Share this

Loadsmart’s Look Ahead: An Analysis of Key Freight & Economic Indicators to Watch in October

by jpallmerine

As usual, in this Monthly Market Update, we will provide a brief update & analysis of the full truckload market and present some compelling trucking-related economic analysis to provide a macroeconomic view on the state of the market.

Please reach out to Stella Carneiro (stella.carneiro@loadsmart.com) or Jon Payne (jonathan.payne@loadsmart.com) with any questions, suggestions, thoughts, etc. Thank you! We hope you enjoy! #movemorewithless

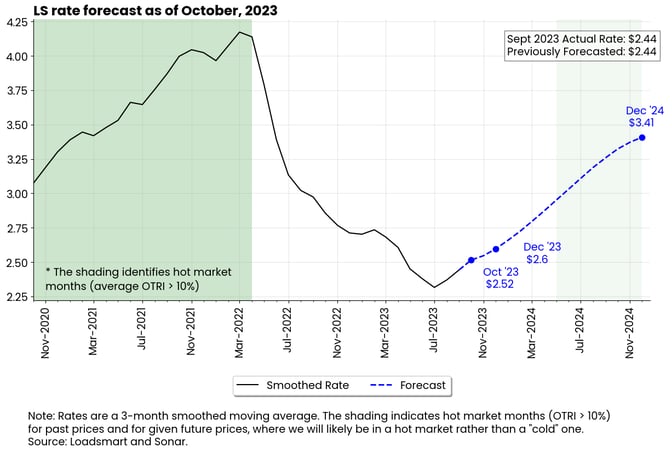

- Since June, when we began publishing Loadsmart's long-term spot rate forecasts, we have adjusted our December 2023 (from $2.56 to $2.6) and December 2024 (from $3.28 to $3.41) predictions due to the mid-year spike in rates, which exceeded our expectations by a few cents in most months, and, most importantly, due to revisions in fuel price expectations.

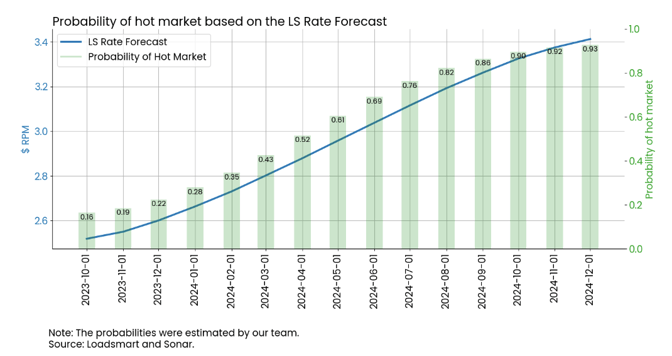

- In Figure 2, we display the probability of being a hot market based on the carrier rate we forecast every month till the end of 2024.

- When LS rates rise above $2.9, the probability that we are in a hot market is higher than the probability that we are not in a hot market.

- Based on these estimates, we are not likely to see a hot market until April 2024.

Figure 1

Figure 2

September's Full Truckload Market Review:

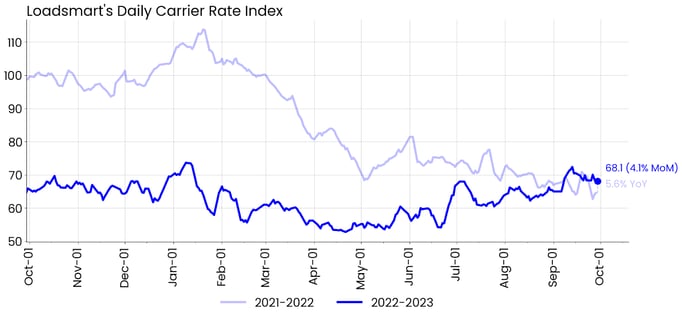

Starting this month, our indices will change. The volume index has been adjusted to reflect more market fluctuations rather than internal volume shifts within our company and, with this change in the volume index, we took the opportunity to rescale our price index using a simpler scale where prices are indexed to the start date of our pricing series (October 1, 2021).

