Share this

The Upside of the Logistics Market: Navigating the Upturn for a Strong 2024

A recent roundtable discussion featuring George Swartz, Michael Munday, Melissa Collins of Loadsmart, and Jim Lane of Redbank Advisors highlighted some perspectives on the current logistics market and what each sees as positive indicators for 2024 and beyond. Each brought several interesting insights (along with some optimism) to the panel.

Here are some webinar highlights

The discussion started with a positive reminder. Although the logistics market has had its challenges of late, this isn’t the first time the economy or the industry has been through tough times. The freight market is constantly changing, and it has been more challenging based on several measures many times in the past. Cyclical by nature, these things always turn around and get better after downturns. And while recovery is sometimes slow, it does happen. Overall, the panel agreed there’s solid data-backed evidence that the current market conditions are easing and things are already trending in a positive direction.

It was also observed that, although the industry took its share of hits from COVID, some parts did well—or even boomed in certain cases. The number of people shopping online created a spike in demand in many parts of the logistics industry, mainly after governments injected cash into the economy. Yet, while demand for warehousing and space on ocean container ships drove up rates, much of the spike was due to artificial growth.

We’re in a recovery

So today, as the market continues to normalize, the recovery is happening, albeit in some uneven ways. Earnings growth has resumed for many types of shippers, driving up demand for freight services. But in some sectors, like industrial, recovery has been slower.

Based on reported company earnings growth in Q3 and Q4 and optimistic projections for Q1 and Q2 of 2024, the panel feels the economy is getting healthier. There’s hope that rising demand and economic activity will continue into 2025 based on what’s happening now. Signs of disinflation also point to a positive future for the logistics industry.

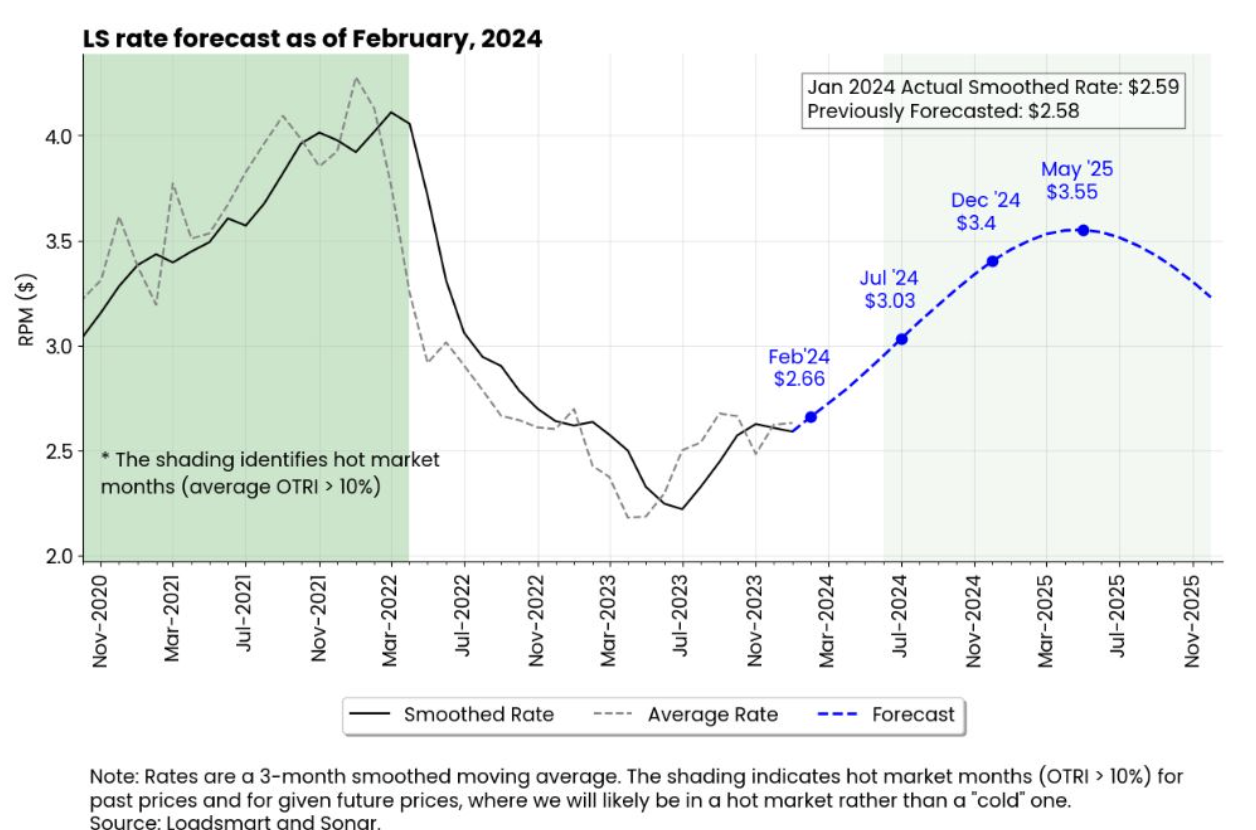

The panel cited recent Loadsmart market data supporting the idea that such freight business cycles typically last about three years, with the most recent ‘trough’ happening in the Spring of 2023. Since that time, things have been on a positive trend. The data suggests that if there are no significant disruptions to the industry or economy in the short term, the current cycle should remain on that upward trend until at least 2025. The expectation, however, is that the cycle won’t be as steep as it was during the last COVID-driven upcycle. It will be a more gradual increase, led by limited transportation capacity and carriers leaving the market, instead of the skyrocketing demand that occurred last time.

