Share this

Loadsmart’s Look Ahead: An Analysis of Key Freight & Economic Indicators to Watch in August

by jpallmerine

As usual, in this Monthly Market Update, we will provide a brief update & analysis of the full truckload market and present some compelling trucking-related economic analysis to provide a macroeconomic view on the state of the market.

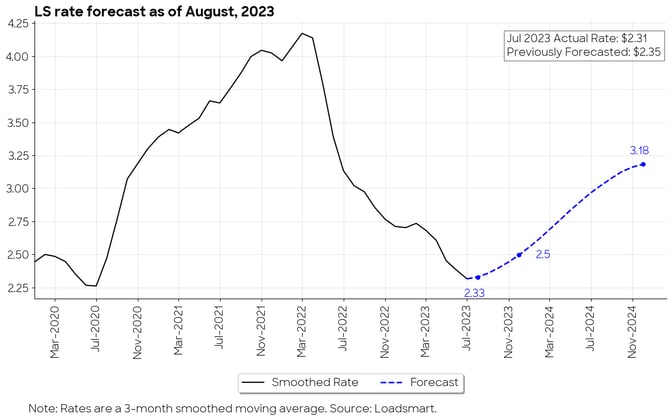

As of August 1, 2023, our model predicts that the average spot price should have bottomed out in July, rising from $2.31 to $2.33 in August.

By the end of 2023, our forecast calls for prices to rise to $2.5 (an 8.2% increase from July's low) and continue on an upward trajectory through 2024.

Figure 1

August's Full Truckload Market Overview:

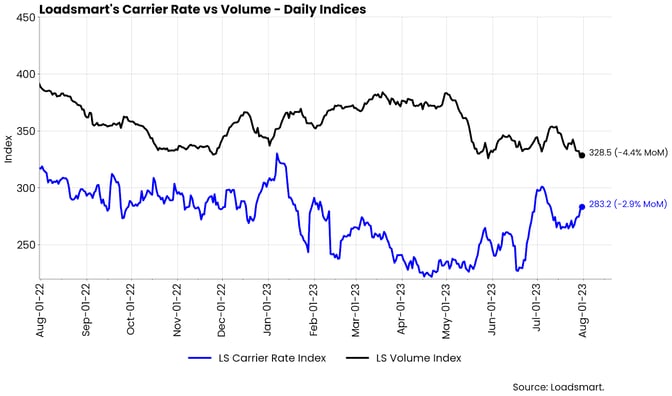

Rates: Our price index decreased by 2.9% MoM in July. The price spike associated with the 4th of July holiday brought the index back to January 2023 levels. However, as we predicted in the previous report, the index later pulled back ~10% from the July 4th high and remained stable throughout the month till the 25th, when a new upward trend started.- We attribute the most recent upturn in prices to be mostly driven by the rise in fuel surcharges in the last week of July (see more in the Freight & Economics Section) as well as some minor tightening from EOM.

Volumes: Our volume Index decreased by 4.4% MoM in July. Sonar's OTVI rose 5% over the same period, but Loadsmart has yet to see the reported increase in freight demand, either in quotes or allocated volumes.

- The only region where volumes recovered significantly was the Northeast, where volumes have been growing since July after a stagnant 2Q.

Figure 2

Freight & Economics

Soaring Fuel Prices

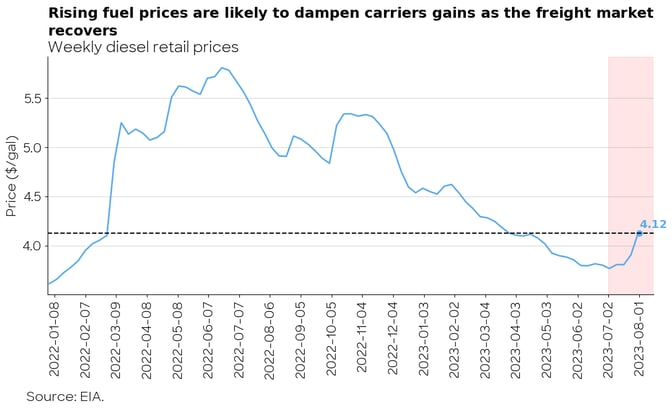

Diesel prices rose 9.5% in July - back to April levels, as shown in the figure below.

