Share this

Loadsmart’s Look Ahead: An Analysis of Key Freight & Economic Indicators to Watch in September

by jpallmerine

As usual, in this Monthly Market Update, we will provide a brief update & analysis of the full truckload market and present some compelling trucking-related economic analysis to provide a macroeconomic view on the state of the market.

Please reach out to Stella Carneiro (stella.carneiro@loadsmart.com) or Jon Payne (jonathan.payne@loadsmart.com) with any questions, suggestions, thoughts, etc. Thank you! We hope you enjoy! #movemorewithless

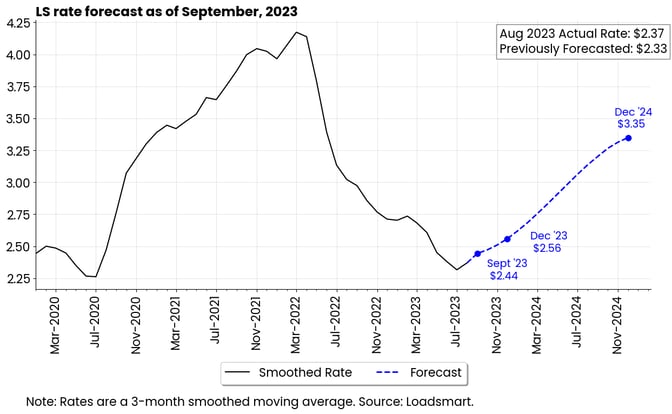

As of September 1, 2023, our model correctly predicted that rates would increase in August, though they increased by $0.04 more than we predicted.

By the end of 2023, our forecast calls for prices to rise to $2.56 (an 8.9% increase from July's low) and continue on an upward trajectory through 2024.

Figure 1

August's Full Truckload Market Review:

Figure 2

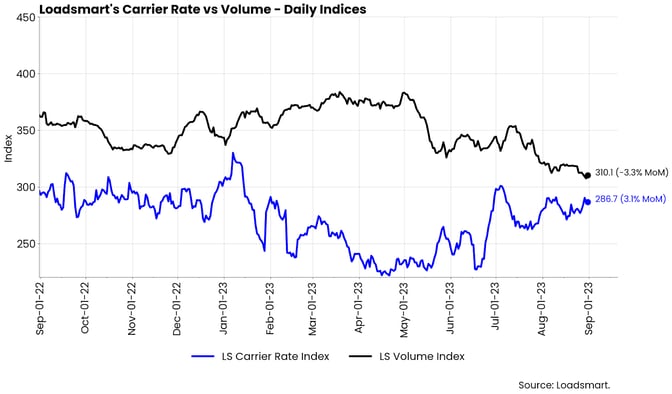

Rates: Our price index increased by 3.1% MoM in August, up 25% from May’s/June’s bottom. However, this increase from the bottom is estimated to be closer to +15% if you account for the fact that diesel prices rose by +$0.40 in August.-

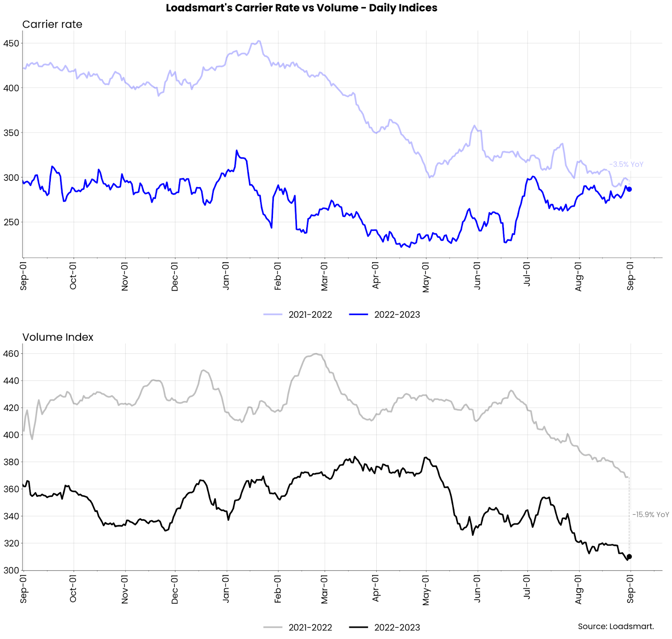

- On a YoY basis (as seen in Figure 3 below), our spot rate index is now only -3.5% YoY, which is the lowest this gap has been since Q1’22. This further supports signs that we are slowly but surely transitioning into an inflationary cycle.

Figure 2

Freight & Economics

Spot and Contract Rates Converged

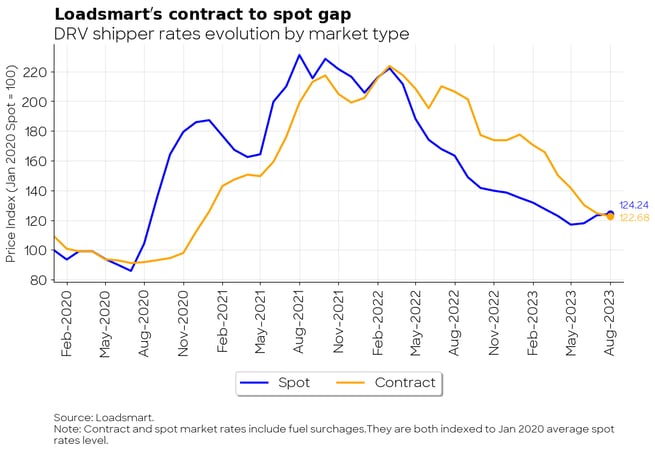

The slight recovery in the spot market paired with 7 quarters straight of contract rate reductions have finally brought the two together. Current Loadsmart data, which is not a perfect representation for the rest of the industry which likely has more of a lag, suggests that average spot rates just crossed above the contracts ones for the first time since Q1’22 - as shown in Figure 4.- The difference between the rates in the two markets is minimal for now, but it comes at a key time for negotiations in the contract market as peak RFP season (Q4/Q1) is approaching rapidly.

