Share this

Loadsmart’s Look Ahead: An Analysis of Key Freight & Economic Indicators to Watch in April

As usual, in this Monthly Market Update, we will (a) provide a brief update/analysis of the full truckload market and (b) present compelling economic analysis to provide a macroeconomic view on the state of the freight market.

We hope you enjoy! #movemorewithless

Loadsmart’s top 30 spot rate forecast

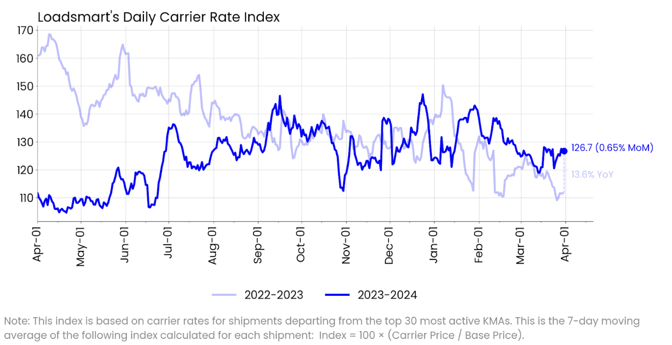

Figure 1

Rates: Our price index rose 0.65% MoM in March, staying almost constant throughout the month. Rates dropped about 20% from mid-January to mid-March. The market then found a new bottom - 5% higher than the Oct'23 one - as the price index hovered around 120 for the rest of the month.- Rates fluctuated by less than 10 cents in most states, which suggests that, while capacity is loose, prices may not fall further in the short term. The exceptions were Florida and Texas, where rates rose more than 20 cents - possibly as an early effect of the produce season

- Sonar's OTRI behaved similarly to our price index but with a two-week lag. From February to March, the rejection rate dropped significantly to roughly last year's level, from 5.4% to 3.4%.

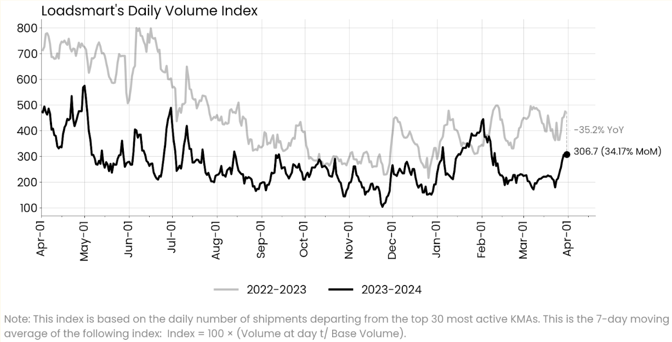

Figure 2

Volumes: Our volume index increased 34.2% MoM in March. Volumes declined from February to early March and remained flat throughout March. However, on the 26th, they rebounded due to increased loads in Texas and Indiana.

- Consumer goods and general retail volumes increased, while food and beverage volumes declined

- Sonar's OTVI declined 7% MoM. The index also remained stable during the month, but unlike our index, it had a sharp drop in the last few days of the month

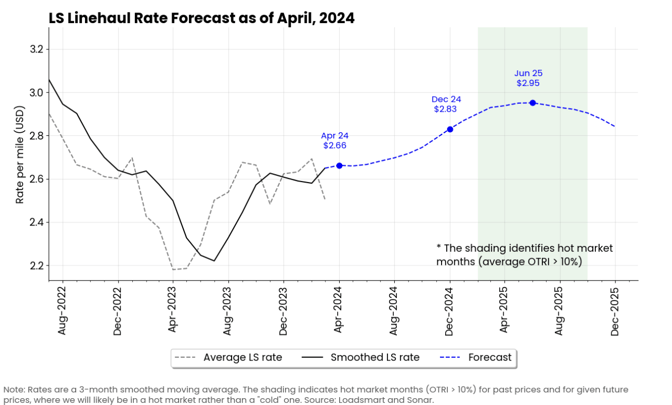

- Our average rates fell sharply in March, but positive figures in January and February were enough to lift the 3-month smoothed rate

- Monthly average rates have reached a floor for the year. Rates should rise slightly in April as we head into the summer, and freight demand from the food & beverage and construction sectors picks up

- The stagnant behavior of prices since November 2023 shows that the market has failed to fit into the previously projected recovery cycle. We ended 1Q2024 with more evidence that price recovery will be slower than in previous cycles.

- Prices are expected to reach $2.83 by December 2024 and continue to rise until June 2025, peaking at $2.95.

Figure 3

Freight & Economics

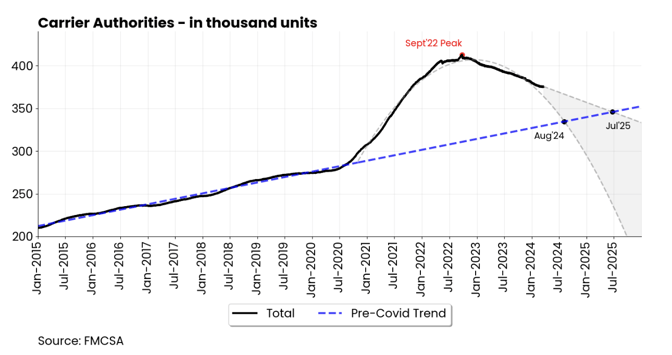

Carrier oversupply may not be fixed until 2025

- The excess of carriers that entered the market from 2020 to 2022 is enduring through its downturn. Until recently, we expected the number of active carriers to return to pre-pandemic levels by August 2024.