Figure 3

Rates: Our Price Index increased by 4.1% MoM in September. Rates were sluggish at the start due to the Labor Day holiday, but jumped after the second week of the month and continued throughout September at a new level. For the first time in the year, we had a YoY increase in the index.

- Our data was not aligned with the OTRI performance through the month, which fell to 3.6% (from 4.4%) in September.

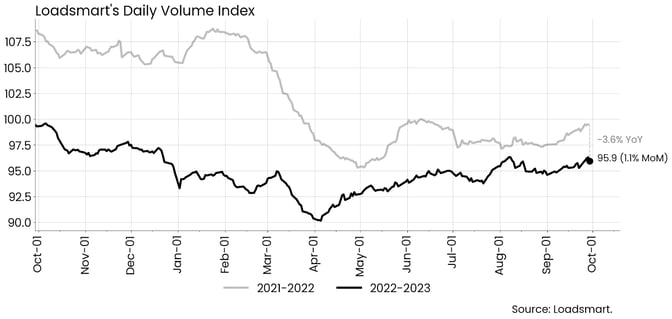

Figure 4

Volumes: Our Volume Index rose 1.1% MoM in September, slightly outperforming Sonar's OTVI, which was flat for the month. The index has already rebounded about 6% from its April low and we expect this trend to continue as we enter the peak season.

Freight & Economics

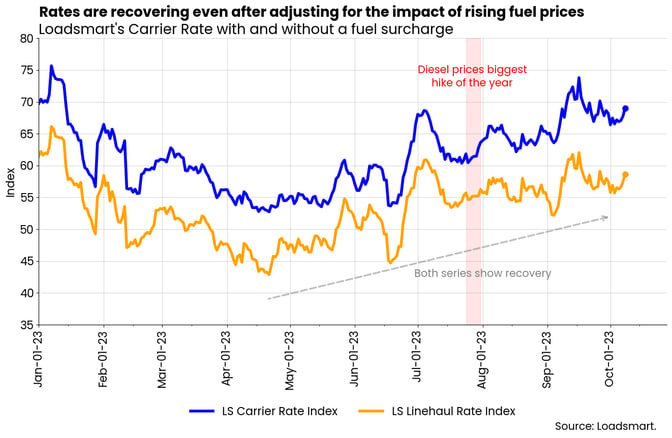

Diesel prices and freight rate recovery

There has been much speculation as to whether the spot rate recovery was simply a pass-through of a diesel price increase to rates. Our data, displayed in Figure 5, contradict this hypothesis.- Firstly, because our rate recovery began in June, about two months before there was a significant surge in fuel prices (diesel prices started an uptrend in July).

- In addition, both linehaul-only and all-in rates have recovered so far. The recovery of the former has indeed slowed due to the increase in fuel prices, but the upward trend continues.

Figure 5

We believe that linehaul-only rates should continue to rise over the long term, even with further fuel price increases, as truck capacity continues to shrink.- According to EIA projections, diesel prices are expected to peak in November 2023 and decline thereafter due to rising oil inventories.

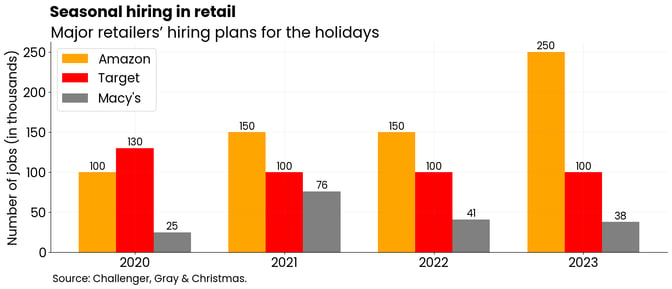

So far, only three major retailers - Amazon, Target, and Macy's - have released their holiday hiring plans. The numbers show how expectations for consumer spending are largely divergent.

- Of the three, Amazon is the only one increasing its numbers from 150k jobs last year to 250k this year. For Target and Macy's, the hiring plans are about the same as they were in 2022 (Figure 6).

