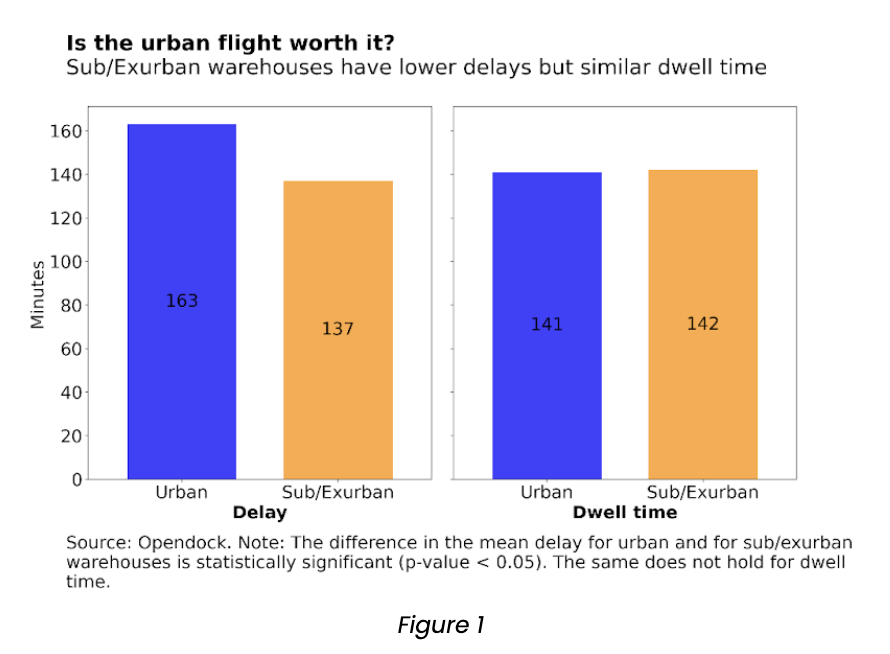

In a nutshell, we find from our data that:- Warehouses in sub/exurban areas are more efficient because truck arrival delays are, on average, 26 minutes lower at these facilities;

- Freight operations are still concentrated in urban areas but this is slowly changing;

- Companies are moving their warehouses away from core consumer markets, the city centers, but also densifying their logistics networks. This means that, although last-mile haul distances might be increasing, first and middle-haul distances are decreasing.

Spatial Decentralization

The pandemic-driven e-commerce boom has transformed the warehousing industry in the U.S. The surge in demand for home deliveries enabled retailers to sell items at a reduced cost because, on a per-sales basis, the cost of operating distribution centers in peripheral areas is lower than the cost of operating stores in central areas - see this article for additional info on online retailers’ geography. Also, suburbs tend to have less traffic congestion and better supply chain connectivity as they have more road infrastructure to support regional and national flows with their easy access to state and interstate highways.

To analyze and understand these trends, we examine Loadsmart's proprietary data. Fortunately, we did not have to look very far, thanks to Opendock, our cloud-based dock scheduling solution. In addition to increased visibility for shippers & reduced detention fees for carriers, Opendock allows us to gather, and analyze data at the warehouse level.

Opendock has over 100,000 carrier users, scheduling 10 million annual appointments in 3,000 warehouses and distribution centers. By leveraging this data, we define whether a facility is urban or sub/exurban based on its location; if the facility is within an area classified as urban by the 2020 Census (1), we define it as such. From this data split, we learned that truck delays (the time between scheduled appointment time and actual arrival) are on average 26 minutes longer in urban facilities, possibly given city-center traffic; while the average dwell time (time between actual arrival and drop-off or pick-up completion) is similar for both - Figure 1.

Densification of Logistics Networks

As facilities move farther away from urban markets, one would expect the average mileage per shipment to increase; which may just be the case for last-mile shipments, but not for first and middle-mile shipments (manufacturer to warehouse and warehouse to warehouse, respectively). This is because shippers are rapidly adjusting to the online shopping boom by building denser distribution networks. A recent article that looked at changes in Amazon's distribution network found that the company reduced its average mileage per shipment from 450 to 141 miles in the 1999-2018 period, thanks to its network densification.