Other market indicators

Tender Rejections

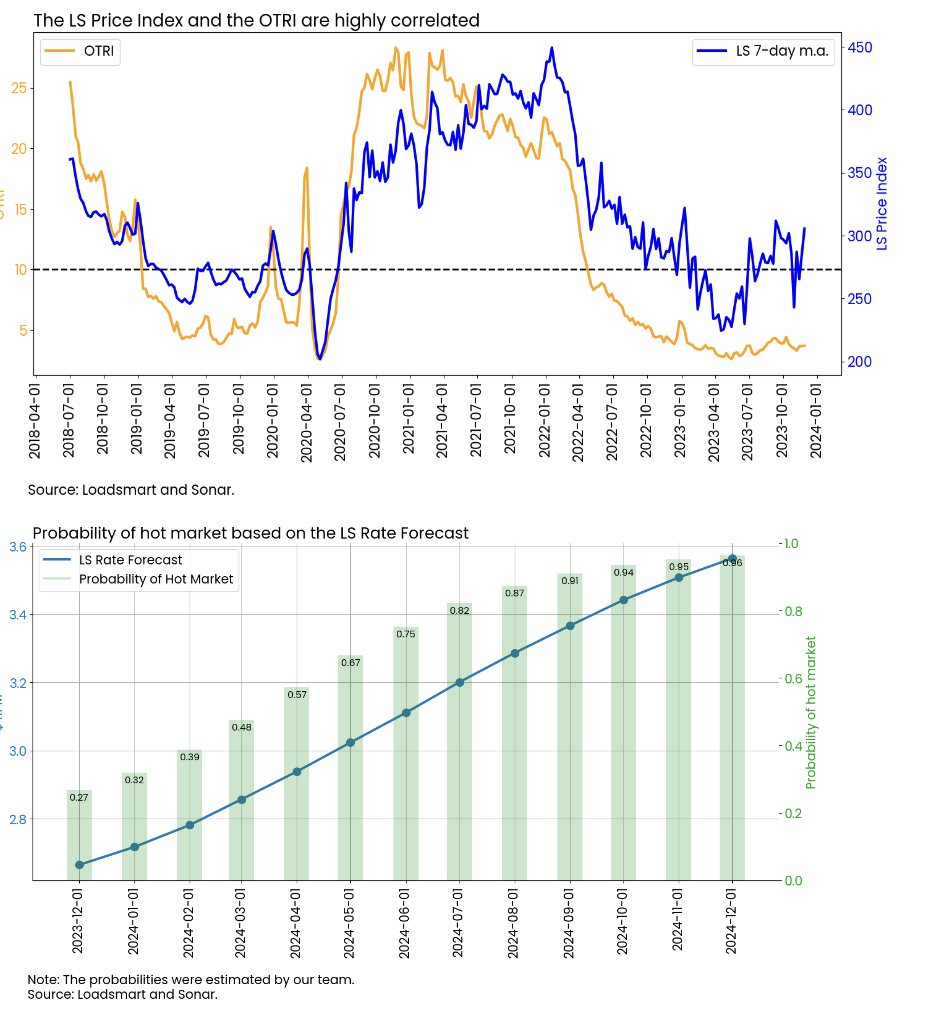

Other transportation market indicators from recent reports, although not exactly what shippers want to hear, include a slight increase in tender rejections and volume, supporting the claim that the market has already reached a bottom and reversing its trajectory. Loadsmart’s modeling shows a strong probability that by July 2024, tender rejections should exceed 10%, a benchmark considered an indicator of a ‘hot market.’ This, the panel agreed, is more proof the market is heading in a positive direction.

Carrier Rates

The panel offered some projections regarding carrier rates. By the end of the year, Loadsmart sees the national all-in price per mile at about $2.60 at the end of 2023. Rates will continue to rise to $3.20 in July, then end 2024 at about $3.56. In the panel’s opinion, although it feels like a significant increase, this is a mild recovery from the carriers’ perspectives. Even at over $3.50 per mile, the market won’t be anywhere near as expensive as it was at the top of the last cycle.

Freight Volume at Ports

Another important market indicator is that freight volumes are building back up. Import volumes are growing at key U.S. ports. Looking at the Port of Los Angeles specifically, starting with the end of Q3, the port had about a 6% increase in the number of containers processed over the same time last year. The Israel-Gaza war is now impacting supply chains, and if the situation continues, we expect to see an increase in truck and intermodal demand out-bound from the West Coast (read further on our January Loadsmart Look Ahead blog post). Furthermore, the American Trucking Association, which has its own forecast, expects truck tonnage to grow from about 11.3 billion tons in 2024 to 14.2 billion in 2034.

