Share this

Loadsmart’s Look Ahead: An Analysis of Key Freight & Economic Indicators to Watch in November

by jpallmerine

As usual, in this Monthly Market Update, we will provide a brief update & analysis of the full truckload market and present some compelling trucking-related economic analysis to provide a macroeconomic view on the state of the market. Please reach out to Stella Carneiro (stella.carneiro@loadsmart.com) with any questions, suggestions, thoughts, etc. Thank you! We hope you enjoy! #movemorewithless

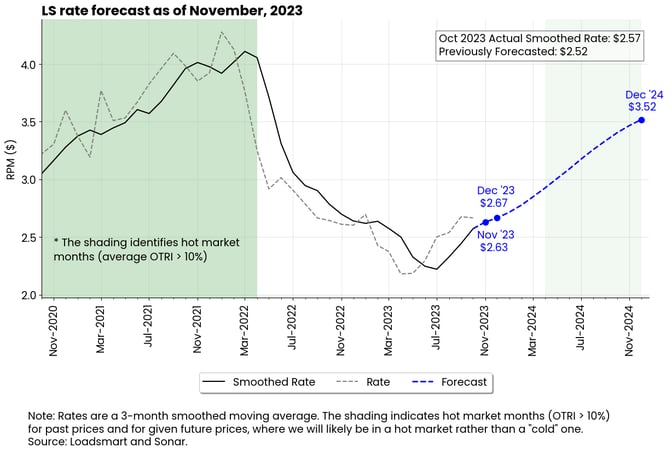

Our model predicts that spot rates will rise from $2.57 in October to $2.65 in November (3% growth).

Our 3-month smoothed rate increased in October because of the positive performance of the average monthly rate in August and September. October's average monthly rate (not smoothed) actually declined slightly - see the gray line in Figure 1.

Given the better-than-expected performance of our rates in August and September, our model suggests that there is not much room for a significant recovery in the coming months. Our smoothed rate should end the year at $2.67.- For next year, the EIA's December 2024 diesel price forecast was revised by 8%, so our rate forecast for that date increased in response - from $3.41 to $3.52.

Figure 1

October's Full Truckload Market Review:

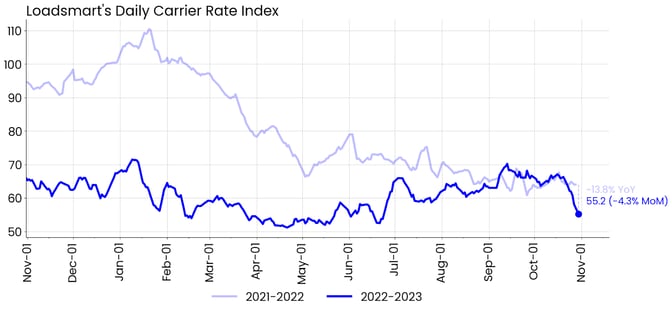

Figure 2

Rates: Our Price Index decreased by 4.3% MoM in October. Rates held steady through the middle of the month but then dropped sharply. The decline occurred in all regions of the country except the Northeast, where rates maintained the upward trend that began in April.- Our data was consistent with the performance of the Sonar OTRI. Despite the instability of the index during the month, the OTRI also began a downward trend in mid-October.

- We do not expect rates to stay this low in November. We believe that both the rate and OTRI dips are temporary.

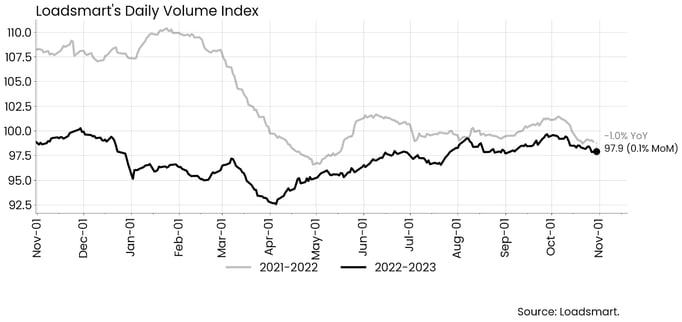

Figure 3

Figure 3

- The performance of our index is in line with the OTVI, which was essentially unchanged over the month.