Figure 4

Typically contract rates lag spot rates by about 6 months, but because the spot rate increases have been so minimal, we don’t anticipate material contract rate increases until Q2’24 at the earliest.Retail sales

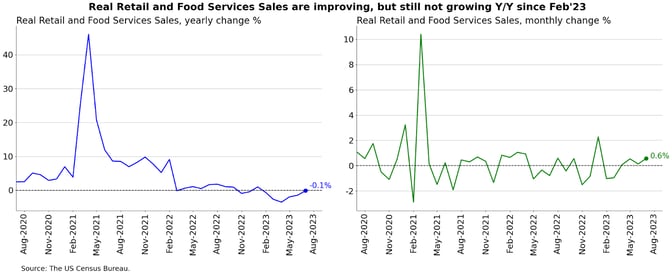

Real retail sales rose 0.5% MoM in July, and August data should show further gains once it is available - Figure 5. According to the National Retail Federation, "consumers are expected to spend record amounts on both back-to-school and back-to-college shopping this year," boosting sales for another month.

August typically sees a MoM inch up in sales due to back-to-school and end-of-summer sales. It is also the start of the peak season for the freight industry.

Figure 5

The monthly increases in retail sales since March have so far not been enough to push the year-on-year growth rate above zero. Freight volumes are also still at a low level compared to last year (Loadsmart volumes are down 18% YoY and Sonar OTVI volumes are down 10% YoY).

A strong back-to-school season can be a sign of a better holiday season to come. If it is confirmed to be stronger than last year, it may indicate that we have a better holiday season ahead.

Share this

- Loadsmart Blog (159)

- Blog (121)

- Shipper (106)

- Market Trends (101)

- Enterprise Shipper (69)

- Carrier (66)

- News (62)

- Data Insights (51)

- Thought Leadership (45)

- Warehouse (41)

- SMB Shipper (38)

- Our Partners (34)

- ShipperGuide TMS (31)

- Opendock (30)

- Product Updates (29)

- Mode Optimization (25)

- Loadsmart (23)

- Mid-Market Shipper (18)

- Case Study (17)

- Brokerage Services (15)

- Managed Transportation (11)

- Video (9)

- Award (7)

- FreightIntel AI (5)

- Instant Execution (4)

- Asset (3)

- Food and Beverage (3)

- Freight Management (3)

- Logistics Solutions (3)

- YMS (3)

- eBook (3)

- 4PL (2)

- International (2)

- NavTrac (2)

- Podcast (2)

- UK (2)

- Yard Management System (2)

- Cold Storage (1)

- Faces of Loadsmart (1)

- Paper Packaging (1)

- Retail (1)

- Security (1)

- Transportation Management System (1)

- January 2026 (1)

- December 2025 (1)

- November 2025 (1)

- October 2025 (2)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (7)

- April 2025 (6)

- March 2025 (3)

- February 2025 (10)

- January 2025 (4)

- December 2024 (4)

- November 2024 (5)

- October 2024 (11)

- September 2024 (11)

- August 2024 (5)

- July 2024 (5)

- June 2024 (9)

- May 2024 (7)

- April 2024 (6)

- March 2024 (2)

- February 2024 (2)

- January 2024 (5)

- December 2023 (6)

- November 2023 (2)

- October 2023 (12)

- September 2023 (5)

- August 2023 (3)

- July 2023 (4)

- June 2023 (10)

- May 2023 (5)

- April 2023 (5)

- March 2023 (7)

- February 2023 (5)

- January 2023 (7)

- December 2022 (4)

- November 2022 (13)

- October 2022 (4)

- September 2022 (7)

- August 2022 (11)

- July 2022 (6)

- June 2022 (5)

- May 2022 (2)

- April 2022 (4)

- March 2022 (6)

- February 2022 (7)

- January 2022 (9)

- December 2021 (3)

- November 2021 (5)

- October 2021 (7)

- September 2021 (2)

- August 2021 (2)

- July 2021 (4)

- June 2021 (6)

- May 2021 (6)

- April 2021 (5)

- March 2021 (8)

- February 2021 (3)

- January 2021 (3)

- December 2020 (7)

- November 2020 (9)

- October 2020 (7)

- September 2020 (6)

- August 2020 (10)

- July 2020 (8)

- June 2020 (3)

- May 2020 (1)

- April 2020 (2)

- March 2020 (2)

- February 2020 (1)

- January 2020 (1)

- November 2019 (2)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- June 2019 (2)

- May 2019 (3)

- March 2019 (1)

- February 2019 (3)

- December 2018 (1)

- November 2018 (2)

- October 2018 (1)

- September 2018 (2)

- August 2018 (1)

- July 2018 (1)

- June 2018 (3)

- May 2018 (4)

- April 2018 (1)

- February 2018 (1)

- January 2018 (4)

- November 2017 (1)

- October 2017 (2)

- June 2017 (1)

- May 2017 (2)

- April 2017 (1)

- February 2017 (1)

- January 2017 (2)

- October 2016 (1)

- August 2016 (1)

- July 2016 (2)

- June 2016 (1)

- March 2016 (1)

- January 2016 (1)

- December 2015 (3)

- November 2015 (2)

- October 2015 (6)

- July 2015 (1)

- June 2015 (1)

- April 2015 (2)

- March 2015 (13)

- February 2015 (17)

- January 2015 (15)

- December 2014 (35)

- November 2014 (26)

- October 2014 (60)

- September 2014 (2)