Share this

March's Inside Look: An Analysis of Loadsmart’s Data & Market Indices

by jpallmerine

As usual, in this Monthly Market Update, we will provide a brief update & analysis of the full truckload market and present some compelling trucking-related economic analysis to provide a macroeconomic view on the state of the market.

Loadsmart's 2023 Truckload Market Outlook:

- As noted in previous updates, our spot market forecast predicted a Q4’23 spot rate rebound which would put us around +10%-15% up from today’s lows or +0-5% YoY. We’re currently refreshing this forecast with some more bearish assumptions that will likely push this rebound back to Q1’24 - Why?

- Demand indicators and the overall economic backdrop have worsened slightly.

- Most notably, Industrial Production for Q1’23 is likely to turn deflationary (YoY) for the first time in 3+ years and we expect consumption to remain flat or even decline amidst the continued high interest rate environment.

- The reduction in capacity is continuing to take longer than expected and we expect nothing different over the coming months due to:

- Excess carrier profits stemming from the historic bull market,

- Lower diesel rates YTD’23, and

- Simply the vast amount of excess trucks in the market today (we estimate 250k+)

- Contract rates are now down -15% YoY and we expect this number to get to -20-25% over the next two quarters based on our internal RFP pricing data (and as we all know contract inevitably follows spot

March 2023 Truckload Market Update:

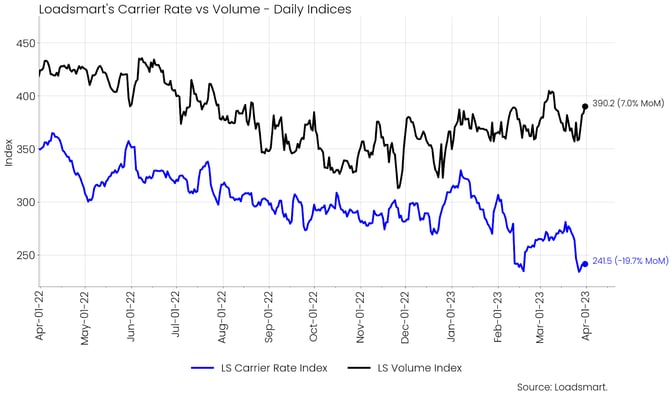

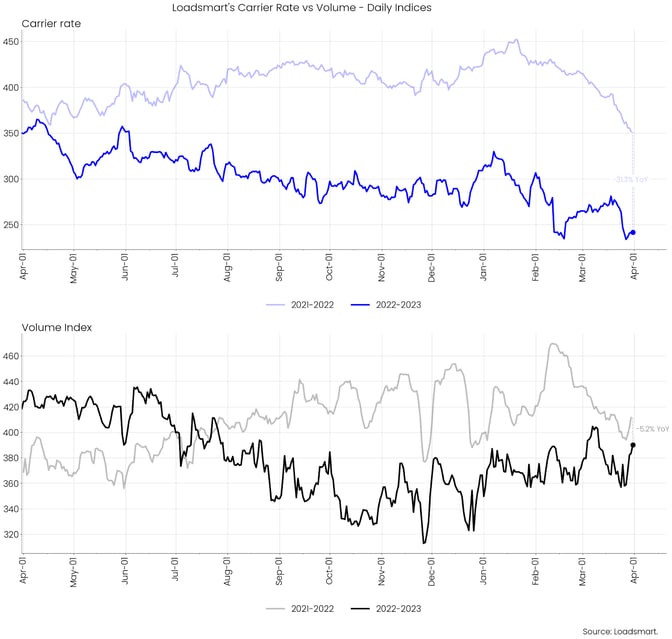

Figure 1

- Volumes: Our volume index increased by 3.5% in March (from day 01 to 31). The index was rather stable during the month. We continue to emphasize the positive recovery of our volume index. Our index rose for the fifth consecutive time in March on the monthly average and is only 5.2% down YoY. If this trend continues, our 2023 produce season should be busier than in the previous year.

- Rates: Our price index fell by 8.7% in March (day 01 to 31). From February 19th to March 24th, prices were on a steady recovery path, moving away from the February low. But by the end of the month, prices had plunged back to the same low point from February. This plunge was widespread across regions and was surprising given the timing with EOQ.

- We expect prices to remain low during March and early April during the transition from winter to spring until the demand for produce season picks up.