Freight & Economics

Holiday season pricing

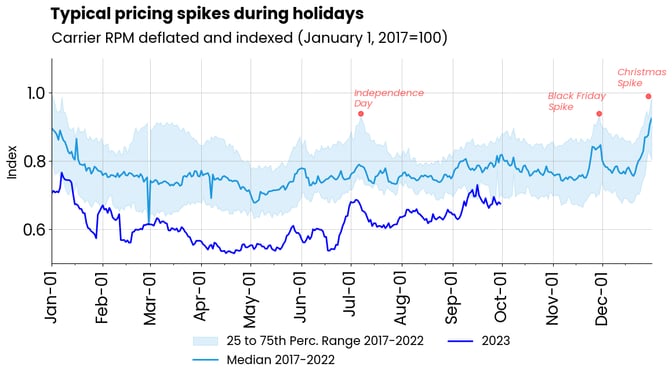

There are a few national holidays that can temporarily increase prices, namely the Fourth of July, Black Friday, and Christmas/New Year's, as we can see in Figure 4. Historically, rate increases due to these events have been most pronounced in up-cycle markets when capacity is tight.

Figure 4

Last year, there were no temporary price spikes associated with the holidays, as capacity was loose and prices fell steadily throughout 2H2022. However, this year's rebound in prices in April/May and the Fourth of July price spike suggest that there may be more temporary spikes over the year-end holidays.On the demand side, the NFR data signals that there will be no real gains in retail sales over the last year, as their 3-4% growth forecast equates to zero real growth when adjusted for inflation. But on the supply side, there are over 15,000 fewer carriers in the market compared to last year.

The current state of the LTL business

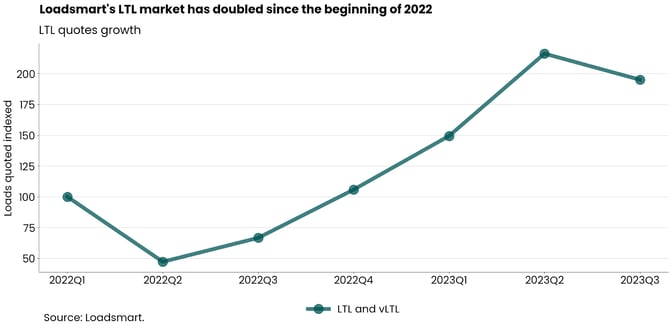

Despite the recessionary environment that continues to stifle the freight market in 2023, this has been a year of consolidation for Loadsmart in the LTL market. Underlying economic conditions, combined with our internal efforts to grow our presence in this mode's market, have driven the LTL freight volumes quoted on our platform to double since 2022 (Figure 5).

Figure 5

In our view, this is a market that will continue to grow over the next few years, not only as a result of the redistribution of Yellow's market share within the industry but also as a result of broader factors.

In the short term, increased demand for LTL will likely be driven by retailers seeking more cost-effective shipping options, even if it means waiting longer for inventory to arrive.

- With the risk of recession and the associated slowdown in consumption lingering throughout the year, retailers are in constant fear of overstocking.

- In this context, the size of the orders is being reduced to the minimum possible to keep inventory levels low, leading many companies to opt for LTL.

- According to August data from the Department of Commerce, retailers' inventory-to-sales ratio is 1.3, down from an average of 1.43 over the 2010-2020 decade, before supply chains were disrupted by the pandemic.

Additionally, there is one fundamental factor benefiting LTL over the long run: the growth of e-commerce, its primary customer. Online shopping should continue to grow as a proportion of core retail sales (as shown in Figure 6). This will not only increase the demand for LTL shipping but may reduce its operating costs through economies of scale in the long run - which has yet to happen.

- Sonar's data shows that the LTL rate per 100 pounds has increased from $13.9 to $36.9 from Jan 2017 to Jan 2023, an increase of over 150%.