Intermodal and Air

Due to those growing imports, a significant increase is also expected for rail and intermodal volumes, with the jump from around 22 billion tons in 2023 to 35 billion in 2034. And air cargo, which is sitting at about 18 billion tons this year, is expected to rise to 23.7 tons in 2034.

The outlook is... positive

The tone of the discussion was positive, and there are many reasons to feel a recovery for the logistics market is underway. And, Loadsmart’s market projections show the improvements are still in the early stages.

A stronger logistics market can result in higher rates for shippers, so the panel’s observations and predictions come with a warning. Now is the time for companies to look closely at their rates and take steps to insulate themselves against any cost increases going forward. The market is shifting, and shippers should be prepared to keep their supply chain costs and service optimized for however the market looks in 2024 and beyond. Take advantage of Loadsmart’s Free Transportation Savings Assessment to uncover hidden savings and optimize your logistics.

Share this

- Loadsmart Blog (159)

- Blog (121)

- Shipper (106)

- Market Trends (101)

- Enterprise Shipper (69)

- Carrier (66)

- News (62)

- Data Insights (51)

- Thought Leadership (45)

- Warehouse (41)

- SMB Shipper (38)

- Our Partners (34)

- ShipperGuide TMS (31)

- Opendock (30)

- Product Updates (29)

- Mode Optimization (25)

- Loadsmart (23)

- Mid-Market Shipper (18)

- Case Study (17)

- Brokerage Services (15)

- Managed Transportation (11)

- Video (9)

- Award (7)

- FreightIntel AI (5)

- Instant Execution (4)

- Asset (3)

- Food and Beverage (3)

- Freight Management (3)

- Logistics Solutions (3)

- YMS (3)

- eBook (3)

- 4PL (2)

- International (2)

- NavTrac (2)

- Podcast (2)

- UK (2)

- Yard Management System (2)

- Cold Storage (1)

- Faces of Loadsmart (1)

- Paper Packaging (1)

- Retail (1)

- Security (1)

- Transportation Management System (1)

- January 2026 (1)

- December 2025 (1)

- November 2025 (1)

- October 2025 (2)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (7)

- April 2025 (6)

- March 2025 (3)

- February 2025 (10)

- January 2025 (4)

- December 2024 (4)

- November 2024 (5)

- October 2024 (11)

- September 2024 (11)

- August 2024 (5)

- July 2024 (5)

- June 2024 (9)

- May 2024 (7)

- April 2024 (6)

- March 2024 (2)

- February 2024 (2)

- January 2024 (5)

- December 2023 (6)

- November 2023 (2)

- October 2023 (12)

- September 2023 (5)

- August 2023 (3)

- July 2023 (4)

- June 2023 (10)

- May 2023 (5)

- April 2023 (5)

- March 2023 (7)

- February 2023 (5)

- January 2023 (7)

- December 2022 (4)

- November 2022 (13)

- October 2022 (4)

- September 2022 (7)

- August 2022 (11)

- July 2022 (6)

- June 2022 (5)

- May 2022 (2)

- April 2022 (4)

- March 2022 (6)

- February 2022 (7)

- January 2022 (9)

- December 2021 (3)

- November 2021 (5)

- October 2021 (7)

- September 2021 (2)

- August 2021 (2)

- July 2021 (4)

- June 2021 (6)

- May 2021 (6)

- April 2021 (5)

- March 2021 (8)

- February 2021 (3)

- January 2021 (3)

- December 2020 (7)

- November 2020 (9)

- October 2020 (7)

- September 2020 (6)

- August 2020 (10)

- July 2020 (8)

- June 2020 (3)

- May 2020 (1)

- April 2020 (2)

- March 2020 (2)

- February 2020 (1)

- January 2020 (1)

- November 2019 (2)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- June 2019 (2)

- May 2019 (3)

- March 2019 (1)

- February 2019 (3)

- December 2018 (1)

- November 2018 (2)

- October 2018 (1)

- September 2018 (2)

- August 2018 (1)

- July 2018 (1)

- June 2018 (3)

- May 2018 (4)

- April 2018 (1)

- February 2018 (1)

- January 2018 (4)

- November 2017 (1)

- October 2017 (2)

- June 2017 (1)

- May 2017 (2)

- April 2017 (1)

- February 2017 (1)

- January 2017 (2)

- October 2016 (1)

- August 2016 (1)

- July 2016 (2)

- June 2016 (1)

- March 2016 (1)

- January 2016 (1)

- December 2015 (3)

- November 2015 (2)

- October 2015 (6)

- July 2015 (1)

- June 2015 (1)

- April 2015 (2)

- March 2015 (13)

- February 2015 (17)

- January 2015 (15)

- December 2014 (35)

- November 2014 (26)

- October 2014 (60)

- September 2014 (2)