Figure 3

According to our estimates, part of our rate price upturn in the past week (July 28- Aug 5), shown in Figure 1, was due to the increase in fuel surcharges. Our all-in carrier RPM rose 4% WoW, but our line-haul rates show an increase of 2% only.

We expect fuel pump prices to continue to hike in the next months, which would further damage spot market profitability for smaller carriers. EIA's latest forecast (from July 6) indicated that diesel prices would average $3.76 in July and $3.58 in August. But we now know that July's average was 10 cents higher than their prediction, and August should be higher as well.

Here are the main reasons why we believe fuel prices should rise further in August:

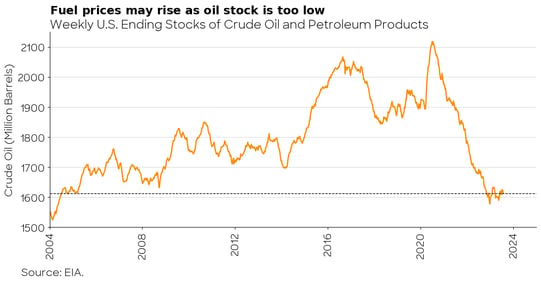

- Supply Cuts: As mentioned in March’s Monthly Update, Opec announced a production cut that began in May and will run until the end of 2023. Additionally, the US crude oil production is also declining. National inventories are at their lowest levels in more than a decade - as shown in Figure 4.

Figure 4

- Expected Demand Boost: Fuel consumption should rise along with household spending in the coming months as a recession-free soft landing becomes more likely.

Freight Sector Revenues

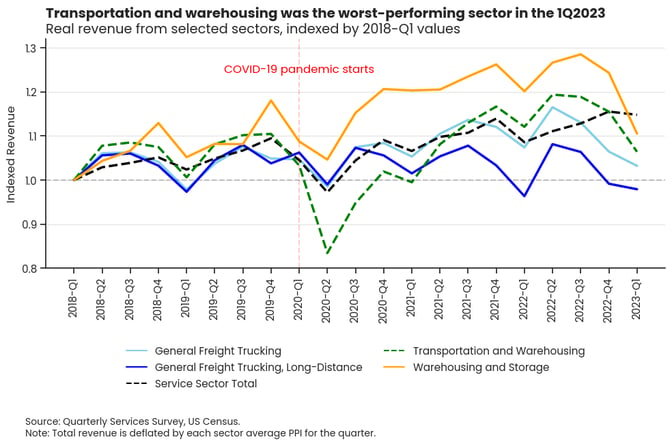

According to the US Quarterly Services Survey, transportation and warehousing had the largest revenue decline among all services sectors in 1Q2023, with its real revenue falling 7.8% QoQ.

Figure 5

Warehousing appears to be the main driver of this large decline, as its real revenue alone fell 11%, while the general and long-haul trucking categories fell 1.2% and 3%, respectively.

The real revenue of the whole services sector decreased by 0.6% QoQ (Figure 5). The first quarter of the year is typically characterized by a seasonal decline in revenue. However, for the trucking categories, this is the third consecutive decline in revenue and may be related to the decline in freight rates that also began in Q2 2022.

We do not expect revenue growth in the next report due to the continued decline in freight rates in Q2 2023, but we’re optimistic that this could begin to switch positive by the end of 2023.

