Share this

Loadsmart’s Look Ahead: An Analysis of Key Freight & Economic Indicators to Watch in February

As usual, in this Monthly Market Update, we will provide a brief update & analysis of the full truckload market and present some compelling trucking-related economic analysis to provide a macroeconomic view on the state of the market. Please reach out to Stella Carneiro (stella.carneiro@loadsmart.com) with any questions, suggestions, thoughts, etc. Thank you! We hope you enjoy! #movemorewithless

Loadsmart’s top 30 spot rate forecast

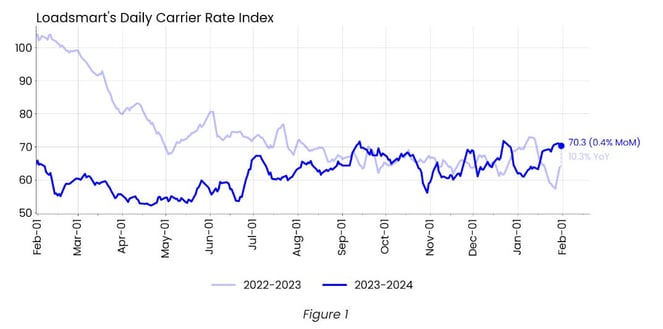

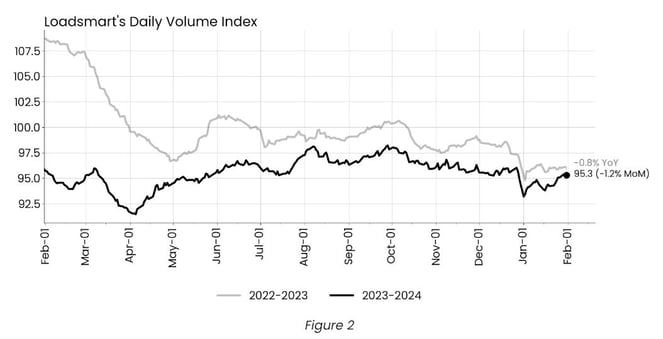

Rates: Our price index fell 0.4% MoM in January. Our price index began January with a sharp drop that followed the Christmas holiday. However, after January 15th, prices rebounded and our rate returned to a level similar to December's peak.

- One hypothesis to explain the mid-January price jump is seasonal capacity tightening due to winter storms, but we do not see a direct causal relationship between rate spikes and the storms. The mid-January price spike was largely driven by rate spikes in the Midwest, Ohio, and Indiana, where rates rose above Christmas levels. However, there were no price spikes in the Mid-Atlantic and Northeast regions, which were hit hardest by winter storms during the period.

- Sonar's OTRI also rebounded in mid-January.

- Sonar's OTVI, on the contrary, has recovered, with volumes rebounding to December levels in the first week of January and remaining elevated throughout the month. The OTVI is up approximately 10% YoY.

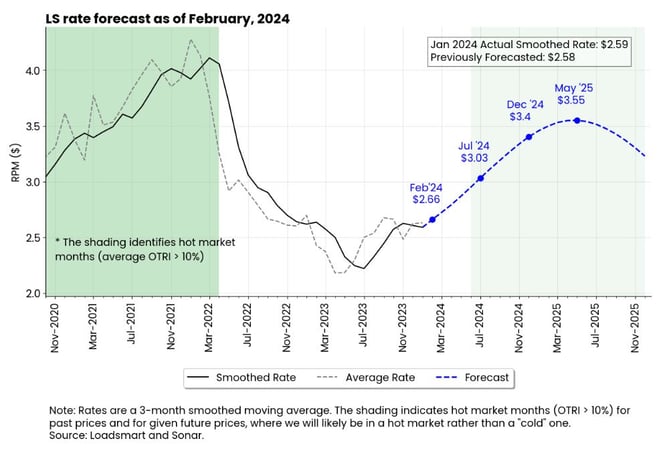

Loadsmart’s Spot Rate Forecast

While the average rate was unchanged from Dec to Jan, the 3-month smoothed rate declined in Jan due to the negative performance of the average rate in November.