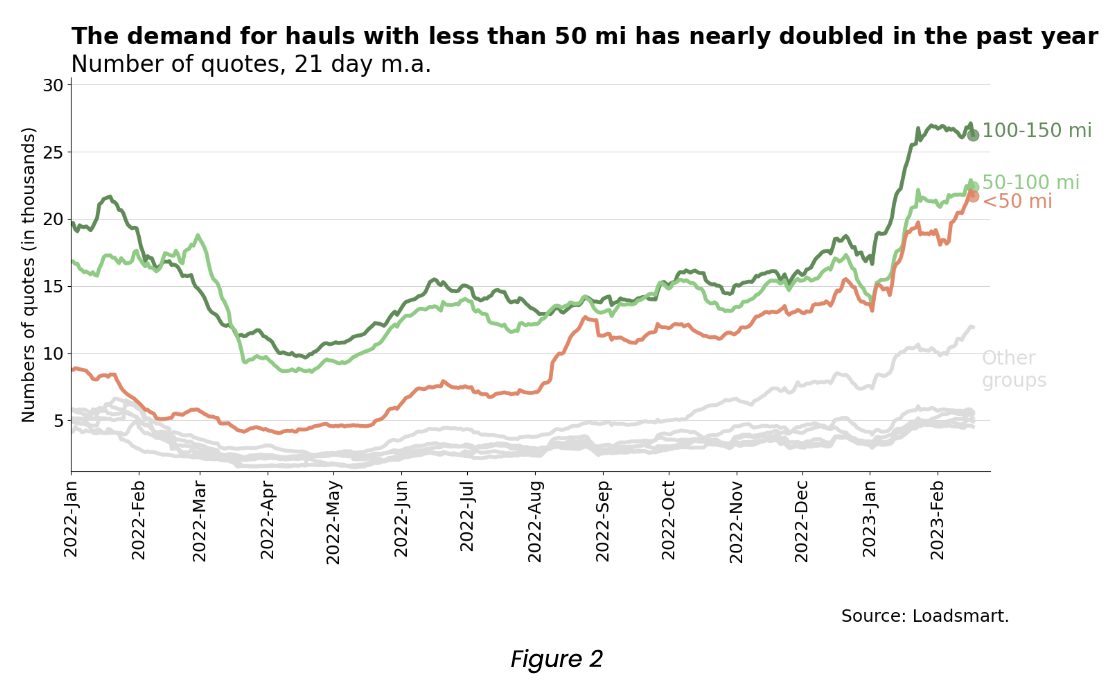

Loadsmart Quote Data

We observe these same two trends in Loadsmart's quote data: (i) the share of quotes for freight with pick-ups in sub/exurban areas rose from 26% to 30% during 2022 (2); (ii) and distance-wise, the demand for shorter hauls grew the most over the same period - Figure 2. The combination of these two trends is forcing carriers to reconfigure their operations by working with shorter distances within cities’ fringes.

By examining Opendock's facility data, as well as the vast amount of quote data from our TMS integrations, we found evidence of both warehousing decentralization and densification. We believe these trends should benefit carriers in the long run, as shorter hauls and fewer delays should allow for more trips per day.

1. Check here the criteria used for the 2020 Census territory classification.

2. This means that 74% of Loadsmart quoted freight is still from urban to urban areas.

Share this

- Loadsmart Blog (159)

- Blog (121)

- Shipper (106)

- Market Trends (101)

- Enterprise Shipper (69)

- Carrier (66)

- News (62)

- Data Insights (51)

- Thought Leadership (45)

- Warehouse (41)

- SMB Shipper (38)

- Our Partners (34)

- ShipperGuide TMS (31)

- Opendock (30)

- Product Updates (29)

- Mode Optimization (25)

- Loadsmart (23)

- Mid-Market Shipper (18)

- Case Study (17)

- Brokerage Services (15)

- Managed Transportation (11)

- Video (9)

- Award (7)

- FreightIntel AI (5)

- Instant Execution (4)

- Asset (3)

- Food and Beverage (3)

- Freight Management (3)

- Logistics Solutions (3)

- YMS (3)

- eBook (3)

- 4PL (2)

- International (2)

- NavTrac (2)

- Podcast (2)

- UK (2)

- Yard Management System (2)

- Cold Storage (1)

- Faces of Loadsmart (1)

- Paper Packaging (1)

- Retail (1)

- Security (1)

- Transportation Management System (1)

- January 2026 (1)

- December 2025 (1)

- November 2025 (1)

- October 2025 (2)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (7)

- April 2025 (6)

- March 2025 (3)

- February 2025 (10)

- January 2025 (4)

- December 2024 (4)

- November 2024 (5)

- October 2024 (11)

- September 2024 (11)

- August 2024 (5)

- July 2024 (5)

- June 2024 (9)

- May 2024 (7)

- April 2024 (6)

- March 2024 (2)

- February 2024 (2)

- January 2024 (5)

- December 2023 (6)

- November 2023 (2)

- October 2023 (12)

- September 2023 (5)

- August 2023 (3)

- July 2023 (4)

- June 2023 (10)

- May 2023 (5)

- April 2023 (5)

- March 2023 (7)

- February 2023 (5)

- January 2023 (7)

- December 2022 (4)

- November 2022 (13)

- October 2022 (4)

- September 2022 (7)

- August 2022 (11)

- July 2022 (6)

- June 2022 (5)

- May 2022 (2)

- April 2022 (4)

- March 2022 (6)

- February 2022 (7)

- January 2022 (9)

- December 2021 (3)

- November 2021 (5)

- October 2021 (7)

- September 2021 (2)

- August 2021 (2)

- July 2021 (4)

- June 2021 (6)

- May 2021 (6)

- April 2021 (5)

- March 2021 (8)

- February 2021 (3)

- January 2021 (3)

- December 2020 (7)

- November 2020 (9)

- October 2020 (7)

- September 2020 (6)

- August 2020 (10)

- July 2020 (8)

- June 2020 (3)

- May 2020 (1)

- April 2020 (2)

- March 2020 (2)

- February 2020 (1)

- January 2020 (1)

- November 2019 (2)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- June 2019 (2)

- May 2019 (3)

- March 2019 (1)

- February 2019 (3)

- December 2018 (1)

- November 2018 (2)

- October 2018 (1)

- September 2018 (2)

- August 2018 (1)

- July 2018 (1)

- June 2018 (3)

- May 2018 (4)

- April 2018 (1)

- February 2018 (1)

- January 2018 (4)

- November 2017 (1)

- October 2017 (2)

- June 2017 (1)

- May 2017 (2)

- April 2017 (1)

- February 2017 (1)

- January 2017 (2)

- October 2016 (1)

- August 2016 (1)

- July 2016 (2)

- June 2016 (1)

- March 2016 (1)

- January 2016 (1)

- December 2015 (3)

- November 2015 (2)

- October 2015 (6)

- July 2015 (1)

- June 2015 (1)

- April 2015 (2)

- March 2015 (13)

- February 2015 (17)

- January 2015 (15)

- December 2014 (35)

- November 2014 (26)

- October 2014 (60)

- September 2014 (2)