Figure 2

Freight & Economics

Credit constraints to weigh on consumer spending

- March marked the beginning of an unprecedented banking crisis that may weigh on consumer spending in the coming months. The failure of three US banks - Silvergate, Silicon Valley, and Signature - plus Credit Suisse has raised fears of a liquidity crunch in the financial system.

- This directly impacts banks' lending activity, so consumers can expect to see a deterioration in personal credit conditions in the months ahead.

- In this article from August 2022, we have already highlighted the slowdown in consumption and its effects on the freight market as inflationary pressures took their toll on the US economy.

- Now, a tightening of consumer credit can be an additional drag on individual spending, as the rise in loan rates and credit card fees will dampen credit-driven consumption.

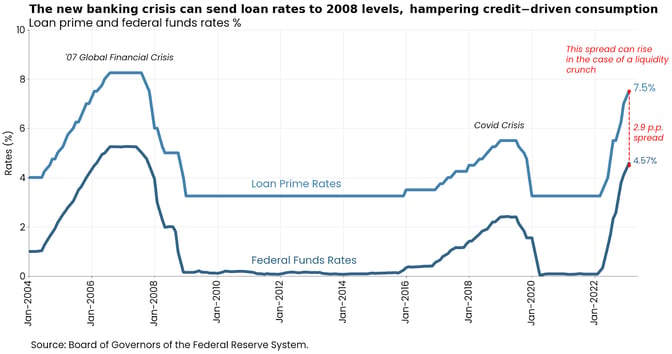

- As Figure 3 shows, the loan prime rate (the rates that commercial banks charge their most creditworthy clients) has increased by 4.75 p.p. since March 2022 given Federal rate hikes. However, amidst a banking crisis, the spread between loan prime rates and Fed rates is expected to rise, pushing credit costs to a high similar to 2008.

Figure 3

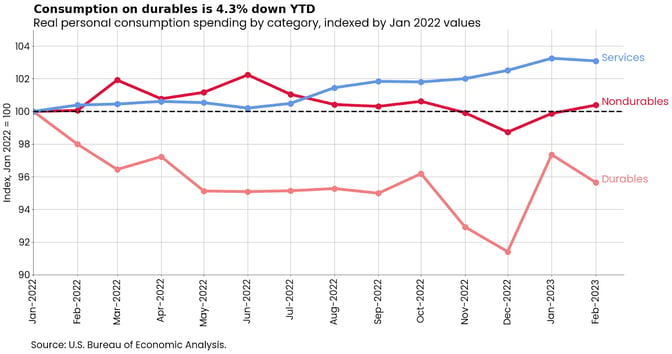

- Real consumption expending is down by 0.2% MoM, but up 1.5% YTD. As Figure 4 shows, only the service sector has kept steady growth since January 2022; while nondurables spending is stagnant, and durables spending plummeted in 2022. In January 2023, durables spending rebounded due to auto sales but decreased again in February.

Figure 4

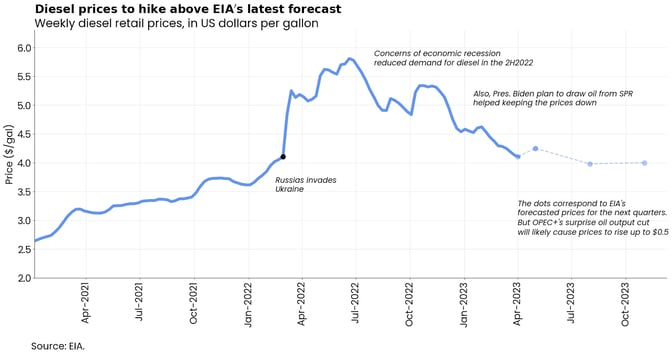

Opec+ surprise production cut to send diesel prices up

- On April 2nd, Opec announced a production cut that will begin in May and run until the end of 2023. The cut came as a surprise to the US administration, which has been trying to lower fuel prices in order to control domestic inflation and ease the dependence on OPEC+ decisions.

- The US government has been controlling the oil supply in its territory through the use of the Strategic Petroleum Reserve (SPR). However, the SPR may not be able to offset the effect of this unexpected production cut by OPEC+ members because it is unable to increase its oil production in the short term.

- It is still unclear how much of the OPEC+ decision will be passed on to retail diesel prices, but we expect an upward revision to the price forecasts from the latest EIA report - shown in Figure 5.