Rates should reach $3.03 by Jul and $3.4 by Dec 2024;

The uptrend should continue through May 2025, when prices will peak at $3.55, 13.6% lower than the Mar 2022 high.

Figure 3

Freight & Economics Review

Deflation in the goods sector is a bullish sign for freight activity

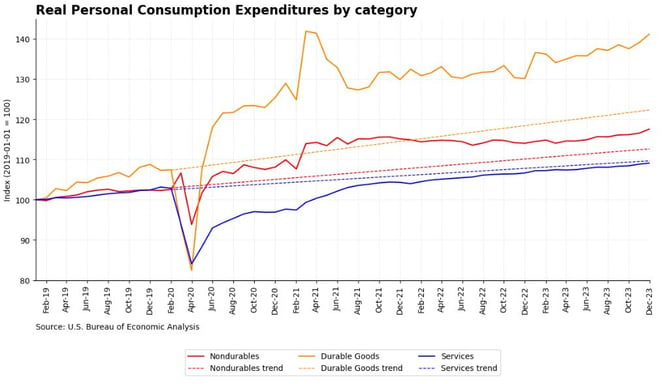

The pandemic caused a shift in consumer spending from services to goods, and after almost three years there is still no rebalancing of the household consumption basket. Consumption of goods is still well above its pre-pandemic trend, while consumption of services is below it - see Figure 4.

Figure 4

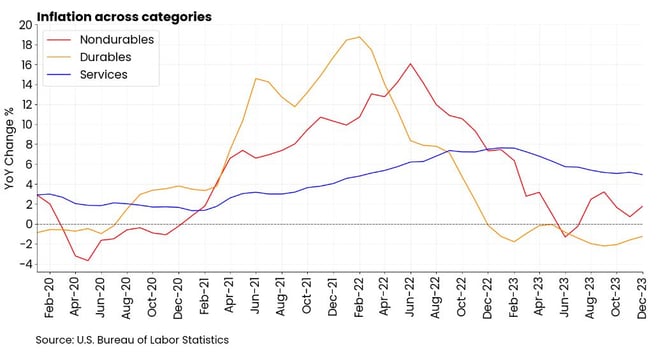

But we continue to believe that the slowdown in goods spending and the reallocation of spending from goods to services will finally begin in 2024. But it will be driven not by a real decline in demand for goods, but by the deflationary process that this category is undergoing - see Figure 5. As the price of goods deflates, the dollar amount spent on goods and its weight in consumers' budgets can fall, even if the demand for goods is still rising in terms of volume.

Figure 5

- Deflation is currently affecting only a few durable goods categories - such as motor vehicles, home furnishings and recreational goods - but with the decline in commodity prices, non-durable goods are also expected to enter deflationary territory in 2024.

- For the truckload market, the potential slowdown in consumer spending in 2024 may not mean less volume to ship.

Industrial production recovery signs

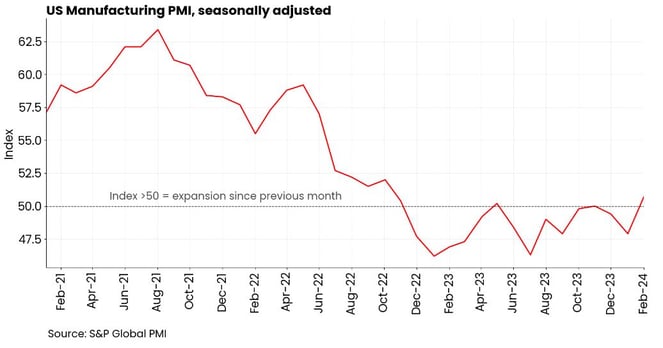

The U.S. manufacturing sector showed signs of recovery in January as manufacturing activity expanded for the first time since April 2023, according to the latest PMI® data from S&P Global.

The manufacturing index stood at 50.7 in January, up from 47.9 in December - see figure 7. A PMI reading above 50 indicates that the manufacturing sector is entering ana expansion zone, as more purchasing managers surveyed reported an increase in activity, compared to those who reported a decrease, over the previous month.