- However, we expect that wider market adoption of dynamic pricing can improve this business density and help carriers reduce costs without sacrificing their revenues.

Figure 6

Share this

- Loadsmart Blog (159)

- Blog (121)

- Shipper (106)

- Market Trends (101)

- Enterprise Shipper (69)

- Carrier (66)

- News (62)

- Data Insights (51)

- Thought Leadership (45)

- Warehouse (41)

- SMB Shipper (38)

- Our Partners (34)

- ShipperGuide TMS (31)

- Opendock (30)

- Product Updates (29)

- Mode Optimization (25)

- Loadsmart (23)

- Mid-Market Shipper (18)

- Case Study (17)

- Brokerage Services (15)

- Managed Transportation (11)

- Video (9)

- Award (7)

- FreightIntel AI (5)

- Instant Execution (4)

- Asset (3)

- Food and Beverage (3)

- Freight Management (3)

- Logistics Solutions (3)

- YMS (3)

- eBook (3)

- 4PL (2)

- International (2)

- NavTrac (2)

- Podcast (2)

- UK (2)

- Yard Management System (2)

- Cold Storage (1)

- Faces of Loadsmart (1)

- Paper Packaging (1)

- Retail (1)

- Security (1)

- Transportation Management System (1)

- January 2026 (1)

- December 2025 (1)

- November 2025 (1)

- October 2025 (2)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (7)

- April 2025 (6)

- March 2025 (3)

- February 2025 (10)

- January 2025 (4)

- December 2024 (4)

- November 2024 (5)

- October 2024 (11)

- September 2024 (11)

- August 2024 (5)

- July 2024 (5)

- June 2024 (9)

- May 2024 (7)

- April 2024 (6)

- March 2024 (2)

- February 2024 (2)

- January 2024 (5)

- December 2023 (6)

- November 2023 (2)

- October 2023 (12)

- September 2023 (5)

- August 2023 (3)

- July 2023 (4)

- June 2023 (10)

- May 2023 (5)

- April 2023 (5)

- March 2023 (7)

- February 2023 (5)

- January 2023 (7)

- December 2022 (4)

- November 2022 (13)

- October 2022 (4)

- September 2022 (7)

- August 2022 (11)

- July 2022 (6)

- June 2022 (5)

- May 2022 (2)

- April 2022 (4)

- March 2022 (6)

- February 2022 (7)

- January 2022 (9)

- December 2021 (3)

- November 2021 (5)

- October 2021 (7)

- September 2021 (2)

- August 2021 (2)

- July 2021 (4)

- June 2021 (6)

- May 2021 (6)

- April 2021 (5)

- March 2021 (8)

- February 2021 (3)

- January 2021 (3)

- December 2020 (7)

- November 2020 (9)

- October 2020 (7)

- September 2020 (6)

- August 2020 (10)

- July 2020 (8)

- June 2020 (3)

- May 2020 (1)

- April 2020 (2)

- March 2020 (2)

- February 2020 (1)

- January 2020 (1)

- November 2019 (2)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- June 2019 (2)

- May 2019 (3)

- March 2019 (1)

- February 2019 (3)

- December 2018 (1)

- November 2018 (2)

- October 2018 (1)

- September 2018 (2)

- August 2018 (1)

- July 2018 (1)

- June 2018 (3)

- May 2018 (4)

- April 2018 (1)

- February 2018 (1)

- January 2018 (4)

- November 2017 (1)

- October 2017 (2)

- June 2017 (1)

- May 2017 (2)

- April 2017 (1)

- February 2017 (1)

- January 2017 (2)

- October 2016 (1)

- August 2016 (1)

- July 2016 (2)

- June 2016 (1)

- March 2016 (1)

- January 2016 (1)

- December 2015 (3)

- November 2015 (2)

- October 2015 (6)

- July 2015 (1)

- June 2015 (1)

- April 2015 (2)

- March 2015 (13)

- February 2015 (17)

- January 2015 (15)

- December 2014 (35)

- November 2014 (26)

- October 2014 (60)

- September 2014 (2)