Figure 5

- Fuel prices were already projected to increase slightly over the summer, and the OPEC announcement will contribute further. However, the effect should be small and it is unlikely that prices will reach 2022 levels and exceed $5 per gal - read more here.

—------------------------------------------------------------------------------------------

Please reach out to Stella Carneiro (stella.carneiro@loadsmart.com) with any questions, suggestions, thoughts, etc. Thank you! We hope you enjoy! #movemorewithless

For more about how you can understand the current market to plan for the future, download our quarterly report.

Share this

- Loadsmart Blog (159)

- Blog (121)

- Shipper (106)

- Market Trends (101)

- Enterprise Shipper (69)

- Carrier (66)

- News (62)

- Data Insights (51)

- Thought Leadership (45)

- Warehouse (41)

- SMB Shipper (38)

- Our Partners (34)

- ShipperGuide TMS (31)

- Opendock (30)

- Product Updates (29)

- Mode Optimization (25)

- Loadsmart (23)

- Mid-Market Shipper (18)

- Case Study (17)

- Brokerage Services (15)

- Managed Transportation (11)

- Video (9)

- Award (7)

- FreightIntel AI (5)

- Instant Execution (4)

- Asset (3)

- Food and Beverage (3)

- Freight Management (3)

- Logistics Solutions (3)

- YMS (3)

- eBook (3)

- 4PL (2)

- International (2)

- NavTrac (2)

- Podcast (2)

- UK (2)

- Yard Management System (2)

- Cold Storage (1)

- Faces of Loadsmart (1)

- Paper Packaging (1)

- Retail (1)

- Security (1)

- Transportation Management System (1)

- January 2026 (1)

- December 2025 (1)

- November 2025 (1)

- October 2025 (2)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (7)

- April 2025 (6)

- March 2025 (3)

- February 2025 (10)

- January 2025 (4)

- December 2024 (4)

- November 2024 (5)

- October 2024 (11)

- September 2024 (11)

- August 2024 (5)

- July 2024 (5)

- June 2024 (9)

- May 2024 (7)

- April 2024 (6)

- March 2024 (2)

- February 2024 (2)

- January 2024 (5)

- December 2023 (6)

- November 2023 (2)

- October 2023 (12)

- September 2023 (5)

- August 2023 (3)

- July 2023 (4)

- June 2023 (10)

- May 2023 (5)

- April 2023 (5)

- March 2023 (7)

- February 2023 (5)

- January 2023 (7)

- December 2022 (4)

- November 2022 (13)

- October 2022 (4)

- September 2022 (7)

- August 2022 (11)

- July 2022 (6)

- June 2022 (5)

- May 2022 (2)

- April 2022 (4)

- March 2022 (6)

- February 2022 (7)

- January 2022 (9)

- December 2021 (3)

- November 2021 (5)

- October 2021 (7)

- September 2021 (2)

- August 2021 (2)

- July 2021 (4)

- June 2021 (6)

- May 2021 (6)

- April 2021 (5)

- March 2021 (8)

- February 2021 (3)

- January 2021 (3)

- December 2020 (7)

- November 2020 (9)

- October 2020 (7)

- September 2020 (6)

- August 2020 (10)

- July 2020 (8)

- June 2020 (3)

- May 2020 (1)

- April 2020 (2)

- March 2020 (2)

- February 2020 (1)

- January 2020 (1)

- November 2019 (2)

- October 2019 (1)

- September 2019 (2)

- August 2019 (3)

- July 2019 (2)

- June 2019 (2)

- May 2019 (3)

- March 2019 (1)

- February 2019 (3)

- December 2018 (1)

- November 2018 (2)

- October 2018 (1)

- September 2018 (2)

- August 2018 (1)

- July 2018 (1)

- June 2018 (3)

- May 2018 (4)

- April 2018 (1)

- February 2018 (1)

- January 2018 (4)

- November 2017 (1)

- October 2017 (2)

- June 2017 (1)

- May 2017 (2)

- April 2017 (1)

- February 2017 (1)

- January 2017 (2)

- October 2016 (1)

- August 2016 (1)

- July 2016 (2)

- June 2016 (1)

- March 2016 (1)

- January 2016 (1)

- December 2015 (3)

- November 2015 (2)

- October 2015 (6)

- July 2015 (1)

- June 2015 (1)

- April 2015 (2)

- March 2015 (13)

- February 2015 (17)

- January 2015 (15)

- December 2014 (35)

- November 2014 (26)

- October 2014 (60)

- September 2014 (2)