Hiring announcements have been mostly muted this year compared to previous years. This may be due to retailers' uncertainty about the state of the economy over the next few months. On one hand, tighter credit availability and the end of the student loan moratorium are expected to weigh on consumer spending in 4Q2023; on the other hand, compared to last year, we have entered the fourth quarter in a better environment with the fall in inflation rates and real income growth.

Figure 6

Share this

- Loadsmart Blog (159)

- Blog (121)

- Shipper (106)

- Market Trends (101)

- Enterprise Shipper (69)

- Carrier (66)

- News (62)

- Data Insights (51)

- Thought Leadership (45)

- Warehouse (41)

- SMB Shipper (38)

- Our Partners (34)

- ShipperGuide TMS (31)

- Opendock (30)

- Product Updates (29)

- Mode Optimization (25)

- Loadsmart (23)

- Mid-Market Shipper (18)

- Case Study (17)

- Brokerage Services (15)

- Managed Transportation (11)

- Video (9)

- Award (7)

- FreightIntel AI (5)

- Instant Execution (4)

- Asset (3)

- Food and Beverage (3)

- Freight Management (3)

- Logistics Solutions (3)

- YMS (3)

- eBook (3)

- 4PL (2)

- International (2)

- NavTrac (2)

- Podcast (2)

- UK (2)

- Yard Management System (2)

- Cold Storage (1)

- Faces of Loadsmart (1)

- Paper Packaging (1)

- Retail (1)

- Security (1)

- Transportation Management System (1)

- January 2026 (1)

- December 2025 (1)

- November 2025 (1)

- October 2025 (2)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (7)

- April 2025 (6)

- March 2025 (3)

- February 2025 (10)

- January 2025 (4)

- December 2024 (4)

- November 2024 (5)

- October 2024 (11)

- September 2024 (11)

- August 2024 (5)

- July 2024 (5)

- June 2024 (9)

- May 2024 (7)

- April 2024 (6)

- March 2024 (2)

- February 2024 (2)

- January 2024 (5)

- December 2023 (6)

- November 2023 (2)

- October 2023 (12)

- September 2023 (5)

- August 2023 (3)

- July 2023 (4)

- June 2023 (10)

- May 2023 (5)

- April 2023 (5)

- March 2023 (7)

- February 2023 (5)

- January 2023 (7)

- December 2022 (4)

- November 2022 (13)

- October 2022 (4)

- September 2022 (7)

- August 2022 (11)

- July 2022 (6)

- June 2022 (5)

- May 2022 (2)

- April 2022 (4)

- March 2022 (6)

- February 2022 (7)

- January 2022 (9)

- December 2021 (3)

- November 2021 (5)

- October 2021 (7)

- September 2021 (2)

- August 2021 (2)

- July 2021 (4)

- June 2021 (6)

- May 2021 (6)

- April 2021 (5)

- March 2021 (8)

- February 2021 (3)

- January 2021 (3)

- December 2020 (7)

- November 2020 (9)

- October 2020 (7)

- September 2020 (6)

- August 2020 (10)

- July 2020 (8)

- June 2020 (3)

- May 2020 (1)

- April 2020 (2)

- March 2020 (2)

- February 2020 (1)

- January 2020 (1)

- November 2019 (2)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- June 2019 (2)

- May 2019 (3)

- March 2019 (1)

- February 2019 (3)

- December 2018 (1)

- November 2018 (2)

- October 2018 (1)

- September 2018 (2)

- August 2018 (1)

- July 2018 (1)

- June 2018 (3)

- May 2018 (4)

- April 2018 (1)

- February 2018 (1)

- January 2018 (4)

- November 2017 (1)

- October 2017 (2)

- June 2017 (1)

- May 2017 (2)

- April 2017 (1)

- February 2017 (1)

- January 2017 (2)

- October 2016 (1)

- August 2016 (1)

- July 2016 (2)

- June 2016 (1)

- March 2016 (1)

- January 2016 (1)

- December 2015 (3)

- November 2015 (2)

- October 2015 (6)

- July 2015 (1)

- June 2015 (1)

- April 2015 (2)

- March 2015 (13)

- February 2015 (17)

- January 2015 (15)

- December 2014 (35)

- November 2014 (26)

- October 2014 (60)

- September 2014 (2)