- However, carrier exits slowed down in 1Q2024, likely influenced by a brief recovery in rates during 2H2023. We now expect this adjustment process to continue until July '25—see Figure 4.

Figure 4

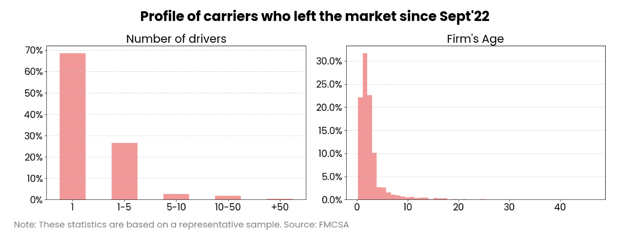

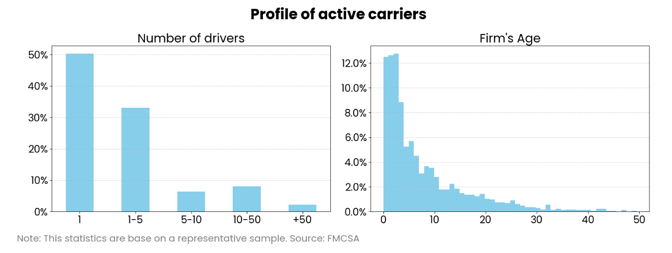

- Using a representative sample of companies whose information remains accessible on the FMCSA's Safer portal, we identified the profiles of companies that have exited the market and those still navigating through the recession.

- Companies that have exited the market are younger; 53% had been in business for less than two years, meaning they entered the market after the onset of the pandemic in 2020 - Figure 5.

- Also, about 70% of them were owner-operators, while only 50% of those who stayed were owner-operators - Figure 6.

Figure 5

Figure 5

Figure 6

Favorable Market Trends for Flatbed

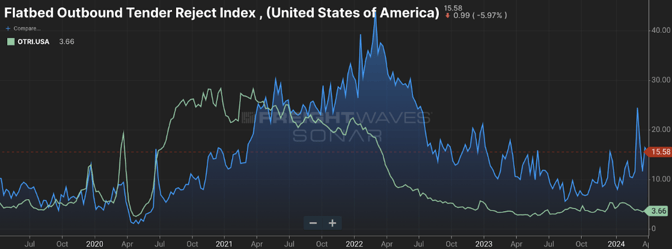

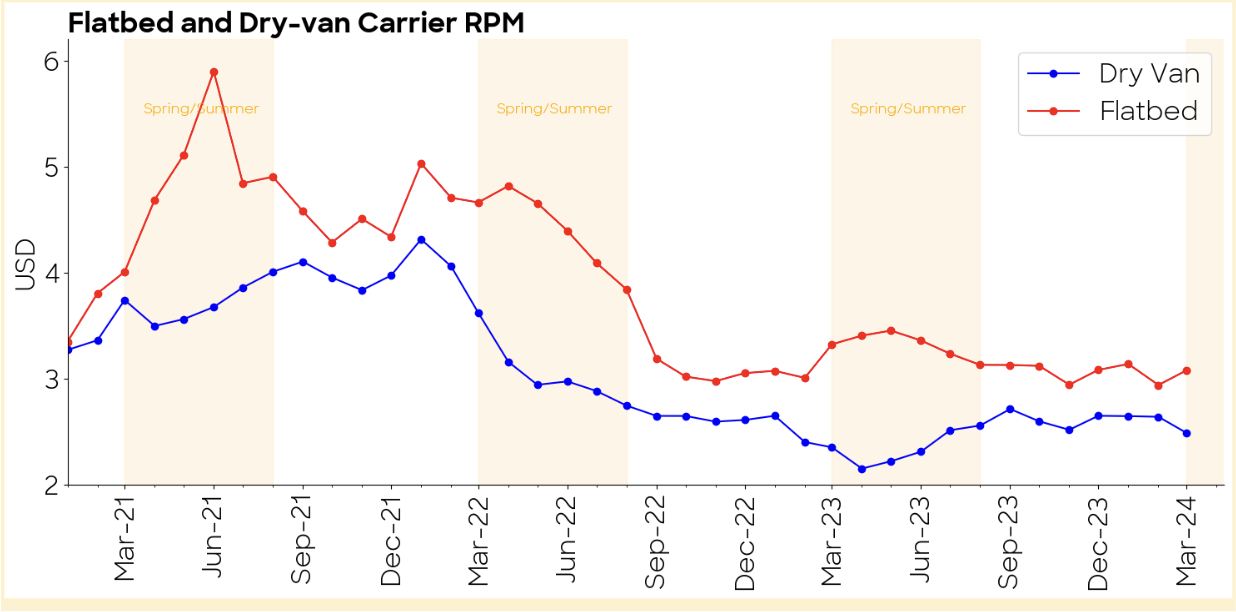

- As we enter 2Q2024, the flatbed market continues to rally, clearly diverging from the performance of the dry van market.