Please reach out to Stella Carneiro (stella.carneiro@loadsmart.com) with any questions, suggestions, thoughts, etc. Thank you! We hope you enjoy! #movemorewithless

Share this

- Loadsmart Blog (159)

- Blog (121)

- Shipper (106)

- Market Trends (101)

- Enterprise Shipper (69)

- Carrier (66)

- News (62)

- Data Insights (51)

- Thought Leadership (45)

- Warehouse (41)

- SMB Shipper (38)

- Our Partners (34)

- ShipperGuide TMS (31)

- Opendock (30)

- Product Updates (29)

- Mode Optimization (25)

- Loadsmart (23)

- Mid-Market Shipper (18)

- Case Study (17)

- Brokerage Services (15)

- Managed Transportation (11)

- Video (9)

- Award (7)

- FreightIntel AI (5)

- Instant Execution (4)

- Asset (3)

- Food and Beverage (3)

- Freight Management (3)

- Logistics Solutions (3)

- YMS (3)

- eBook (3)

- 4PL (2)

- International (2)

- NavTrac (2)

- Podcast (2)

- UK (2)

- Yard Management System (2)

- Cold Storage (1)

- Faces of Loadsmart (1)

- Paper Packaging (1)

- Retail (1)

- Security (1)

- Transportation Management System (1)

- January 2026 (1)

- December 2025 (1)

- November 2025 (1)

- October 2025 (2)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (7)

- April 2025 (6)

- March 2025 (3)

- February 2025 (10)

- January 2025 (4)

- December 2024 (4)

- November 2024 (5)

- October 2024 (11)

- September 2024 (11)

- August 2024 (5)

- July 2024 (5)

- June 2024 (9)

- May 2024 (7)

- April 2024 (6)

- March 2024 (2)

- February 2024 (2)

- January 2024 (5)

- December 2023 (6)

- November 2023 (2)

- October 2023 (12)

- September 2023 (5)

- August 2023 (3)

- July 2023 (4)

- June 2023 (10)

- May 2023 (5)

- April 2023 (5)

- March 2023 (7)

- February 2023 (5)

- January 2023 (7)

- December 2022 (4)

- November 2022 (13)

- October 2022 (4)

- September 2022 (7)

- August 2022 (11)

- July 2022 (6)

- June 2022 (5)

- May 2022 (2)

- April 2022 (4)

- March 2022 (6)

- February 2022 (7)

- January 2022 (9)

- December 2021 (3)

- November 2021 (5)

- October 2021 (7)

- September 2021 (2)

- August 2021 (2)

- July 2021 (4)

- June 2021 (6)

- May 2021 (6)

- April 2021 (5)

- March 2021 (8)

- February 2021 (3)

- January 2021 (3)

- December 2020 (7)

- November 2020 (9)

- October 2020 (7)

- September 2020 (6)

- August 2020 (10)

- July 2020 (8)

- June 2020 (3)

- May 2020 (1)

- April 2020 (2)

- March 2020 (2)

- February 2020 (1)

- January 2020 (1)

- November 2019 (2)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- June 2019 (2)

- May 2019 (3)

- March 2019 (1)

- February 2019 (3)

- December 2018 (1)

- November 2018 (2)

- October 2018 (1)

- September 2018 (2)

- August 2018 (1)

- July 2018 (1)

- June 2018 (3)

- May 2018 (4)

- April 2018 (1)

- February 2018 (1)

- January 2018 (4)

- November 2017 (1)

- October 2017 (2)

- June 2017 (1)

- May 2017 (2)

- April 2017 (1)

- February 2017 (1)

- January 2017 (2)

- October 2016 (1)

- August 2016 (1)

- July 2016 (2)

- June 2016 (1)

- March 2016 (1)

- January 2016 (1)

- December 2015 (3)

- November 2015 (2)

- October 2015 (6)

- July 2015 (1)

- June 2015 (1)

- April 2015 (2)

- March 2015 (13)

- February 2015 (17)

- January 2015 (15)

- December 2014 (35)

- November 2014 (26)

- October 2014 (60)

- September 2014 (2)