Figure 6

According to the report, the increase was driven by renewed growth in new orders at manufacturing firms. But the improvement in demand is domestically focused as new export orders continue to decline.

Despite the growth in new orders, producers output declined in January given transportation delays and severe storms.

Share this

- Loadsmart Blog (159)

- Blog (121)

- Shipper (106)

- Market Trends (101)

- Enterprise Shipper (69)

- Carrier (66)

- News (62)

- Data Insights (51)

- Thought Leadership (45)

- Warehouse (41)

- SMB Shipper (38)

- Our Partners (34)

- ShipperGuide TMS (31)

- Opendock (30)

- Product Updates (29)

- Mode Optimization (25)

- Loadsmart (23)

- Mid-Market Shipper (18)

- Case Study (17)

- Brokerage Services (15)

- Managed Transportation (11)

- Video (9)

- Award (7)

- FreightIntel AI (5)

- Instant Execution (4)

- Asset (3)

- Food and Beverage (3)

- Freight Management (3)

- Logistics Solutions (3)

- YMS (3)

- eBook (3)

- 4PL (2)

- International (2)

- NavTrac (2)

- Podcast (2)

- UK (2)

- Yard Management System (2)

- Cold Storage (1)

- Faces of Loadsmart (1)

- Paper Packaging (1)

- Retail (1)

- Security (1)

- Transportation Management System (1)

- January 2026 (1)

- December 2025 (1)

- November 2025 (1)

- October 2025 (2)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (7)

- April 2025 (6)

- March 2025 (3)

- February 2025 (10)

- January 2025 (4)

- December 2024 (4)

- November 2024 (5)

- October 2024 (11)

- September 2024 (11)

- August 2024 (5)

- July 2024 (5)

- June 2024 (9)

- May 2024 (7)

- April 2024 (6)

- March 2024 (2)

- February 2024 (2)

- January 2024 (5)

- December 2023 (6)

- November 2023 (2)

- October 2023 (12)

- September 2023 (5)

- August 2023 (3)

- July 2023 (4)

- June 2023 (10)

- May 2023 (5)

- April 2023 (5)

- March 2023 (7)

- February 2023 (5)

- January 2023 (7)

- December 2022 (4)

- November 2022 (13)

- October 2022 (4)

- September 2022 (7)

- August 2022 (11)

- July 2022 (6)

- June 2022 (5)

- May 2022 (2)

- April 2022 (4)

- March 2022 (6)

- February 2022 (7)

- January 2022 (9)

- December 2021 (3)

- November 2021 (5)

- October 2021 (7)

- September 2021 (2)

- August 2021 (2)

- July 2021 (4)

- June 2021 (6)

- May 2021 (6)

- April 2021 (5)

- March 2021 (8)

- February 2021 (3)

- January 2021 (3)

- December 2020 (7)

- November 2020 (9)

- October 2020 (7)

- September 2020 (6)

- August 2020 (10)

- July 2020 (8)

- June 2020 (3)

- May 2020 (1)

- April 2020 (2)

- March 2020 (2)

- February 2020 (1)

- January 2020 (1)

- November 2019 (2)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- June 2019 (2)

- May 2019 (3)

- March 2019 (1)

- February 2019 (3)

- December 2018 (1)

- November 2018 (2)

- October 2018 (1)

- September 2018 (2)

- August 2018 (1)

- July 2018 (1)

- June 2018 (3)

- May 2018 (4)

- April 2018 (1)

- February 2018 (1)

- January 2018 (4)

- November 2017 (1)

- October 2017 (2)

- June 2017 (1)

- May 2017 (2)

- April 2017 (1)

- February 2017 (1)

- January 2017 (2)

- October 2016 (1)

- August 2016 (1)

- July 2016 (2)

- June 2016 (1)

- March 2016 (1)

- January 2016 (1)

- December 2015 (3)

- November 2015 (2)

- October 2015 (6)

- July 2015 (1)

- June 2015 (1)

- April 2015 (2)

- March 2015 (13)

- February 2015 (17)

- January 2015 (15)

- December 2014 (35)

- November 2014 (26)

- October 2014 (60)

- September 2014 (2)