- Both markets bottomed in 2H2023, with flatbed rejection rates at 2.8% and dry van rates at 5%, respectively, and then entered a recovery phase. However, dry van rejection rates declined after Feb'24—see Figure 7.

Figure 7

- Based on the current rejection numbers, we are projecting an increase in flatbed rates for the upcoming spring/summer season, consistent with last year's trends. Figure 8 shows that rates escalated to an average of $3.27 in the spring/summer period, in contrast to $3.06, which was the average for the rest of the year.

Figure 8

Please reach out to Stella Carneiro (stella.carneiro@loadsmart.com) with any questions, suggestions, thoughts, etc. Thank you!

Share this

- Loadsmart Blog (159)

- Blog (121)

- Shipper (106)

- Market Trends (101)

- Enterprise Shipper (69)

- Carrier (66)

- News (62)

- Data Insights (51)

- Thought Leadership (45)

- Warehouse (41)

- SMB Shipper (38)

- Our Partners (34)

- ShipperGuide TMS (31)

- Opendock (30)

- Product Updates (29)

- Mode Optimization (25)

- Loadsmart (23)

- Mid-Market Shipper (18)

- Case Study (17)

- Brokerage Services (15)

- Managed Transportation (11)

- Video (9)

- Award (7)

- FreightIntel AI (5)

- Instant Execution (4)

- Asset (3)

- Food and Beverage (3)

- Freight Management (3)

- Logistics Solutions (3)

- YMS (3)

- eBook (3)

- 4PL (2)

- International (2)

- NavTrac (2)

- Podcast (2)

- UK (2)

- Yard Management System (2)

- Cold Storage (1)

- Faces of Loadsmart (1)

- Paper Packaging (1)

- Retail (1)

- Security (1)

- Transportation Management System (1)

- January 2026 (1)

- December 2025 (1)

- November 2025 (1)

- October 2025 (2)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (7)

- April 2025 (6)

- March 2025 (3)

- February 2025 (10)

- January 2025 (4)

- December 2024 (4)

- November 2024 (5)

- October 2024 (11)

- September 2024 (11)

- August 2024 (5)

- July 2024 (5)

- June 2024 (9)

- May 2024 (7)

- April 2024 (6)

- March 2024 (2)

- February 2024 (2)

- January 2024 (5)

- December 2023 (6)

- November 2023 (2)

- October 2023 (12)

- September 2023 (5)

- August 2023 (3)

- July 2023 (4)

- June 2023 (10)

- May 2023 (5)

- April 2023 (5)

- March 2023 (7)

- February 2023 (5)

- January 2023 (7)

- December 2022 (4)

- November 2022 (13)

- October 2022 (4)

- September 2022 (7)

- August 2022 (11)

- July 2022 (6)

- June 2022 (5)

- May 2022 (2)

- April 2022 (4)

- March 2022 (6)

- February 2022 (7)

- January 2022 (9)

- December 2021 (3)

- November 2021 (5)

- October 2021 (7)

- September 2021 (2)

- August 2021 (2)

- July 2021 (4)

- June 2021 (6)

- May 2021 (6)

- April 2021 (5)

- March 2021 (8)

- February 2021 (3)

- January 2021 (3)

- December 2020 (7)

- November 2020 (9)

- October 2020 (7)

- September 2020 (6)

- August 2020 (10)

- July 2020 (8)

- June 2020 (3)

- May 2020 (1)

- April 2020 (2)

- March 2020 (2)

- February 2020 (1)

- January 2020 (1)

- November 2019 (2)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- June 2019 (2)

- May 2019 (3)

- March 2019 (1)

- February 2019 (3)

- December 2018 (1)

- November 2018 (2)

- October 2018 (1)

- September 2018 (2)

- August 2018 (1)

- July 2018 (1)

- June 2018 (3)

- May 2018 (4)

- April 2018 (1)

- February 2018 (1)

- January 2018 (4)

- November 2017 (1)

- October 2017 (2)

- June 2017 (1)

- May 2017 (2)

- April 2017 (1)

- February 2017 (1)

- January 2017 (2)

- October 2016 (1)

- August 2016 (1)

- July 2016 (2)

- June 2016 (1)

- March 2016 (1)

- January 2016 (1)

- December 2015 (3)

- November 2015 (2)

- October 2015 (6)

- July 2015 (1)

- June 2015 (1)

- April 2015 (2)

- March 2015 (13)

- February 2015 (17)

- January 2015 (15)

- December 2014 (35)

- November 2014 (26)

- October 2014 (60)

- September 2014 (2)